Federal Reserve Cuts Interest Rates by 0.25% for First Time in Nine Months: What This Historic Decision Means for Your Money

Federal Reserve Cuts Interest Rates by 0.25% for First Time in Nine Months: What This Historic Decision Means for Your Money

Table of Contents

Historic Federal Reserve Rate Cut Signals Economic Policy Shift

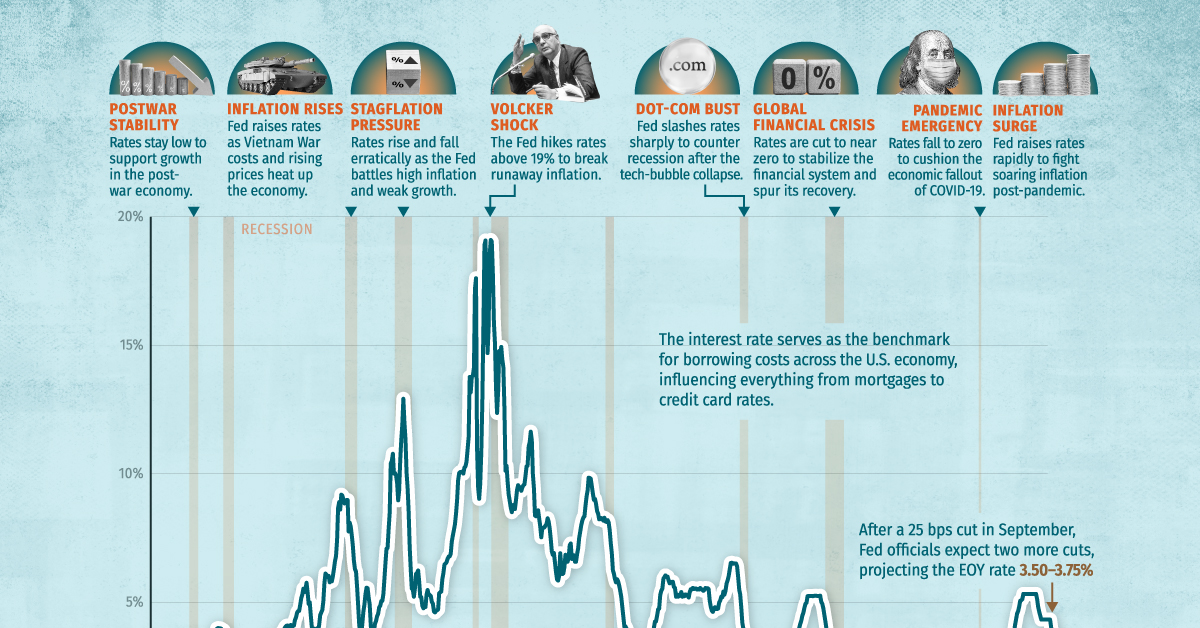

In a highly anticipated move that marks a significant shift in monetary policy, the Federal Reserve announced on September 17, 2025, its first interest rate cut in nine months. The central bank reduced its benchmark federal funds rate by 0.25 percentage points, bringing it to a range of 4.00% to 4.25% from the previous 4.25% to 4.5%.

This decision represents the Fed's first rate reduction since December 2024, signaling growing concerns about a cooling labor market that now outweigh persistent inflation worries. The unanimous decision—with one notable dissent—comes as the U.S. economy faces a complex set of challenges including weakening job growth, elevated inflation, and mounting political pressure from the Trump administration.

Federal Reserve Decision Analysis: Why Now?

Fed Chair Jerome Powell emphasized during the post-meeting press conference that "the labor market is really cooling off," explaining the rationale behind the rate cut. The decision follows a series of disappointing employment reports that have raised alarm bells about economic momentum.

Key Economic Indicators Behind the Decision

The August jobs report proved particularly concerning, showing only 22,000 jobs added—far below economist expectations. This represented a dramatic slowdown from previous months, with the unemployment rate climbing to 4.3%, the highest level since October 2021 outside of the COVID-19 pandemic period.

Additional labor market weakness emerged from revised data showing the economy actually lost 13,000 jobs in June, marking the first monthly job losses since December 2020. Year-to-date job creation has totaled just 598,000 positions, compared to 1.4 million during the same period in 2024.

The Dissenting Vote and Committee Dynamics

The Federal Open Market Committee (FOMC) vote was 11-1, with newly appointed Fed Governor Stephen Miran casting the sole dissent in favor of a more aggressive 0.50 percentage point cut. Miran, who was confirmed just days before the meeting while maintaining his role as chairman of the White House Council of Economic Advisers, represents an unprecedented situation in Fed governance.

This arrangement has raised questions about the Fed's independence, as Miran is technically on unpaid leave from his White House position and could return when his Fed term concludes in January. Treasury Secretary Scott Bessent defended the arrangement as "much more transparent" since "everyone knows that he's going back to the White House."

Economic Impact Assessment: Balancing Growth and Inflation

The rate cut reflects the Fed's attempt to balance its dual mandate of maintaining price stability and supporting maximum employment. Recent economic data has created what economists call an "uncomfortable position" for policymakers.

Inflation Challenges Persist

Despite the focus on employment concerns, inflation remains above the Fed's 2% target. Consumer prices accelerated to 2.9% in August, while core inflation (excluding volatile food and energy prices) held steady at 3.1%. Since April, when the Trump administration announced sweeping reciprocal tariffs, inflation has increased from 2.3% to current levels.

Fed officials project inflation will remain elevated through 2025, with Personal Consumption Expenditures (PCE) expected to reach 3% by year-end before gradually declining to 2.6% in 2026 and finally reaching the 2% target by 2028.

