Doug Lebda: Visionary LendingTree Founder Dies at 55 in Tragic ATV Accident

Doug Lebda: Visionary LendingTree Founder Dies at 55 in Tragic ATV Accident

The financial technology world mourns the unexpected loss of Doug Lebda, the visionary founder and CEO of LendingTree, who died tragically in an all-terrain vehicle accident on October 12, 2025, at his family farm in North Carolina. At just 55 years old, Lebda leaves behind a transformative legacy that revolutionized how millions of Americans access financial services.

The Early Vision That Changed Financial Services

Doug Lebda's journey to transforming the lending industry began with a personal frustration. In 1996, after experiencing the cumbersome process of securing his first mortgage, Lebda recognized a fundamental problem in the financial services landscape. Traditional lending required consumers to visit banks in person, often without the ability to compare options effectively.

This personal experience sparked the creation of LendingTree, founded in 1996 with a revolutionary concept: create an online platform that would allow customers to shop for loans from multiple lenders simultaneously, fostering competition and better rates for consumers. As Lebda once told The Wall Street Journal in 2012, "All of my ideas come from my own experiences and problems."

Building a Financial Technology Empire

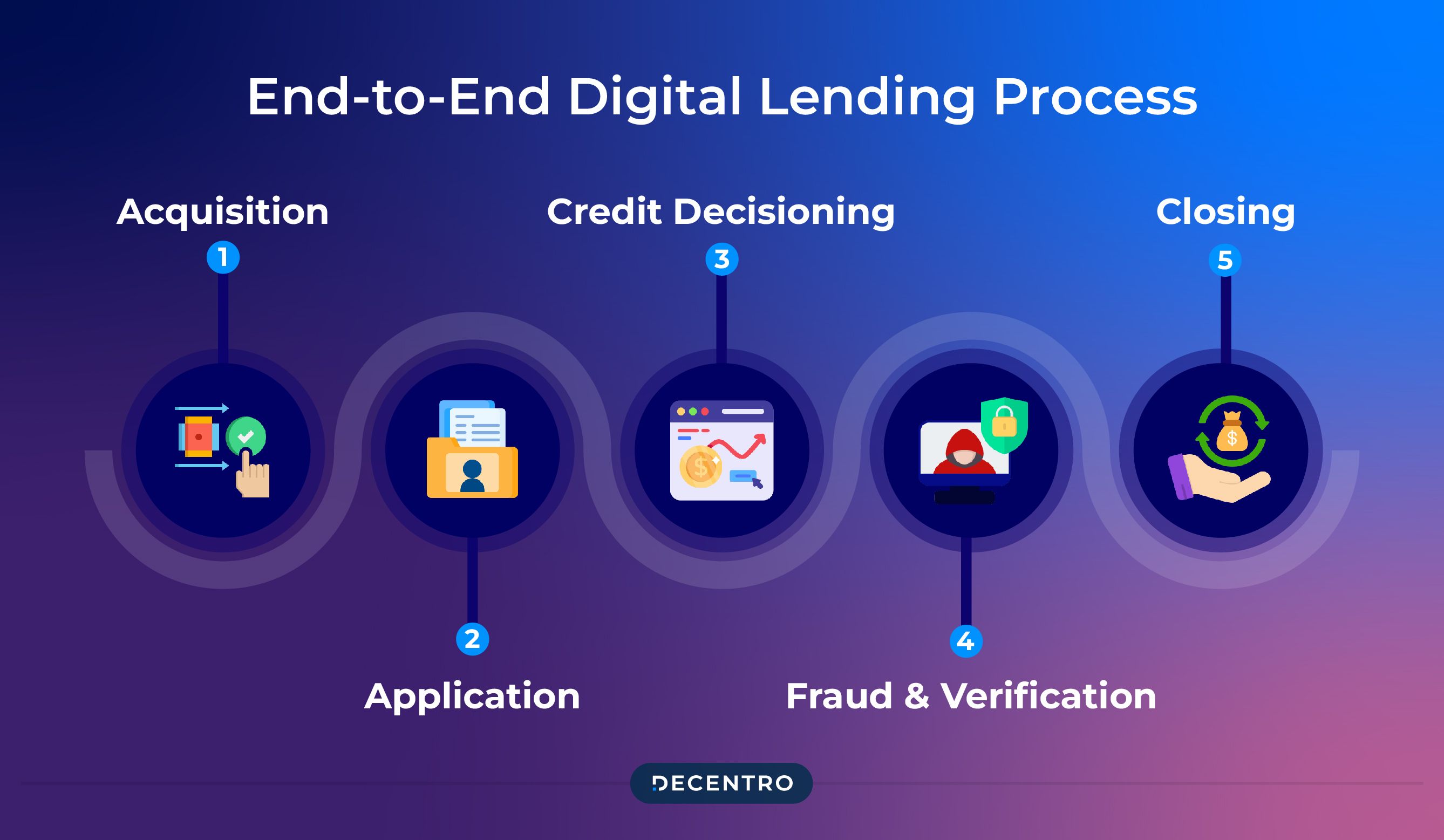

LendingTree launched nationally in 1998, quickly gaining traction in the emerging digital economy. The company went public in 2000, marking a significant milestone in the fintech revolution. The business model was innovative for its time: rather than consumers having to apply to individual lenders, LendingTree allowed them to submit one application and receive multiple offers.

Corporate Evolution and Growth

