Fannie Mae 2025: Complete Guide to America's Housing Finance Giant

Fannie Mae 2025: Complete Guide to America's Housing Finance Giant

The Federal National Mortgage Association, commonly known as Fannie Mae (FNMA), stands as one of America's most influential housing finance institutions. As a government-sponsored enterprise (GSE), Fannie Mae plays a pivotal role in maintaining liquidity in the U.S. mortgage market, directly impacting millions of American homebuyers, homeowners, and renters across the nation.

Understanding Fannie Mae's Critical Role in Housing Finance

Fannie Mae operates as a foundational pillar of the American housing finance system, purchasing mortgages from lenders and transforming them into mortgage-backed securities (MBS) that are sold to investors. This process creates a continuous flow of capital back to mortgage lenders, enabling them to originate new loans and maintain market stability.

The organization's mission centers on making housing more accessible and affordable for American families. Through its sophisticated financial mechanisms, Fannie Mae helps ensure that the traditional 30-year, fixed-rate mortgage remains available to qualified borrowers across diverse economic conditions.

Core Functions and Services

Fannie Mae's operations encompass several critical areas that directly benefit the housing market:

- Mortgage Acquisition: Purchasing qualified mortgages from approved lenders nationwide

- Risk Management: Implementing comprehensive underwriting standards and guidelines

- Market Liquidity: Providing continuous capital flow to support lending activities

- Affordable Housing: Supporting programs that increase access to homeownership for underserved communities

Fannie Mae's 2025 Housing Market Outlook

According to Fannie Mae's Economic and Strategic Research (ESR) Group, led by Chief Economist Mark Palim, the housing market is projected to maintain relative stability through 2025. Total home sales are forecast at 4.74 million units for 2025, with existing home sales expected to reach 4.09 million units, representing a modest increase from the 4.06 million units recorded in 2024.

These projections reflect Fannie Mae's comprehensive analysis of economic indicators, demographic trends, and mortgage market conditions. The ESR Group's research incorporates data from multiple sources, including consumer surveys, lender feedback, and historical market patterns to provide accurate forecasting.

