2026 Tax Brackets: Complete Guide to New IRS Rates and Standard Deductions

2026 Tax Brackets: Complete Guide to New IRS Rates and Standard Deductions

The IRS just released the official 2026 tax brackets on October 9, 2025, bringing significant changes that will affect millions of American taxpayers. With inflation adjustments and permanent tax reforms under the One Big Beautiful Bill Act, understanding these new brackets is crucial for effective tax planning. Here's everything you need to know about the 2026 tax year that will apply when you file your taxes in 2027.

What Changed in the 2026 Tax Brackets?

The IRS made substantial adjustments to the 2026 tax brackets to account for inflation and implement permanent changes from recent tax legislation. The seven federal tax rates remain the same—10%, 12%, 22%, 24%, 32%, 35%, and 37%—but the income thresholds have increased significantly.

These adjustments help prevent "bracket creep," where inflation pushes taxpayers into higher tax brackets without actually increasing their purchasing power. For 2026, taxpayers will need to earn more income before reaching the next tax bracket level.

2026 Tax Brackets for Single Filers

Single taxpayers will see notable increases in their tax bracket thresholds for 2026. Here's the complete breakdown:

:max_bytes(150000):strip_icc()/standarddeduction-resized-8f2ac3f88bca4ef099d637cb80f79e29.jpg)

- 10% bracket: $0 to $12,400 (up from $11,925 in 2025)

- 12% bracket: $12,401 to $50,400 (up from $11,926 to $48,475)

- 22% bracket: $50,401 to $105,700 (up from $48,476 to $103,350)

- 24% bracket: $105,701 to $201,775 (up from $103,351 to $197,300)

- 32% bracket: $201,776 to $256,225 (up from $197,301 to $250,525)

- 35% bracket: $256,226 to $640,600 (up from $250,526 to $626,350)

- 37% bracket: $640,601 and above (up from $626,351 and above)

2026 Tax Brackets for Married Filing Jointly

Married couples filing jointly benefit from doubled brackets and higher standard deductions. The 2026 thresholds are:

- 10% bracket: $0 to $24,800 (up from $23,850 in 2025)

- 12% bracket: $24,801 to $100,800 (up from $23,851 to $96,950)

- 22% bracket: $100,801 to $211,400 (up from $96,951 to $206,700)

- 24% bracket: $211,401 to $403,550 (up from $206,701 to $394,600)

- 32% bracket: $403,551 to $512,450 (up from $394,601 to $501,050)

- 35% bracket: $512,451 to $768,700 (up from $501,051 to $751,600)

- 37% bracket: $768,701 and above (up from $751,601 and above)

Enhanced Standard Deductions for 2026

The standard deduction amounts have increased substantially for 2026, providing immediate tax relief for most taxpayers:

- Single filers: $16,100 (up from $15,750 in 2025)

- Married filing jointly: $32,200 (up from $31,500 in 2025)

- Head of household: $24,150 (up from $23,625 in 2025)

- Married filing separately: $16,100 (up from $15,750 in 2025)

Special Senior Deduction Under OBBBA

Seniors aged 65 and older may qualify for an additional deduction of up to $6,000 under the One Big Beautiful Bill Act. This temporary benefit expires at the end of 2028 and is available to singles earning $75,000 or less and married couples earning $150,000 or less.

