ASTS Stock Analysis: AST SpaceMobile's Revolutionary Space-Based Cellular Network

ASTS Stock Analysis: AST SpaceMobile's Revolutionary Space-Based Cellular Network

Company Overview | Stock Performance | Technology & Innovation | Strategic Partnerships | Financial Analysis | Investment Outlook | Risk Factors | FAQs

AST SpaceMobile Inc. (NASDAQ: ASTS) represents one of the most ambitious technological ventures in the space communication sector. As of October 8, 2025, ASTS stock has demonstrated remarkable volatility and growth potential, making it a focal point for investors interested in the emerging space economy.

AST SpaceMobile: Pioneering Direct-to-Cell Technology

AST SpaceMobile is revolutionizing global connectivity by building the first space-based cellular broadband network accessible directly by standard smartphones. Founded in 2017 and headquartered in Midland, Texas, the company has positioned itself as a potential game-changer in the telecommunications industry.

The company's SpaceMobile service aims to provide cellular broadband coverage to areas where traditional terrestrial networks are unavailable or unreliable. This innovative approach could potentially serve over 5 billion people worldwide who lack reliable mobile connectivity.

ASTS Stock Performance Analysis

ASTS stock has experienced extraordinary volatility throughout 2025, with shares surging over 254% year-to-date. Recent trading data shows the stock trading in the $80-$90 range, with a 52-week range spanning from $17.50 to $91.41.

:max_bytes(150000):strip_icc()/dotdash_Final_Introductio_to_Technical_Analysis_Price_Patterns_Sep_2020-05-a19b59070c434400988fca7fa83898dd.jpg)

Key Stock Metrics

- Market Capitalization: Approximately $29.5 billion

- Trading Volume: Significantly above average at 30+ million shares daily

- Beta: 2.41 (highly volatile compared to market)

