CRM Stock Analysis: Salesforce's AI Revolution Drives Market Momentum

CRM Stock Analysis: Salesforce's AI Revolution Drives Market Momentum

Comprehensive analysis of Salesforce's transformative journey into artificial intelligence, Data Cloud growth, and the investment implications for 2024 and beyond

Real-time Salesforce (CRM) stock chart showing recent trading patterns and technical indicators

Executive Summary

Salesforce (NYSE: CRM) stands at a pivotal moment in its corporate evolution, transforming from a traditional customer relationship management platform into an artificial intelligence powerhouse. With shares currently trading at $256.45, representing a modest 0.54% daily gain, the stock has experienced significant volatility throughout 2024, declining approximately 24% year-to-date while the broader S&P 500 has delivered positive returns.

Despite near-term headwinds, Salesforce's fundamental business metrics reveal a company successfully navigating the transition to an AI-first strategy. The company's fourth-quarter 2024 performance demonstrated resilience with $9.29 billion in revenue, marking an 11% year-over-year increase, while its full-year revenue reached an impressive $34.9 billion. This performance places Salesforce among the elite enterprise software companies globally, with CEO Marc Benioff describing it as "one of the best performances of any enterprise software companies ever."

The investment thesis for CRM stock hinges on three critical factors: the successful monetization of artificial intelligence through Agentforce and Data Cloud initiatives, the company's ability to maintain double-digit growth rates in an increasingly competitive market, and management's execution of shareholder-friendly capital allocation policies, including the recent initiation of a quarterly dividend and expanded share repurchase program.

Financial Performance Deep Dive

Q4 2024 Revenue

$9.29B

+11% YoY growth (10% constant currency)

Full Year Revenue

$34.9B

+11% YoY growth

Non-GAAP Operating Margin

31.4%

+220 basis points YoY (Q4)

Free Cash Flow (Q4)

$3.3B

+27% YoY growth

Salesforce's fourth-quarter performance exceeded Wall Street expectations across multiple metrics, with CFO Amy Weaver highlighting the company's operational efficiency improvements. The 220 basis point expansion in non-GAAP operating margin to 31.4% demonstrates management's commitment to balancing growth investments with profitability enhancement. This margin expansion is particularly impressive given the company's significant investments in artificial intelligence and Data Cloud infrastructure.

The company's cash generation capabilities remain robust, with Q4 operating cash flow reaching $3.4 billion, up 22% year-over-year. This strong cash generation has enabled Salesforce to pursue an aggressive capital return strategy, returning $7.7 billion to shareholders in fiscal 2024 through share repurchases, representing more than 80% of free cash flow. The board's recent approval of a $0.40 quarterly dividend and a $10 billion increase to the share repurchase authorization signals confidence in the company's long-term cash generation prospects.

Geographic revenue performance showed healthy diversification, with the Americas growing 9%, EMEA expanding 14% (11% in constant currency), and APAC delivering 14% growth (19% in constant currency). This geographic balance provides resilience against regional economic headwinds and demonstrates the global applicability of Salesforce's platform solutions.

The AI Revolution: Data Cloud and Agentforce

Salesforce's Data Cloud platform drives the next generation of AI-powered business applications