Labor Market Complexities

Powell described the current employment situation as "unusual," noting that while fewer firms are hiring, the available supply of workers is also declining due to the Trump administration's immigration crackdown. This creates what economists term a "low firing, low hiring" environment that particularly challenges recent college graduates, younger workers, and minorities seeking employment.

What the Rate Cut Means for Your Wallet

The Federal Reserve's decision will have cascading effects across various aspects of consumer financial life, though the magnitude of impact may vary by sector.

Mortgage Rates and Housing Market

While Fed rate cuts typically influence mortgage rates, Powell cautioned that the housing market faces deeper structural issues. "There's a deeper problem here, not a cyclical problem the Fed can address, and that's pretty much a nationwide housing shortage," he explained.

As of September 11, the average 30-year fixed-rate mortgage stood at 6.35% according to Freddie Mac. While rates may decline modestly, Powell suggested the Fed would need to implement "pretty big rate changes for it to matter a lot for the housing sector."

:max_bytes(150000):strip_icc()/GettyImages-2235975535-2c2fb2f079c940d58fe4a61eaad30803.jpg)

Credit Cards and Personal Loans

Consumer borrowing costs should begin declining as banks pass through lower rates. Credit card rates, which typically track closely with the federal funds rate, may see modest reductions over the coming months. Personal loan rates and auto financing should also become marginally less expensive.

Savings and Investment Impacts

Savers will likely see lower returns on savings accounts, certificates of deposit, and money market accounts as banks reduce deposit rates in response to the Fed's action. However, the gradual nature of the cuts means these changes will unfold over time rather than immediately.

Wall Street Response and Market Dynamics

Financial markets exhibited mixed reactions to the Fed's decision, with the rate cut already largely priced in by investors. The S&P 500 closed down 0.10% at 6,600.13 points, while the Nasdaq fell 0.33% to 22,260.85. Conversely, the Dow Jones Industrial Average gained 0.56% to 46,012.75.

The muted market response reflects that investors had assigned a 94% probability to a quarter-point cut based on CME FedWatch tool data. Market attention has now shifted to future rate path projections and the Fed's commitment to additional cuts.

Future Rate Projections and Fed Policy Path

Federal Reserve officials signaled the possibility of two additional quarter-point rate cuts in 2025, with meetings scheduled for October and December. However, the Fed's summary of economic projections reveals significant disagreement among committee members about future policy direction.

Dot Plot Reveals Committee Division

The Fed's updated "dot plot" projections show nine officials expecting rates between 3.5% and 3.75% by year-end 2025, while six members favor maintaining rates between 4.0% and 4.25%. This division suggests future rate decisions will depend heavily on incoming economic data.

For 2026, officials project just one additional quarter-point cut, though market participants have been pricing in more aggressive easing totaling 75 basis points throughout next year.

Political Pressures and Fed Independence

The rate cut decision occurs amid unprecedented political pressure from the Trump administration, which has consistently demanded more aggressive monetary easing. President Trump has repeatedly criticized Powell personally and suggested the entire Fed board "should be ashamed of its work."

Lisa Cook Controversy

Adding to the political tension, the Trump administration has attempted to remove Fed Governor Lisa Cook, the first Black woman on the board, over allegations of mortgage fraud that she has denied. An appeals court ruling allows Cook to continue her duties while challenging the administration's removal attempt in court.

Powell maintained the Fed's independence stance, stating: "It's deeply in our culture to do our work based on the incoming data and never consider anything else." He added that if political considerations influenced decisions, "you would be able to tell by the way" officials speak about their choices.

Frequently Asked Questions About the Fed Rate Cut

Why did the Federal Reserve cut interest rates now?

The Fed cut rates due to growing concerns about a cooling labor market, with unemployment rising to 4.3% and job growth slowing dramatically. The August jobs report showed only 22,000 jobs added, far below expectations.

How will this rate cut affect my mortgage?

Mortgage rates may decline modestly, but Fed Chair Powell noted that housing faces structural supply shortages that monetary policy cannot address. The current average 30-year mortgage rate is 6.35%.

Will there be more rate cuts this year?

The Fed projects two additional quarter-point cuts in 2025, with meetings in October and December. However, committee members are divided, with some preferring to hold rates steady.

What about inflation concerns?

Inflation remains above the Fed's 2% target at 2.9%, and officials don't expect to reach the target until 2028. The Fed is balancing inflation risks against employment concerns.

How does political pressure affect Fed decisions?

Fed Chair Powell emphasized the central bank's independence, stating they make decisions "based on incoming data and never consider anything else," despite pressure from the Trump administration.

Conclusion: Navigating Economic Uncertainty

The Federal Reserve's decision to cut interest rates for the first time in nine months represents a pivotal moment in U.S. monetary policy. While the 0.25% reduction provides modest economic stimulus, it reflects deeper concerns about labor market weakening and the challenging balance between supporting employment and controlling inflation.

For consumers, the rate cut offers marginal relief in borrowing costs but signals broader economic uncertainties ahead. The Fed's cautious approach—favoring quarter-point rather than half-point cuts—demonstrates officials' recognition that both inflation risks and employment concerns remain elevated.

As the central bank navigates political pressures while maintaining its independence, future rate decisions will depend critically on incoming economic data. Whether this marks the beginning of an extended easing cycle or a measured response to temporary weakness will become clearer in the coming months.

Stay Informed About Fed Policy Changes

Interest rate changes can significantly impact your financial planning. Monitor upcoming Fed meetings in October and December to understand how monetary policy may affect your loans, savings, and investments.

Subscribe to our newsletter for the latest Federal Reserve updates and economic analysis.