Cryptocurrency Integration with Traditional Finance: The 2025 Revolution in the US

Cryptocurrency Integration with Traditional Finance: The 2025 Revolution in the US

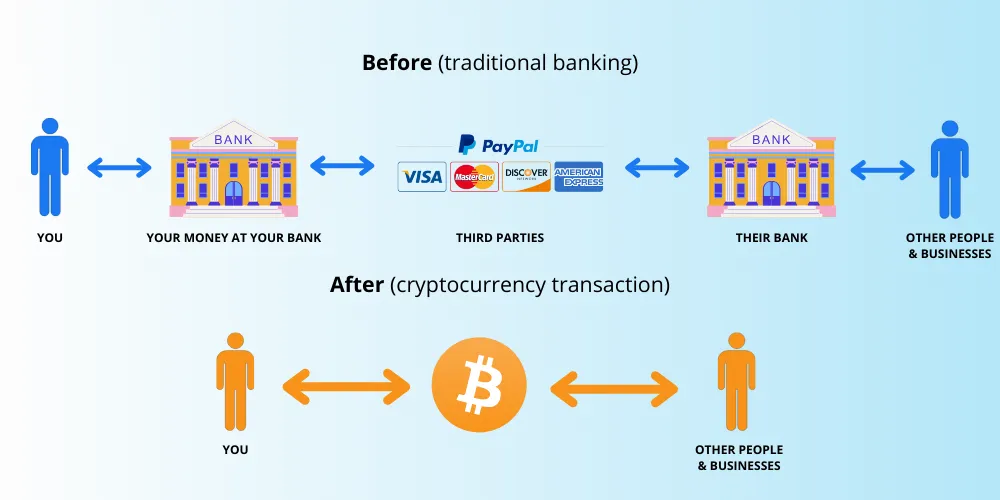

The walls between cryptocurrency and traditional finance are crumbling. What was once a battle between two opposing financial philosophies has evolved into a strategic partnership that's reshaping American banking. In 2025, the United States stands at the forefront of this transformation as crypto exchanges go public, major banks launch digital asset services, and federal legislation creates the framework for a hybrid financial ecosystem.

The Historic Policy Shift: Making America the "Crypto Capital"

President Trump's January 2025 promise to make the United States the "Crypto Capital of the World" wasn't empty rhetoric. Within months, the federal government executed a stunning about-face in crypto policy. On July 18, 2025, President Trump signed the GENIUS Act—America's first crypto-specific federal legislation—establishing a comprehensive framework for payment stablecoin activities with overwhelming bipartisan support.

The Securities and Exchange Commission launched "Project Crypto," a Commission-wide initiative to modernize securities rules for on-chain financial markets. Within weeks, the SEC withdrew SAB 121 accounting rules that burdened crypto custody, dismissed nearly all non-fraud enforcement actions from the previous administration, and released comprehensive guidance on staking, mining, and stablecoin activities. This regulatory clarity has unleashed a wave of innovation across American financial institutions.