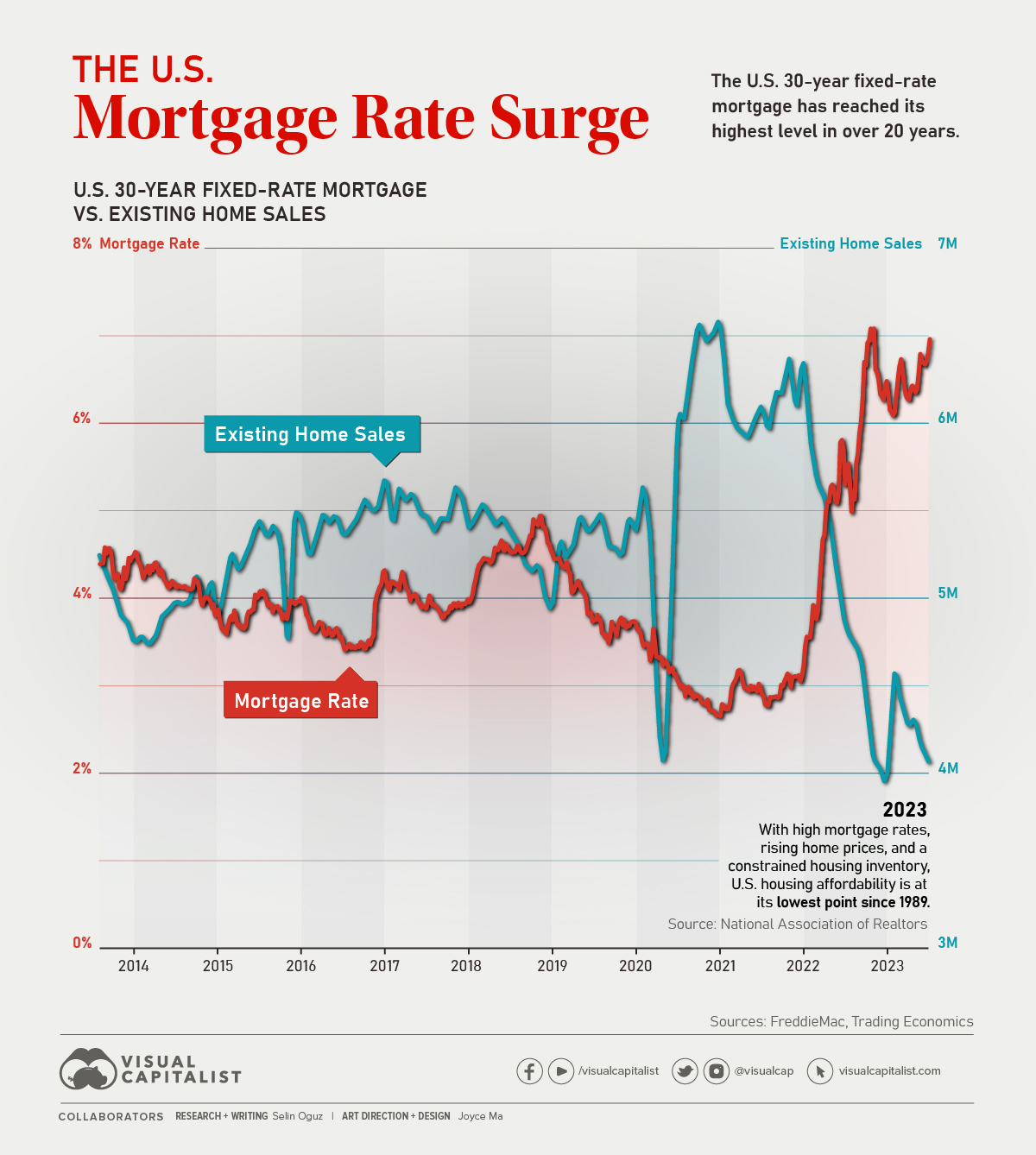

Current Mortgage Rate Environment and Projections

Mortgage rates remain a central focus for Fannie Mae's market analysis and forecasting efforts. Current projections indicate that mortgage rates are expected to end 2025 at approximately 6.5 percent, with a gradual decline to 6.1 percent by the end of 2026. These forecasts represent modest upward revisions compared to earlier projections, reflecting evolving economic conditions and Federal Reserve policy considerations.

The ESR Group continuously monitors factors that influence mortgage rate trends, including:

- Federal Reserve monetary policy decisions

- Long-term Treasury yield movements

- Credit market conditions and investor demand

- Economic growth indicators and inflation expectations

2025 Conforming Loan Limits and Guidelines

Fannie Mae operates within conforming loan limits established by the Federal Housing Finance Agency (FHFA). For 2025, the baseline conforming loan limit for most areas is $806,500 for single-unit properties, with higher limits in designated high-cost areas reaching up to $1,209,750 in Alaska, Hawaii, Guam, and the U.S. Virgin Islands.

These loan limits are adjusted annually based on home price appreciation in various markets, ensuring that Fannie Mae can continue serving borrowers in both affordable and high-cost housing markets across the United States.

Fannie Mae's Business Operations Overview

Fannie Mae operates through several distinct business segments, each designed to serve specific aspects of the housing finance market:

Single-Family Business

The Single-Family segment provides liquidity to the home purchase market by acquiring mortgages from lenders and overseeing loan servicing operations. This division handles the majority of Fannie Mae's mortgage portfolio and directly impacts individual homebuyers nationwide.

Multifamily Business

Focusing on rental housing, the Multifamily segment supports affordable rental housing development and preservation through various financing programs and investment strategies.

Capital Markets

The Capital Markets division manages Fannie Mae's funding operations, including the issuance of mortgage-backed securities and debt instruments that attract investor capital to the housing market.

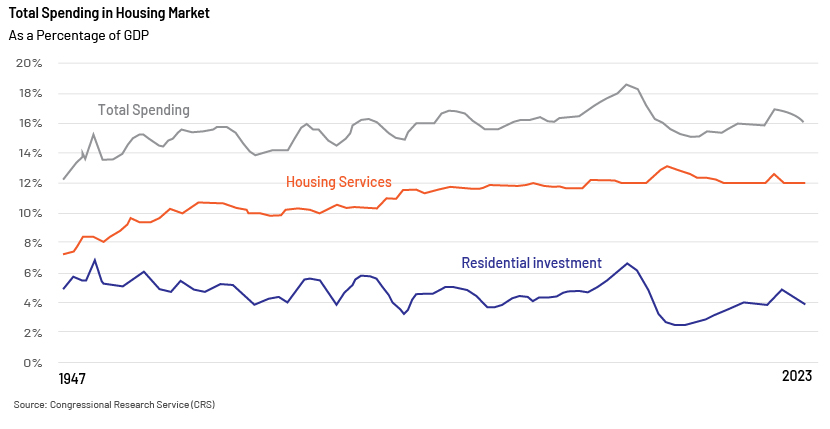

Economic Impact and Market Statistics

Fannie Mae's influence on the U.S. housing market is substantial and measurable. In the first half of 2025 alone, the organization provided $178 billion in funding to support the U.S. housing market, directly assisting 668,000 households in buying, refinancing, or renting homes.

With total assets of $4.3 trillion as of June 30, 2025, Fannie Mae represents one of the largest financial institutions in the United States. This scale enables the organization to maintain market stability during economic uncertainties and provide consistent access to mortgage credit across diverse market conditions.

Innovation and Technology Initiatives

Fannie Mae continues investing in technological innovations to improve the mortgage process. Key initiatives include:

- Desktop Underwriter (DU): Celebrating 30 years of automated underwriting innovation

- Income Calculator: Tools helping lenders efficiently calculate complex borrower income scenarios

- Digital Mortgage Solutions: Streamlining the loan origination and servicing process

Frequently Asked Questions About Fannie Mae

What is the maximum loan amount Fannie Mae will purchase in 2025?

For 2025, the baseline conforming loan limit is $806,500 for single-unit properties in most areas, with higher limits up to $1,209,750 in designated high-cost areas.

How does Fannie Mae affect mortgage rates?

Fannie Mae influences mortgage rates by providing liquidity to the mortgage market through purchasing loans from lenders and creating mortgage-backed securities, helping maintain competitive rates for borrowers.

What are Fannie Mae's current mortgage rate forecasts?

Fannie Mae projects mortgage rates to end 2025 at 6.5% and decline to 6.1% by the end of 2026, based on current economic conditions and Federal Reserve policy expectations.

How many households did Fannie Mae help in 2025?

In the first half of 2025, Fannie Mae assisted 668,000 households in buying, refinancing, or renting homes, while providing $178 billion in market funding.

Share This Housing Market Analysis

Found this Fannie Mae analysis valuable? Share it with others interested in housing finance! Stay informed about mortgage market trends and make better housing decisions with expert insights.