AMD Stock Analysis 2024: OpenAI Partnership Drives Massive Growth Potential

AMD Stock Analysis 2024: OpenAI Partnership Drives Massive Growth Potential

Table of Contents

- The Game-Changing OpenAI Partnership

- 2024 Financial Performance Overview

- AMD's Position in the AI Race

- Investment Outlook and Price Targets

- Key Risks and Considerations

- Frequently Asked Questions

The Game-Changing OpenAI Partnership

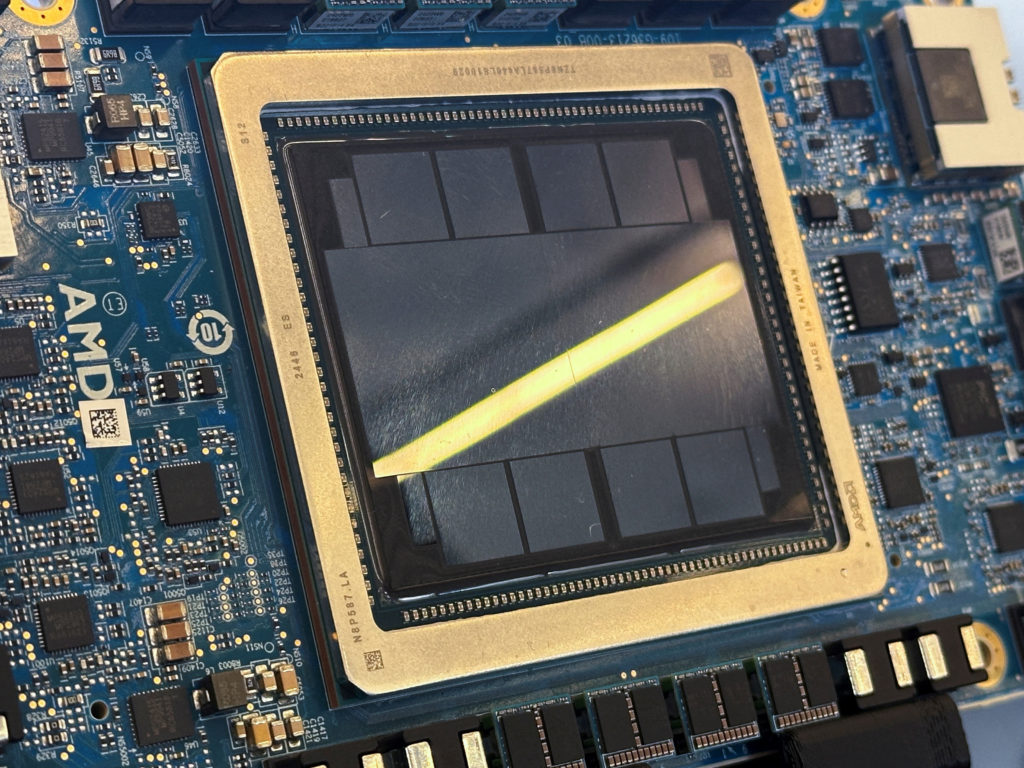

Advanced Micro Devices (NASDAQ: AMD) experienced its most significant single-day gain in recent history on October 6, 2025, surging over 23% following the announcement of a groundbreaking partnership with OpenAI. This multibillion-dollar deal represents a pivotal moment for AMD as it positions itself as a serious competitor to NVIDIA in the artificial intelligence chip market.

Under the agreement, OpenAI will deploy 6 gigawatts of AMD's graphics processing units across multiple generations, starting with the Instinct MI450 series chips in the second half of 2026. The partnership includes a unique equity component, with OpenAI receiving warrants to purchase up to 160 million AMD shares at $0.01 per share—representing approximately 10% of the company.

AMD CEO Lisa Su emphasized that this partnership is expected to generate "tens of billions of dollars in revenue" for the company, with a clear path to achieving initial goals of tens of billions in annual data-center AI revenue starting in 2027.

