Broadcom Stock (AVGO): Complete Investment Guide & Analysis 2025

Broadcom Stock (AVGO): Complete Investment Guide & Analysis 2025

Broadcom Inc. (NASDAQ: AVGO) has emerged as one of the most compelling investment opportunities in the semiconductor sector, particularly as artificial intelligence continues to reshape the technology landscape. Trading at approximately $356.70 as of October 13, 2025, the stock has demonstrated remarkable resilience and growth potential that investors cannot afford to ignore.

Current Broadcom Stock Performance

Broadcom's stock has exhibited exceptional performance in 2025, with shares gaining over 53% year-to-date. The company's market capitalization has soared to approximately $1.68 trillion, establishing it as one of the most valuable technology companies globally. Recent trading sessions have shown significant volatility, with the stock touching a 52-week high of $374.23 in September 2025.

The stock's impressive trajectory reflects investor confidence in Broadcom's strategic positioning within the AI ecosystem. Key performance metrics include a trailing P/E ratio of 91.44, which, while elevated, reflects the market's premium valuation of companies with strong AI exposure. The company's forward P/E of 42.64 suggests more reasonable valuations based on projected earnings growth.

Recent Market Catalysts

Several factors have contributed to Broadcom's recent stock surge, including strategic partnerships with major AI companies like OpenAI. These deals, reportedly worth billions of dollars, demonstrate Broadcom's critical role in supplying custom AI chips that power next-generation artificial intelligence applications.

Company Overview & Business Model

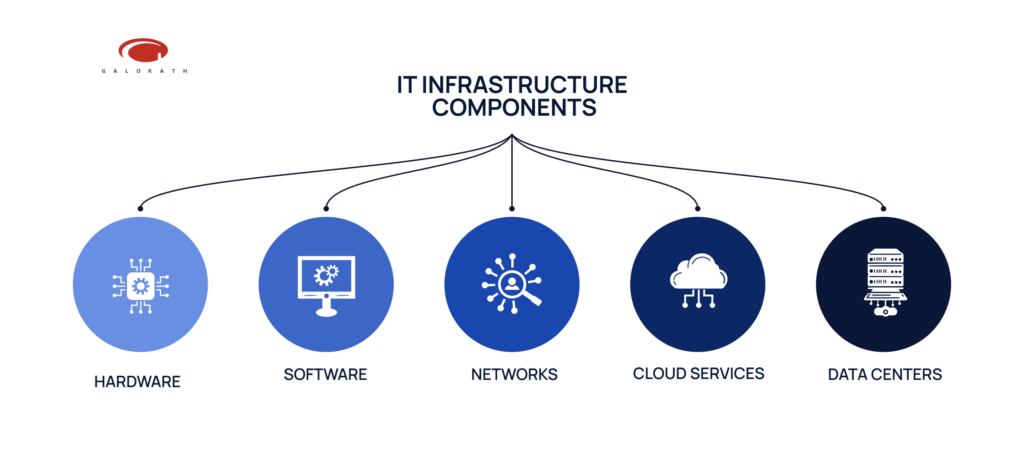

Founded in 1961 and headquartered in Palo Alto, California, Broadcom operates through two primary segments: Semiconductor Solutions and Infrastructure Software. The company employs approximately 37,000 people worldwide and has established itself as a global leader in fabless semiconductor design and infrastructure software solutions.

Semiconductor Solutions Division

Broadcom's semiconductor portfolio encompasses a diverse range of products including Ethernet switching solutions, optical components, wireless connectivity chips, and specialized processors for data centers. The company's products are integral to smartphones, data centers, networking equipment, and increasingly, AI infrastructure.

Infrastructure Software Segment

Following strategic acquisitions including CA Technologies and VMware, Broadcom has built a substantial software business focused on mainframe, distributed computing, and cybersecurity solutions. This diversification has provided stable recurring revenue streams that complement the more cyclical semiconductor business.

AI Revolution Impact on Broadcom Stock

The artificial intelligence boom has positioned Broadcom as a critical enabler of AI infrastructure. The company's custom ASIC (Application-Specific Integrated Circuit) capabilities have made it an essential partner for major cloud providers and AI companies developing specialized computing solutions.

Broadcom's AI-related revenue has shown exponential growth, with custom AI chip solutions representing a significant and rapidly expanding portion of the business. The company's ability to design and manufacture specialized processors for machine learning workloads has created substantial competitive advantages and pricing power.

