7 Simple Money Habits That Made Ordinary People Millionaires in America

7 Simple Money Habits That Made Ordinary People Millionaires in America

Building wealth isn't reserved for Wall Street executives or tech entrepreneurs. Across America, ordinary people have transformed their financial lives through simple, consistent money habits. These aren't get-rich-quick schemes or complex investment strategies—they're proven principles that anyone can implement, regardless of their starting point.

Let's explore the seven fundamental habits that have helped countless Americans achieve millionaire status, starting from modest beginnings.

1. They Live Below Their Means Consistently

The foundation of wealth building starts with spending less than you earn. Self-made millionaires understand that your income doesn't determine your wealth—your spending habits do. They resist lifestyle inflation and maintain modest living expenses even as their income grows.

This doesn't mean living in poverty. It means making conscious choices about where your money goes. Warren Buffett, one of America's wealthiest individuals, still lives in the same Omaha home he bought in 1958 for $31,500. Today, it's worth about $850,000—modest by billionaire standards.

2. They Prioritize Financial Education

Millionaires are lifelong learners, especially when it comes to money management. They read financial books, follow market trends, and understand basic investment principles. This habit separates them from those who rely on financial advisors for every decision.

Popular books among wealthy Americans include "Rich Dad Poor Dad," "The Millionaire Next Door," and "The Intelligent Investor." They spend time learning about tax strategies, real estate markets, and investment opportunities rather than scrolling social media.

3. They Automate Their Savings and Investments

The "pay yourself first" principle is non-negotiable for wealth builders. They automatically transfer a percentage of their income to savings and investment accounts before paying other expenses. This removes the temptation to spend money that should be saved.

Most self-made millionaires save at least 20% of their gross income. They set up automatic transfers on payday, treating savings like a mandatory bill that must be paid.

4. They Follow a Strict Monthly Budget

Budgeting isn't just for people in debt—it's a wealth-building tool. Millionaires track every dollar coming in and going out. They use budgeting to identify areas where they can cut expenses and redirect money toward investments.

Their budgets include categories for savings, investments, emergency funds, and specific financial goals. They review and adjust their budgets monthly, treating it as a business would treat financial planning.

5. They Avoid High-Interest Debt Like the Plague

Consumer debt is wealth's biggest enemy. Self-made millionaires avoid credit card debt, personal loans, and other high-interest borrowing. When they do use credit, they pay balances in full every month.

They understand that paying 18-25% interest on credit card debt makes it nearly impossible to build wealth through investments that might return 7-10% annually. The math simply doesn't work in your favor.