Wall Street Embraces Digital Assets

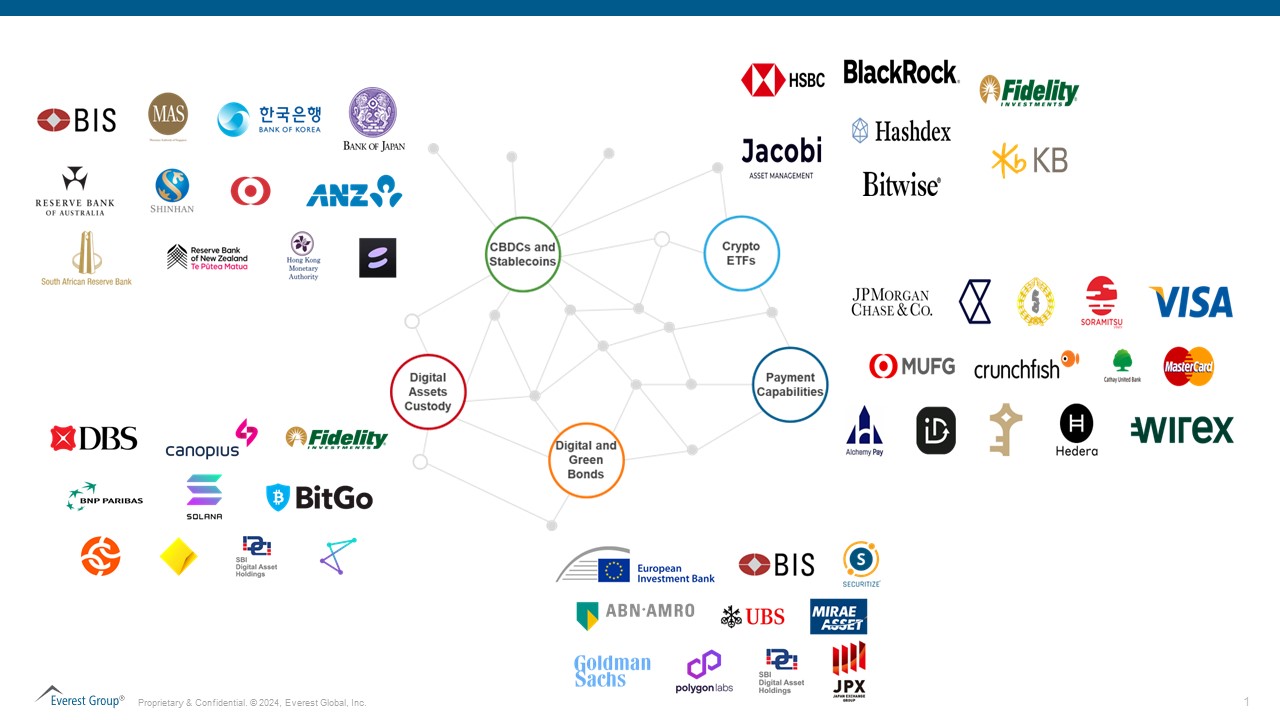

Traditional banking giants are no longer sitting on the sidelines. JPMorgan Chase's JPM Coin now facilitates institutional payments, while its blockchain division Onyx runs pilot programs for real-time settlements. Goldman Sachs operates a full crypto trading desk for Bitcoin and Ethereum, and Morgan Stanley provides its wealth management clients with direct access to Bitcoin funds through approved investment products.

Major Banks Leading the Charge

Citi has announced plans to launch cryptocurrency custody services by 2026, positioning itself as a bridge between institutional investors and digital assets. Bank of America, Wells Fargo, and US Bancorp have established crypto trading desks serving their corporate and high-net-worth clients. The asset management titans—BlackRock, Fidelity Investments, State Street, and BNY Mellon—now offer digital asset custody services, lending legitimacy and security to crypto holdings.

This isn't simply adding a new product line. Banks are fundamentally reimagining their service offerings. HSBC introduced tokenized deposit services enabling corporate clients to move currencies across borders instantaneously using blockchain technology. PNC Bank partnered with Coinbase to integrate crypto trading directly into its banking platform, allowing customers to manage both traditional and digital assets from a single interface.

The Stablecoin Revolution: Bridging Two Worlds

Stablecoins—cryptocurrencies pegged to the US dollar—are emerging as the killer application that finally merges crypto innovation with traditional finance stability. Circle, the issuer of USDC stablecoin, holds over $50 billion in US Treasury debt to back its digital currency. The company's recent move to go public signals crypto's integration into mainstream financial markets.

The GENIUS Act provides federal regulatory oversight for stablecoin issuers, establishing reserve requirements, redemption guarantees, and consumer protections. This framework transforms stablecoins from experimental technology into regulated payment instruments comparable to traditional money market funds. American banks are now exploring joint stablecoin issuance, recognizing that blockchain-based payments offer 24/7 settlement at a fraction of traditional wire transfer costs.

The Hybrid Finance Advantage: Why Banks Win

Traditional financial institutions possess decisive advantages in the race toward crypto integration. Trust built over decades cannot be replicated overnight. Banks already safeguard trillions in customer assets, understand regulatory compliance, and maintain relationships with millions of account holders. When a bank offers cryptocurrency services, customers gain the security of FDIC insurance alongside the innovation of blockchain technology.

This "one-stop financial shop" approach transforms banking from a transactional relationship into a comprehensive financial ecosystem. Customers can use cryptocurrencies as collateral for traditional loans, automatically invest portions of their salary into Bitcoin while maintaining conventional savings accounts, and seamlessly transfer value between fiat and digital currencies without navigating multiple platforms.

Beyond Trading: The Future of Integrated Services

The convergence extends far beyond basic cryptocurrency buying and selling. Tokenization—converting traditional assets like stocks, real estate, and commodities into blockchain-based tokens—enables 24/7 trading of historically illiquid investments. Nasdaq has announced plans to offer tokenized share trading, potentially revolutionizing equity markets by eliminating settlement delays and reducing counterparty risk.