The company's journey included strategic phases that demonstrated Lebda's adaptability as a leader. LendingTree was acquired by internet conglomerate IAC/InterActiveCorp before spinning off again as an independent public company in 2008. This experience gave the company additional resources and expertise while maintaining its innovative edge.

Under Lebda's leadership, LendingTree expanded beyond mortgages to become a comprehensive financial marketplace. Today, the Charlotte, North Carolina-based company helps consumers find and compare mortgages, credit cards, personal loans, insurance products, and other financial services. The LendingTree family of brands includes CompareCards and ValuePenguin, broadening its reach in the financial comparison space.

Beyond LendingTree: Expanding Financial Innovation

Lebda's entrepreneurial spirit extended beyond his flagship company. In 2010, he co-founded Tykoon, a financial services platform designed specifically for children and families. This venture demonstrated his commitment to financial literacy and education across all age groups, recognizing that financial habits and understanding should begin early in life.

Before his entrepreneurial success, Lebda built valuable experience as an auditor and consultant for PriceWaterhouseCoopers, where he developed the analytical and business skills that would later prove crucial in identifying market opportunities and building successful companies.

Leadership Philosophy and Company Culture

Those who knew Lebda described him as a visionary leader whose "relentless drive, innovation, and passion transformed the financial services landscape, touching the lives of millions of consumers," according to LendingTree's board of directors. His leadership style emphasized solving real problems for real people, always staying connected to the consumer experience that inspired his original vision.

