BDO Hospital Financial Benchmark 2025: Critical Healthcare Economics Analysis

BDO Hospital Financial Benchmark 2025: Critical Healthcare Economics Analysis

The healthcare sector faces unprecedented financial challenges as revealed in BDO's comprehensive Hospital Financial Benchmark 2025 report. This critical analysis examines 59 general hospitals and 7 university medical centers (UMCs), revealing stark financial realities that demand immediate attention from healthcare stakeholders across the United States and internationally.

Executive Summary: Hospital Financial Performance 2025

BDO's latest benchmark study presents a mixed picture of hospital financial health. While general hospitals show modest improvement with average scores rising from 5.4 to 6.1, underlying structural challenges persist. University medical centers continue their concerning downward trajectory, dropping from 7.0 to 6.5 in overall financial performance ratings.

General Hospitals: Cautious Recovery Amid Persistent Challenges

Positive Financial Indicators

General hospitals demonstrated resilience with several encouraging metrics. The profit margin increased from 1.2% to 1.9%, primarily driven by reduced financial expenses and the absence of extraordinary depreciation charges. Additionally, financial leverage improved significantly, with the Net Debt/EBITDA ratio decreasing from 2.19 to 1.64, indicating stronger debt management capabilities.

Concerning Operational Trends

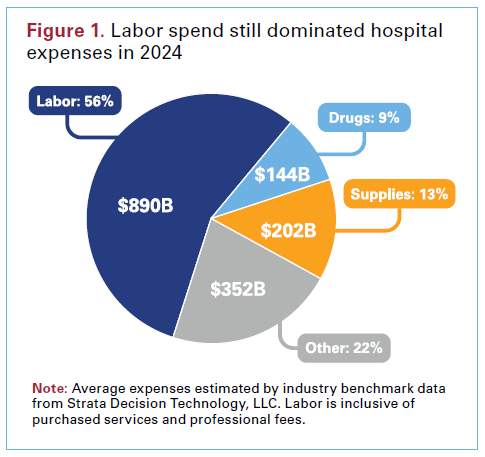

Despite surface-level improvements, fundamental operational challenges intensify. Personnel obligations reached €15,400 per full-time equivalent (FTE), representing an 8.5% increase. The personnel cost ratio climbed from 60.4% to 61% of total revenues, reflecting unsustainable labor cost inflation.

Infrastructure investment deficits remain critical, with 39 of 59 hospitals operating outdated facilities. Alarmingly, 30% fail to meet banking EBITDA standards, severely limiting access to development financing. The property age ratio decreased by only 0.4% to 45.8%, indicating insufficient modernization efforts.

University Medical Centers: Accelerating Financial Decline

Academic medical centers face more severe challenges, with financial performance declining for the second consecutive year. Two UMCs recorded failing grades for the first time since 2018, signaling systemic problems in academic healthcare financing.

The operational result (EBITDA margin) dropped one percentage point to 6.3%, breaking the positive trend maintained since 2020. Personnel costs surged 8.3%, primarily due to collective bargaining agreements, pushing the staff cost ratio from 58.8% to 60.1%.

Strategic Solutions for Healthcare Transformation

1. Strategic Focus and Societal Healthcare Debate

Healthcare costs require systematic prioritization as competing national priorities, including defense spending, create budget pressure. Essential questions demand public discourse: Which services remain in guaranteed coverage packages? This necessitates comprehensive stakeholder engagement including hospitals, insurers, municipalities, and healthcare providers.

2. Investment Incentive Restructuring

Current financing models inhibit necessary infrastructure investment. Allowing hospitals to retain sustainable performance improvements would address the investment dilemma. BDO identifies that efficiency gains from automation and productivity improvements often disappear during contract renegotiations, discouraging innovation.

3. Regional Collaboration Framework

Coordinated regional approaches to capital projects prevent redundant individual hospital investments while enhancing knowledge sharing. Joint regional strategies distribute investment risks across multiple stakeholders, creating more viable financing scenarios.

4. Digital Transformation and AI Integration

Advanced digitalization and artificial intelligence implementation offer substantial productivity improvements and personnel pressure relief. Back-office applications in finance, human resources, and administration present significant efficiency opportunities often overlooked in current technology strategies.

5. Modern Employment Practices

Personnel costs outpace revenue growth, driven by collective agreements and lifecycle benefit programs. Addressing younger employee preferences, such as immediate financial support for housing purchases, prevents hospitals from becoming de facto life insurance providers while improving sector labor market attractiveness.

Market Impact and Future Outlook

The financial instability affects approximately one-third of Dutch hospitals, with broader implications for international healthcare systems facing similar pressures. Transformation funding depletion under the Integrated Care Agreement (IZA) creates additional uncertainty, while breakthrough funding from the Supplementary Care and Welfare Agreement (AZWA) remains unclear.

Key Performance Indicators Analysis

- Financial Leverage: General hospitals improved from 2.19 to 1.64 (Net Debt/EBITDA)

- Personnel Costs: €15,400 per FTE (+8.5% increase)

- Staff Cost Ratio: 61% of revenues (up from 60.4%)

- Operational Margin: 7.5% for general hospitals (modest increase from 7.2%)

- UMC EBITDA Margin: 6.3% (decreased from 7.3%)

Frequently Asked Questions

What is the BDO Hospital Benchmark 2025?

The BDO Hospital Benchmark 2025 is an annual comprehensive financial health assessment of general hospitals and university medical centers, analyzing 59 general hospitals and 7 UMCs based on their 2024 annual reports.

Why are hospital personnel costs rising so rapidly?

Personnel costs increase due to collective bargaining agreements, lifecycle benefit programs, and competitive labor market pressures. The staff cost ratio now exceeds 60% of total hospital revenues.

How does hospital financial performance affect patient care?

Poor financial performance limits infrastructure investment, technology upgrades, and staff development, potentially impacting care quality and access to advanced medical services.

What role do UMCs play beyond patient care?

University medical centers provide complex care, train healthcare professionals, and conduct innovative research - all essential elements for healthcare sector transformation.

Industry Recommendations

Mike Tagage, BDO Healthcare Branch Chair, emphasizes immediate action necessity: "Transformation urgency is clear. The healthcare gap widens. Regional plans and transformation funding created unequal national opportunities. This inequality increases as Integrated Care Agreement transformation funding is exhausted."

Healthcare stakeholders must collaborate immediately on sustainable solutions, addressing infrastructure deficits, personnel cost management, and operational efficiency improvements. The window for gradual change closes rapidly, demanding accelerated transformation strategies.

Conclusion: Critical Juncture for Healthcare Economics

The BDO Hospital Benchmark 2025 reveals a healthcare sector at a crossroads. While general hospitals show modest improvement, underlying structural challenges intensify. University medical centers face accelerating decline, threatening the entire healthcare ecosystem's future viability.

Successful transformation requires coordinated action from all stakeholders - hospitals, government agencies, insurers, and healthcare professionals. The solutions exist, but implementation demands unprecedented collaboration and decisive leadership.

Share this critical healthcare analysis: Help spread awareness about hospital financial challenges by sharing this comprehensive analysis with healthcare professionals, policymakers, and industry stakeholders. Together, we can drive the necessary transformation for sustainable healthcare.