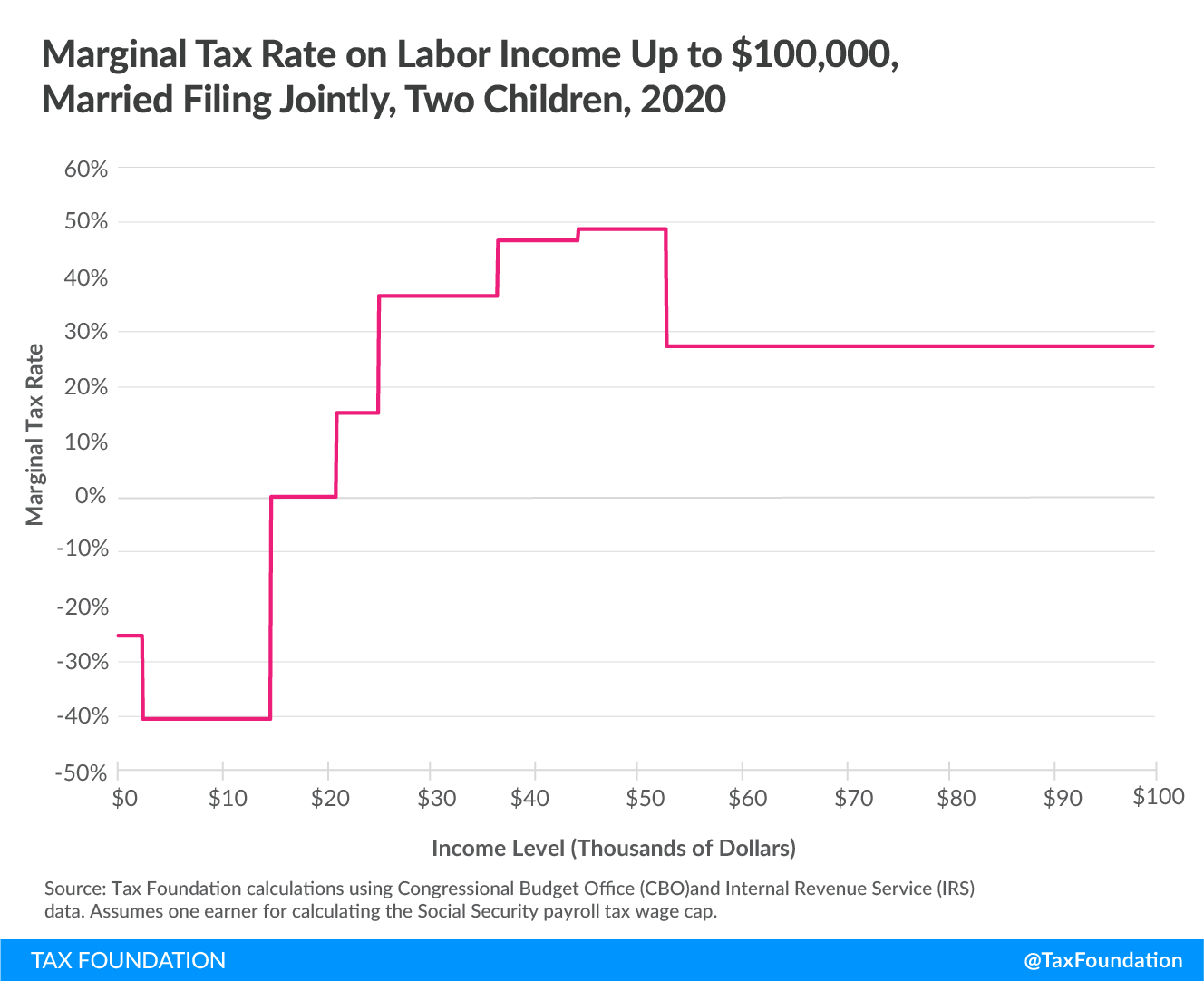

How Marginal Tax Rates Actually Work

Many taxpayers misunderstand how tax brackets function. You don't pay your highest tax rate on all your income—you pay progressively higher rates on different portions of your income.

Example: Single Filer Earning $60,000 in 2026

Here's how the progressive tax system works for a single taxpayer earning $60,000:

- First $12,400 taxed at 10% = $1,240

- Next $38,000 ($12,401 to $50,400) taxed at 12% = $4,560

- Remaining $9,600 ($50,401 to $60,000) taxed at 22% = $2,112

- Total tax: $7,912

- Effective tax rate: 13.2%

Key Changes from the One Big Beautiful Bill Act

The One Big Beautiful Bill Act made several Tax Cuts and Jobs Act provisions permanent, providing long-term tax planning certainty. Major changes include:

- Permanent preservation of current tax brackets

- Enhanced employer-provided childcare credit (up to $500,000)

- Increased estate tax exclusion ($15 million for 2026)

- Higher adoption credit ($17,670 maximum)

- Senior deduction for taxpayers 65 and older

Other Important 2026 Tax Adjustments

Alternative Minimum Tax (AMT)

AMT exemption amounts for 2026:

- Single filers: $90,100 (phase-out begins at $500,000)

- Married filing jointly: $140,200 (phase-out begins at $1,000,000)

Retirement and Benefit Limits

- Foreign earned income exclusion: $132,900

- Health FSA contribution limit: $3,400

- Qualified transportation benefit: $340 monthly

- Annual gift exclusion: $19,000

Tax Planning Strategies for 2026

With the new brackets in place, consider these strategies:

- Income timing: Consider deferring income if you're near a bracket threshold

- Retirement contributions: Maximize 401(k) and IRA contributions to reduce taxable income

- Tax-loss harvesting: Offset gains with losses in investment accounts

- Charitable giving: Bundle donations to exceed the standard deduction

- Health Savings Accounts: Triple tax advantage for medical expenses

Frequently Asked Questions

When do the 2026 tax brackets take effect?

The 2026 tax brackets apply to income earned from January 1, 2026, through December 31, 2026. You'll use these brackets when filing your tax return in 2027.

Will my taxes go up or down in 2026?

Most taxpayers will see lower taxes due to inflation adjustments and permanent TCJA provisions. However, your specific situation depends on your income level and filing status.

How do I calculate my effective tax rate?

Divide your total tax liability by your total taxable income. This gives you the average rate you pay across all income levels, which is always lower than your marginal rate.

Should I itemize or take the standard deduction in 2026?

With the increased standard deductions, most taxpayers benefit from the standard deduction. Only itemize if your deductions exceed $16,100 (single) or $32,200 (married filing jointly).

What happens to state taxes?

Federal tax brackets don't affect state income taxes. Each state sets its own tax rates and brackets, which may or may not align with federal changes.

Looking Ahead: Planning for Success

The 2026 tax brackets provide welcome relief for American taxpayers through inflation adjustments and permanent tax reforms. By understanding how these brackets work and planning accordingly, you can minimize your tax burden and maximize your financial outcomes.

Remember that tax planning is an ongoing process, not a once-a-year activity. Consider consulting with a qualified tax professional to develop strategies tailored to your specific situation and goals.

Share this comprehensive guide with family and friends who could benefit from understanding the 2026 tax changes. Proper tax planning today can save thousands of dollars tomorrow!