- Revenue (TTM): $4.89 million

Revolutionary BlueBird Satellite Technology

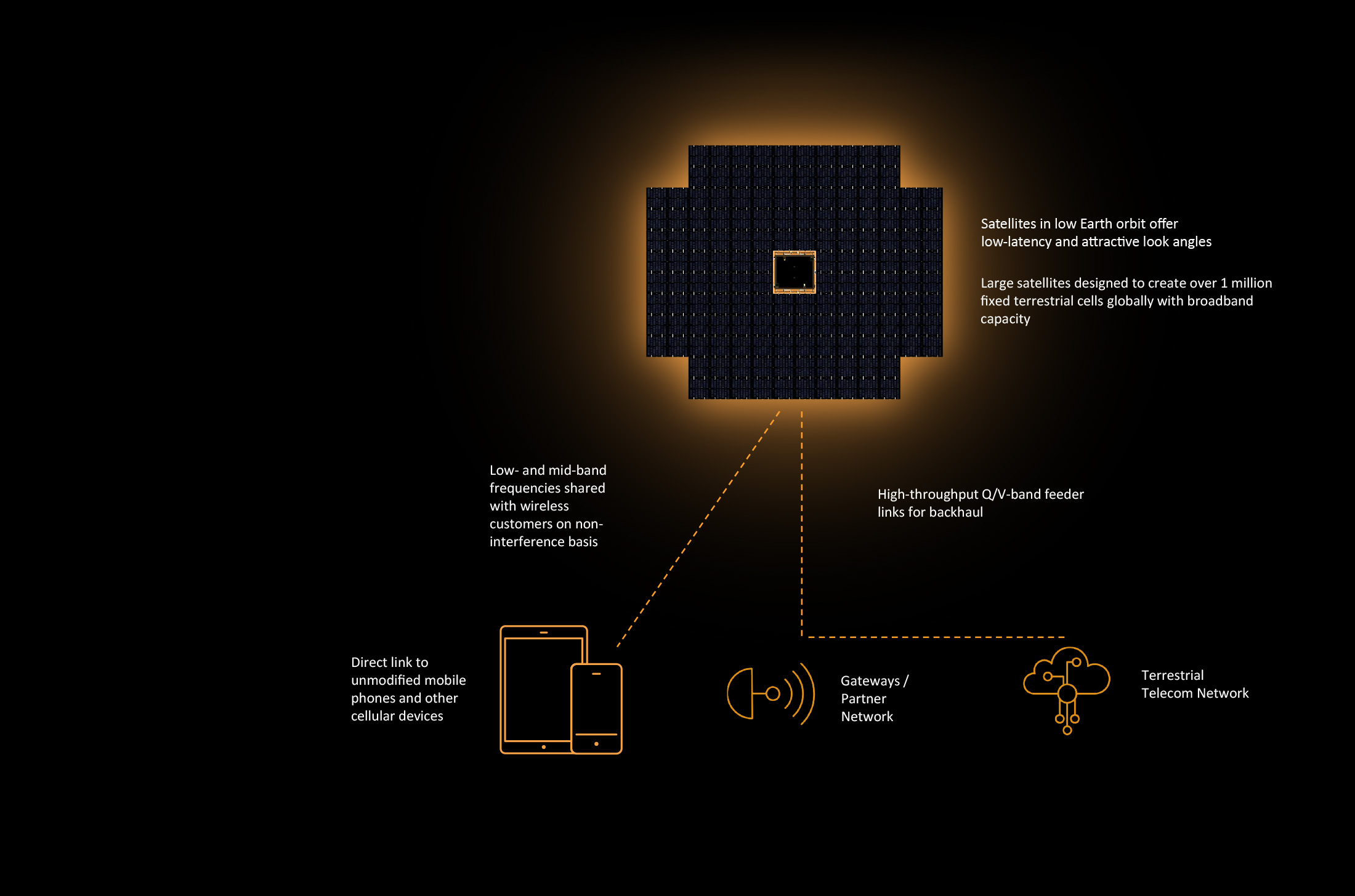

AST SpaceMobile's competitive advantage lies in its BlueBird satellite constellation. These large, low-Earth orbit satellites are designed with substantial antenna arrays capable of communicating directly with standard 4G and 5G smartphones without requiring specialized equipment or apps.

The company successfully deployed BlueBird 1-5 satellites and conducted successful tests with major carriers, demonstrating the viability of their direct-to-cell technology. The planned constellation will eventually include 45-60 operational satellites covering global markets.

Strategic Partnership with Verizon Drives Growth

A major catalyst for ASTS stock's recent surge was the announcement of a strategic partnership with Verizon Communications. This collaboration aims to provide direct-to-cell services across the United States and Canada starting in 2026, marking a significant milestone for commercial deployment.

AST SpaceMobile has also established partnerships with over 25 mobile network operators globally, including major carriers in Africa, Europe, and Asia. These partnerships provide a clear pathway to monetization and global market penetration.

Financial Health and Investment Considerations

While ASTS shows tremendous promise, investors should carefully consider the company's financial position. Current metrics reveal:

- Cash Position: $923.65 million in total cash

- Net Income: -$352.9 million (TTM)

- Free Cash Flow: -$586.15 million (leveraged)

- Return on Equity: -79.26%

The company operates in a pre-revenue stage with high capital expenditure requirements for satellite deployment and network infrastructure. However, once operational, the space-based network could achieve profit margins of 90-95% according to management projections.

Investment Outlook and Price Targets

Analyst coverage of ASTS stock presents mixed opinions. The consensus rating stands at "Hold" with an average price target of $45.82, suggesting potential downside from current levels. Price targets range from $30 to $60, reflecting the uncertainty surrounding the company's execution capabilities.

Bullish Factors

- First-mover advantage in direct-to-cell satellite communication

- Strong partnership ecosystem with major telecom operators

- Successful technology demonstrations and regulatory approvals

- Massive addressable market for underserved populations

Bearish Considerations

- High execution risk and capital requirements

- Competition from established players like Starlink

- Regulatory challenges across multiple jurisdictions

- Extended timeline to profitability

Risk Factors for ASTS Investors

Investing in ASTS stock carries significant risks typical of early-stage technology companies in the space sector. Key risks include technical execution challenges, regulatory approval delays, competitive pressures, and substantial capital requirements for constellation deployment.

The company's high beta of 2.41 indicates extreme price volatility, making it unsuitable for conservative investors. Market sentiment can dramatically impact share prices, as evidenced by recent trading patterns.

Frequently Asked Questions

Is ASTS stock a good investment in 2025?

ASTS represents a high-risk, high-reward investment opportunity. While the technology shows promise and partnerships are developing, significant execution risks remain. Investors should only allocate capital they can afford to lose.

When will AST SpaceMobile become profitable?

The company targets commercial service launch in 2026 with Verizon. Profitability depends on successful satellite deployment, regulatory approvals, and subscriber adoption rates. Management projects 90-95% profit margins once operational.

How does ASTS compare to Starlink?

While Starlink focuses on broadband internet service requiring terminals, AST SpaceMobile targets direct connectivity with standard smartphones. The addressable markets and business models differ significantly.

What are the main catalysts for ASTS stock?

Key catalysts include successful satellite launches, new partnership announcements, regulatory approvals, and progress toward commercial service launch. Quarterly earnings and technology milestones also impact stock performance.

Share This Analysis

Found this ASTS stock analysis helpful? Share it with fellow investors and help others make informed investment decisions in the revolutionary space communication sector.

💡 Stay informed about ASTS stock developments and space technology investments by bookmarking this comprehensive analysis.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Always conduct your own research and consult with financial professionals before making investment decisions.