6. They Invest in Diversified Portfolios Consistently

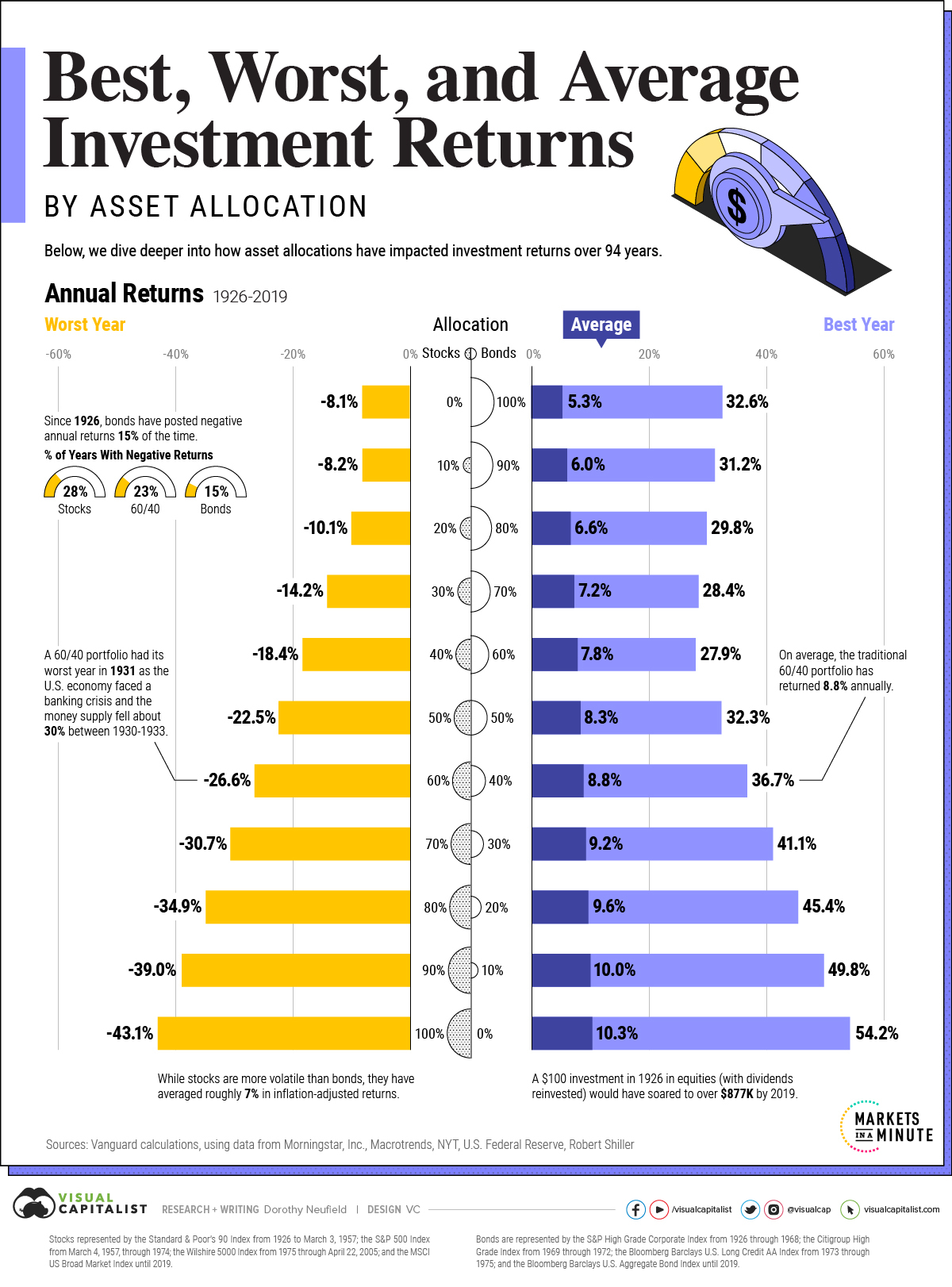

Millionaires don't try to time the market or chase hot stock tips. They invest consistently in diversified portfolios, primarily through low-cost index funds and ETFs. They understand that time in the market beats timing the market.

Most focus on broad market index funds that track the S&P 500 or total stock market. They also include bonds and real estate investment trusts (REITs) for diversification. The key is consistency—they invest the same amount monthly regardless of market conditions.

7. They Build Multiple Income Streams

While maintaining their primary job, millionaires create additional income sources. This might include rental properties, side businesses, dividend-paying stocks, or freelance work in their expertise area.

Multiple income streams provide financial security and accelerate wealth building. If one income source disappears, others continue generating money. This diversification principle applies to both investments and income.

The Power of Emergency Funds

Before investing aggressively, millionaires build substantial emergency funds. Most maintain 6-12 months of expenses in high-yield savings accounts. This prevents them from going into debt during unexpected situations and allows them to take calculated investment risks.

Starting Your Millionaire Journey Today

These habits aren't exclusive to high earners. Teachers, nurses, plumbers, and retail workers have all become millionaires by following these principles consistently over time. The key is starting now, regardless of your current financial situation.

Begin with one habit—perhaps automating your savings or creating your first budget. Once that becomes routine, add another habit. Small, consistent actions compound over time, just like investments.

Frequently Asked Questions

How long does it take to become a millionaire using these habits?

Most self-made millionaires reach their goal in 15-25 years by consistently following these habits. The timeline depends on your starting income, savings rate, and investment returns.

What percentage of income should I save to build wealth?

Aim to save at least 20% of your gross income. If that's not possible initially, start with whatever you can and gradually increase the percentage as your income grows.

Is it too late to start building wealth if I'm over 40?

It's never too late to start. Many people become millionaires in their 50s and 60s by implementing these habits. The key is starting immediately and being consistent.

Should I pay off debt before investing?

Pay off high-interest debt (above 7%) before investing aggressively. However, take advantage of employer 401(k) matches even while paying off debt—it's free money.

Take Action Today

Knowledge without action is worthless. Choose one habit from this list and implement it this week. Whether it's setting up automatic savings, creating your first budget, or opening a high-yield savings account, taking that first step is crucial.

Building wealth is a marathon, not a sprint. These seven habits have helped thousands of ordinary Americans achieve extraordinary financial success. With patience, consistency, and discipline, they can work for you too.

Found this article helpful? Share it with friends and family who could benefit from these wealth-building strategies. Your financial success story could inspire others to start their own journey to becoming millionaires.