Strategic AI Partnerships

Recent announcements regarding multi-billion dollar AI chip deals have highlighted Broadcom's strategic importance in the AI supply chain. These long-term contracts provide revenue visibility and demonstrate the company's technical capabilities in delivering cutting-edge silicon solutions for artificial intelligence applications.

Key Financial Metrics & Performance

Broadcom's financial performance reflects both the strength of its core businesses and the impact of strategic acquisitions. The company generated approximately $59.93 billion in trailing twelve-month revenue, with a robust net profit margin of 31.39%.

:max_bytes(150000):strip_icc()/dotdash_Final_Introductio_to_Technical_Analysis_Price_Patterns_Sep_2020-02-59df8834491946bcb9588197942fabb6.jpg)

Financial Strength Indicators

The company maintains strong profitability metrics with a return on equity of 27.08% and return on assets of 8.90%. Broadcom's balance sheet shows $11.11 billion in total cash, providing financial flexibility for continued investment in R&D and strategic acquisitions.

Free cash flow generation remains robust at $23.1 billion, supporting the company's dividend policy. Broadcom pays a quarterly dividend of $0.59 per share, yielding approximately 0.66%, though investors primarily hold the stock for capital appreciation rather than income.

Valuation Considerations

While Broadcom's current valuation appears elevated by traditional metrics, the company's exposure to high-growth AI markets and strong competitive positioning justify premium multiples. Analysts have set price targets averaging around $375, suggesting potential upside from current levels.

Investment Analysis & Future Outlook

Broadcom's investment thesis rests on several key pillars: dominant market positions in critical semiconductor markets, strategic exposure to AI growth trends, and a proven track record of successful acquisitions and integration.

The company's diversified revenue streams provide stability during semiconductor cycle downturns, while its AI-focused products offer significant growth potential. Infrastructure software acquisitions have created recurring revenue streams that enhance overall business predictability.

Risk Factors to Consider

Potential investors should consider several risk factors including semiconductor industry cyclicality, geopolitical tensions affecting global supply chains, and competition from other chip designers. Additionally, the high valuation leaves little room for execution missteps or market disappointments.

Regulatory scrutiny of large technology companies and potential changes in AI demand patterns could also impact future performance. However, Broadcom's diversified portfolio and strong competitive moats help mitigate many of these risks.

Frequently Asked Questions

Is Broadcom stock a good buy in 2025?

Broadcom appears well-positioned for continued growth, particularly given its strategic exposure to AI infrastructure. However, investors should consider the elevated valuation and potential volatility in semiconductor markets.

What is Broadcom's main business?

Broadcom operates two main segments: Semiconductor Solutions (designing chips for various applications) and Infrastructure Software (enterprise software solutions). The company is particularly known for its AI chips and networking semiconductors.

How does Broadcom benefit from AI trends?

Broadcom designs custom AI chips (ASICs) for major cloud providers and AI companies. These specialized processors are essential for training and running AI models, positioning Broadcom as a key beneficiary of AI infrastructure spending.

What are the risks of investing in Broadcom stock?

Key risks include semiconductor industry cyclicality, high current valuation, geopolitical supply chain disruptions, and potential changes in AI demand. The stock may be volatile during market downturns.

Does Broadcom pay dividends?

Yes, Broadcom pays a quarterly dividend of $0.59 per share, yielding approximately 0.66%. However, the company is primarily focused on growth and capital appreciation rather than income generation.

How does Broadcom compare to NVIDIA in AI?

While NVIDIA focuses on general-purpose AI GPUs, Broadcom specializes in custom AI chips (ASICs) designed for specific applications. Both companies benefit from AI growth but serve different market segments with complementary technologies.

Investment Recommendation

Broadcom represents a compelling long-term investment opportunity for investors seeking exposure to the artificial intelligence revolution and semiconductor innovation. The company's strong market positions, diversified revenue streams, and strategic AI partnerships provide multiple avenues for sustained growth.

While the current valuation requires careful consideration, Broadcom's fundamental strengths and growth prospects support its premium market position. Investors with a long-term horizon and tolerance for technology sector volatility may find Broadcom stock an attractive addition to diversified portfolios.

The company's proven ability to execute acquisitions, maintain market leadership across multiple product categories, and adapt to evolving technology trends positions it well for continued success in the dynamic semiconductor landscape.