Decentralized Finance Meets Traditional Banking

Decentralized finance (DeFi) protocols offer lending, borrowing, and yield generation without traditional intermediaries. Rather than competing with DeFi, forward-thinking banks are integrating these capabilities. Customers could soon earn yield on stablecoin deposits through DeFi protocols while maintaining the security and customer service of their traditional bank relationship. This hybrid approach captures DeFi's innovation while addressing its challenges around security, customer support, and regulatory compliance.

Investment Opportunities in Crypto-Traditional Integration

For American investors, this convergence creates multiple wealth-building opportunities. Banks offering comprehensive crypto services are positioning themselves to capture younger, tech-savvy customers who demand digital asset access. Financial institutions that successfully integrate blockchain technology gain operational efficiencies—faster settlements, reduced costs, and 24/7 transaction capabilities—that translate into competitive advantages.

The technology providers enabling this transformation—custody solution developers, blockchain infrastructure companies, and compliance software firms—represent another investment avenue. As every major bank builds crypto capabilities, demand for secure, scalable, and regulatory-compliant infrastructure will surge.

Regulatory Clarity Drives Adoption

The three-phase roadmap identified by industry analysts maps the evolution from short-term guidance to long-term legislative frameworks. In the immediate term, regulators are issuing no-action relief and exemptive orders allowing banks to experiment with crypto services. The medium term will see formal rulemaking through the Administrative Procedure Act, providing durable regulatory standards. Long-term, comprehensive market structure legislation—like the CLARITY Act in the House and the Responsible Financial Innovation Act in the Senate—will establish permanent jurisdictional boundaries and licensing frameworks.

This regulatory progression provides certainty for financial institutions planning multi-year technology investments. Banks no longer fear that crypto initiatives will be shut down by regulatory changes, enabling committed long-term strategic planning.

Frequently Asked Questions

What is the GENIUS Act and how does it affect crypto?

The GENIUS Act, signed into law in July 2025, is America's first federal cryptocurrency legislation. It establishes a regulatory framework for payment stablecoins, including reserve requirements, redemption guarantees, and consumer protections, allowing stablecoins to function as regulated payment instruments.

Which major US banks offer cryptocurrency services?

JPMorgan Chase, Goldman Sachs, Morgan Stanley, Citi, Bank of America, Wells Fargo, and US Bancorp all offer various crypto services. Asset managers like BlackRock, Fidelity, State Street, and BNY Mellon provide digital asset custody for institutional clients.

Are my cryptocurrency holdings protected in traditional banks?

Banks offering crypto custody services provide institutional-grade security, regulatory compliance, and often insurance protection. However, cryptocurrency holdings are not FDIC-insured. Banks typically use cold storage, multi-signature authentication, and robust security protocols to protect digital assets.

What are stablecoins and why are they important?

Stablecoins are cryptocurrencies pegged to stable assets like the US dollar. They combine crypto's technological benefits—instant settlement, 24/7 availability, low costs—with traditional currency stability. They're becoming the primary bridge between crypto and traditional finance for payments and transfers.

How will crypto integration benefit traditional banking customers?

Customers gain access to crypto trading, custody, and yield opportunities through their existing bank relationships. Benefits include using crypto as loan collateral, instant international transfers via stablecoins, 24/7 trading, and seamless management of both traditional and digital assets in one place.

The Path Forward: Convergence as Competitive Necessity

The integration of cryptocurrency with traditional finance is no longer experimental—it's a competitive necessity for American financial institutions. Banks that master this convergence will capture younger generations, diversify revenue streams, reduce operational costs, and position themselves for the next wave of financial innovation. The institutions that hesitate risk becoming obsolete as nimble competitors and crypto-native firms capture market share.

For investors, this convergence represents a generational opportunity. The companies successfully bridging these two worlds—whether traditional banks adding crypto capabilities or crypto firms achieving institutional legitimacy—stand to capture enormous value as digital and traditional finance become indistinguishable. The future of American finance isn't crypto versus traditional banking. It's a hybrid ecosystem delivering the best of both worlds, and 2025 marks the year this vision becomes reality.

💡 Found this analysis valuable? Share it with investors and financial professionals who need to understand how the convergence of crypto and traditional finance is creating unprecedented opportunities in American markets!