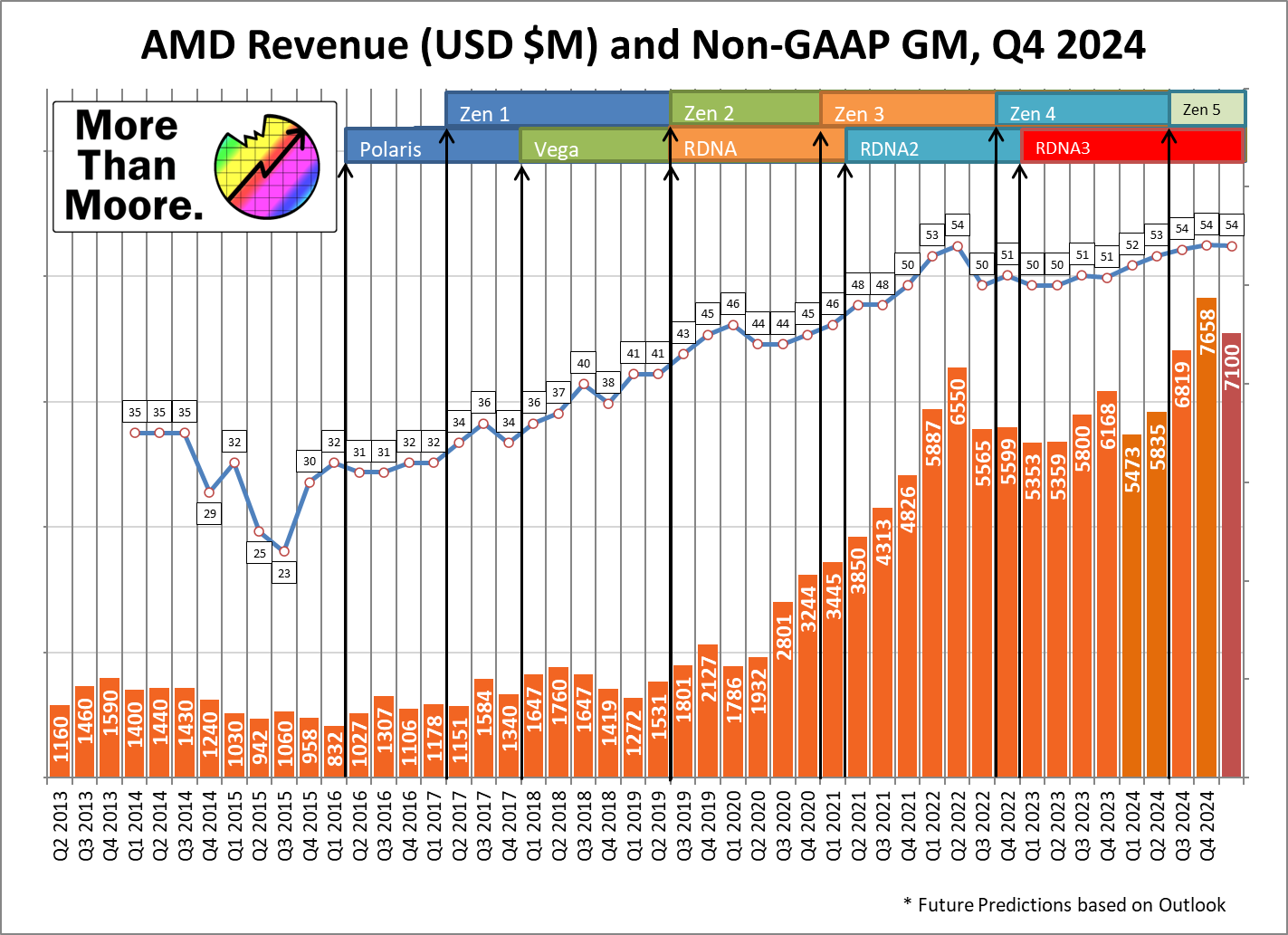

2024 Financial Performance Overview

AMD delivered impressive financial results in 2024, reporting record revenue of $25.8 billion—a 13.69% increase from the previous year's $22.68 billion. The company achieved a gross margin of 49%, operating income of $1.9 billion, and net income of $1.6 billion, translating to diluted earnings per share of $1.00.

The company's data center segment has been a particular bright spot, driven by strong demand for AI accelerators and server processors. This growth trajectory positions AMD well for continued expansion in the lucrative artificial intelligence market, which analysts predict will experience explosive growth through 2028.

AMD's Position in the AI Race

While NVIDIA has dominated the AI chip market with its stock rising 1,180% since the dawn of AI, AMD has posted more modest gains of 154% during the same period. However, the OpenAI partnership significantly strengthens AMD's competitive position and provides validation for its technology roadmap.

The deal addresses OpenAI's critical need to diversify its processor supply chain while scaling its computing infrastructure. With OpenAI currently valued at $500 billion as the world's most valuable startup, this partnership provides AMD with access to one of the most demanding and well-funded AI companies globally.

Wedbush analyst Dan Ives noted that this agreement "quickly brings AMD right into the core of the AI-chip spending cycle" and represents "a huge vote of confidence" in the company's technology capabilities.

Investment Outlook and Price Targets

Wall Street analysts maintain optimistic outlooks for AMD stock, with an average price target of $187.73 based on 34 analyst estimates. Price targets range from a low of $140.00 to a high of $230.00, suggesting significant upside potential from current levels.

Analysts expect AMD's revenue to grow 28% in 2025 to approximately $33 billion, followed by another 20%+ increase in 2026 to over $40 billion. This growth trajectory is supported by the company's expanding presence in data centers, AI applications, and the recent OpenAI partnership.

The OpenAI deal's unique structure, with performance-based warrant vesting, aligns both companies' interests and could provide additional upside for AMD shareholders as milestones are achieved.

Key Risks and Considerations

Despite the positive momentum, investors should consider several risk factors. Manufacturing capacity constraints at Taiwan Semiconductor Manufacturing Company (TSMC) could pose challenges, particularly with increased demand from both AMD and NVIDIA for advanced chip production.

Competition remains intense, with NVIDIA maintaining its market leadership position and continuing to invest heavily in AI infrastructure. Additionally, the broader AI market faces concerns about potential bubble conditions, as noted by Amazon founder Jeff Bezos.

Execution risk exists around AMD's ability to deliver on the ambitious OpenAI deployment timeline, with the first gigawatt of chips scheduled for the second half of 2026.

Frequently Asked Questions

Is AMD stock a good buy in 2024?

AMD appears well-positioned for growth with strong financial performance, the transformative OpenAI partnership, and expanding AI market opportunities. Analysts expect significant revenue growth through 2028, making it attractive for long-term investors.

How does the OpenAI deal benefit AMD?

The partnership provides AMD with tens of billions in potential revenue, validates its AI technology roadmap, and gives OpenAI a 10% equity stake that aligns both companies' interests for long-term success.

What are AMD's 2025 revenue projections?

Analysts project AMD's revenue will grow 28% in 2025 to approximately $33 billion, driven by data center growth, AI applications, and the OpenAI partnership beginning to contribute in the second half of 2026.

How does AMD compare to NVIDIA in AI?

While NVIDIA maintains market leadership, AMD is gaining ground with competitive products and strategic partnerships like OpenAI. AMD offers investors potential upside as the "second player" in the AI race with significant growth opportunities.

Ready to dive deeper into AMD's investment potential? Share this comprehensive analysis with fellow investors and stay informed about one of 2024's most compelling tech stock opportunities. Share this article to help others make informed investment decisions.