The Impact on Financial Services Industry

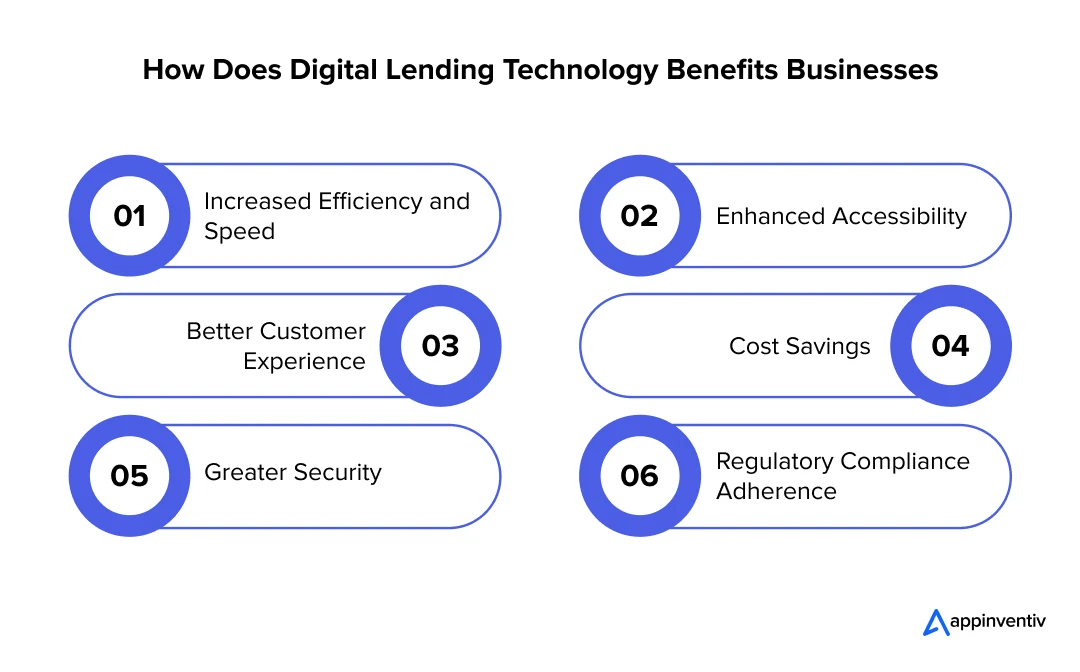

Lebda's influence extended far beyond LendingTree itself. His pioneering approach to online lending marketplaces helped establish an entire category of financial technology companies. The concept of aggregating loan offers and empowering consumers with choice became the foundation for numerous fintech innovations that followed.

Market Transformation

The lending comparison model that Lebda championed has become standard practice in financial services. Today, consumers expect to be able to compare options across multiple providers, whether for mortgages, insurance, or credit cards. This shift has increased competition among lenders and generally resulted in better terms and rates for consumers.

Personal Life and Family Legacy

Beyond his professional achievements, Doug Lebda was a devoted family man. He is survived by his wife, Megan, and three daughters. In a heartfelt statement, Megan Lebda described her husband as "an amazing man with a heart so big it seemed to have room for everyone he met." She emphasized that his legacy would continue both through LendingTree and "the lives he touched."

The accident occurred at the family's farm in North Carolina, highlighting Lebda's connection to his roots and his desire to provide his family with experiences beyond the corporate world.

Succession and Company Future

In the wake of this tragedy, LendingTree has moved quickly to ensure business continuity. Scott Peyree, who served as the company's chief operating officer and president, has been appointed as the new CEO, effective immediately. Steve Ozonian, the lead independent director, will assume the role of chairman of the board.

Peyree acknowledged the devastating impact of losing Lebda while expressing confidence in the leadership team's ability to continue the company's mission. "One of the most immediate impacts of his legacy is the strong management team he put in place at LendingTree," he stated.

Frequently Asked Questions

What was Doug Lebda's net worth at the time of his death?

While specific figures haven't been publicly disclosed, as founder and CEO of a publicly traded company, Lebda's wealth was largely tied to his LendingTree holdings and other business investments.

How will LendingTree continue without its founder?

The company has appointed Scott Peyree as CEO and Steve Ozonian as chairman. Both leaders have extensive experience with the company and are committed to continuing Lebda's vision.

What was the cause of the ATV accident?

Specific details about the accident have not been publicly released. The incident occurred at the family's farm in North Carolina on October 12, 2025.

What other companies did Doug Lebda found besides LendingTree?

In addition to LendingTree, Lebda co-founded Tykoon in 2010, a financial services platform designed for children and families to promote financial literacy.

A Lasting Legacy in Financial Innovation

Doug Lebda's sudden passing represents a significant loss for the financial technology industry and the millions of consumers who have benefited from his innovations. His vision of empowering consumers with choice and transparency in financial services has become a cornerstone of modern fintech.

As the industry continues to evolve with new technologies like artificial intelligence and blockchain, Lebda's fundamental principle—solving real problems for real people—remains as relevant as ever. His legacy will undoubtedly inspire future entrepreneurs to identify inefficiencies in traditional systems and create solutions that benefit consumers.

The financial services landscape today looks dramatically different than it did in 1996, thanks largely to pioneers like Doug Lebda who saw opportunity where others saw only established tradition. His impact will be felt for generations to come, both through the company he built and the industry transformation he helped lead.

Found this article informative? Share it with others who might benefit from learning about Doug Lebda's remarkable legacy.