Data Cloud: The Growth Engine

$400M

Approaching ARR

90%

YoY Growth Rate

25%

Of $1M+ deals include Data Cloud

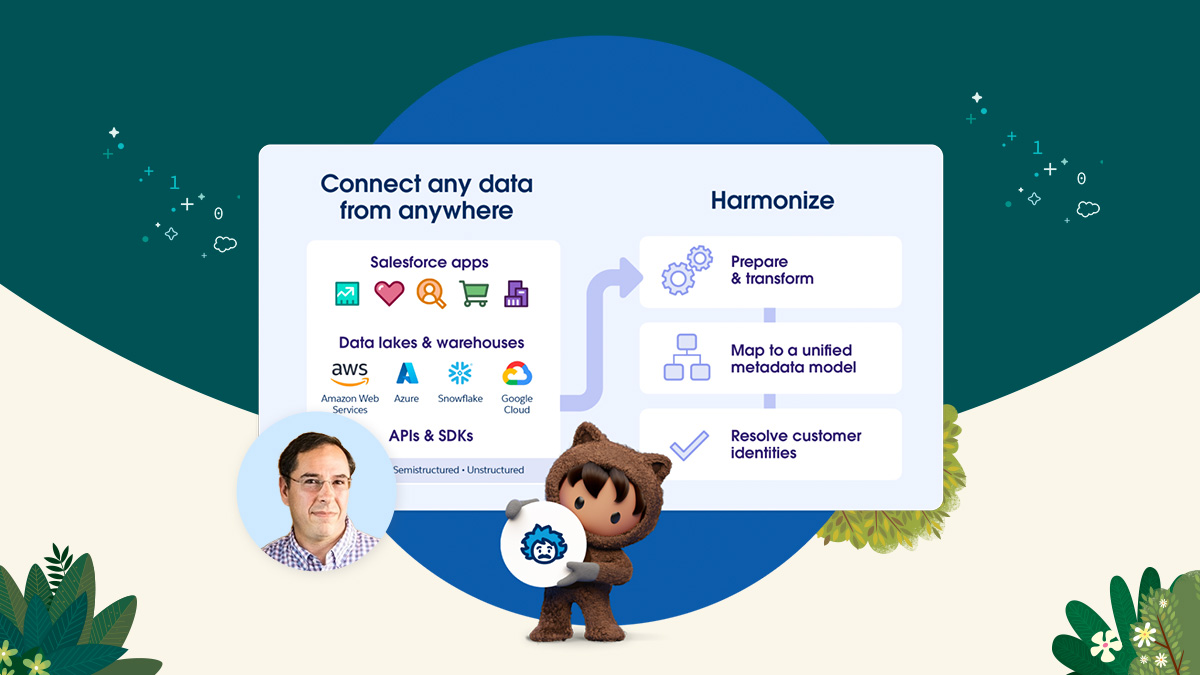

Salesforce's transformation into an AI-centric platform centers around two flagship initiatives: Data Cloud and Agentforce. Data Cloud, the company's unified data platform, has emerged as a critical growth driver, approaching $400 million in annual recurring revenue (ARR) with an impressive 90% year-over-year growth rate. This performance significantly exceeds industry benchmarks and validates management's strategic pivot toward data-driven artificial intelligence solutions.

The platform's market adoption is accelerating, with COO Brian Millham noting that "more than half of our top 25 wins included Data Cloud" in Q4 2024. This attachment rate demonstrates the platform's value proposition in enabling customers to unlock insights from previously siloed data sources. The integration of Data Cloud with Salesforce's core CRM functionality creates powerful network effects, increasing customer stickiness and expanding the total addressable market for AI-powered business applications.

Agentforce, Salesforce's autonomous AI agent platform, represents the next evolution of the company's AI strategy. Unlike traditional chatbots or basic automation tools, Agentforce leverages large language models and Data Cloud's unified data foundation to create intelligent agents capable of handling complex business processes autonomously. Early customer feedback suggests strong demand, with the platform addressing critical workforce productivity challenges across industries.

The convergence of Data Cloud and Agentforce creates a formidable competitive moat. As organizations increasingly rely on AI to drive operational efficiency, Salesforce's integrated approach provides a compelling alternative to point solutions from specialized AI vendors. This positioning aligns with enterprise preferences for consolidated technology stacks, particularly as CIOs seek to reduce vendor complexity and improve data governance.

Advanced AI Technical Details

Market Position and Competitive Analysis

Technical analysis showing CRM stock support levels and potential buying opportunities

Salesforce maintains its position as the dominant force in the global customer relationship management market, commanding approximately 20% market share according to recent industry analyses. The company's competitive advantages extend beyond traditional CRM functionality, encompassing a comprehensive platform that integrates sales, marketing, service, and analytics capabilities. This holistic approach creates significant switching costs for customers and provides multiple expansion opportunities within existing accounts.

The competitive landscape has intensified with the emergence of AI-native startups and traditional enterprise software vendors enhancing their AI capabilities. Microsoft's integration of AI across its Dynamics 365 platform and Oracle's autonomous database offerings present formidable competition. However, Salesforce's early investment in AI research, exemplified by the Einstein platform launched in 2016, provides a technological and market timing advantage that continues to manifest in superior product capabilities and customer adoption metrics.

The company's multi-cloud strategy has proven particularly effective in driving revenue growth and competitive differentiation. CFO Amy Weaver noted that "eight of our top 10 deals included six or more clouds" in Q4 2024, with more than half of the top 100 customer wins incorporating six or more Salesforce cloud solutions. This multi-cloud adoption pattern increases customer lifetime value, reduces churn risk, and creates powerful network effects