Get Health Insurance Now: Your Complete Guide to Finding Coverage Today

Get Health Insurance Now: Your Complete Guide to Finding Coverage Today

Finding health insurance can feel overwhelming, especially when you need coverage immediately. Whether you've recently lost your job, turned 26 and aged off your parent's plan, or are facing an unexpected health situation, understanding your options is crucial. This comprehensive guide walks you through everything you need to know about getting health insurance now in the United States.

Understanding Your Health Insurance Options in America

Health insurance isn't one-size-fits-all, and your best option depends on your current situation, income level, and health needs. The good news? You have multiple pathways to coverage, even outside the traditional Open Enrollment Period.

Marketplace Plans Through Healthcare.gov

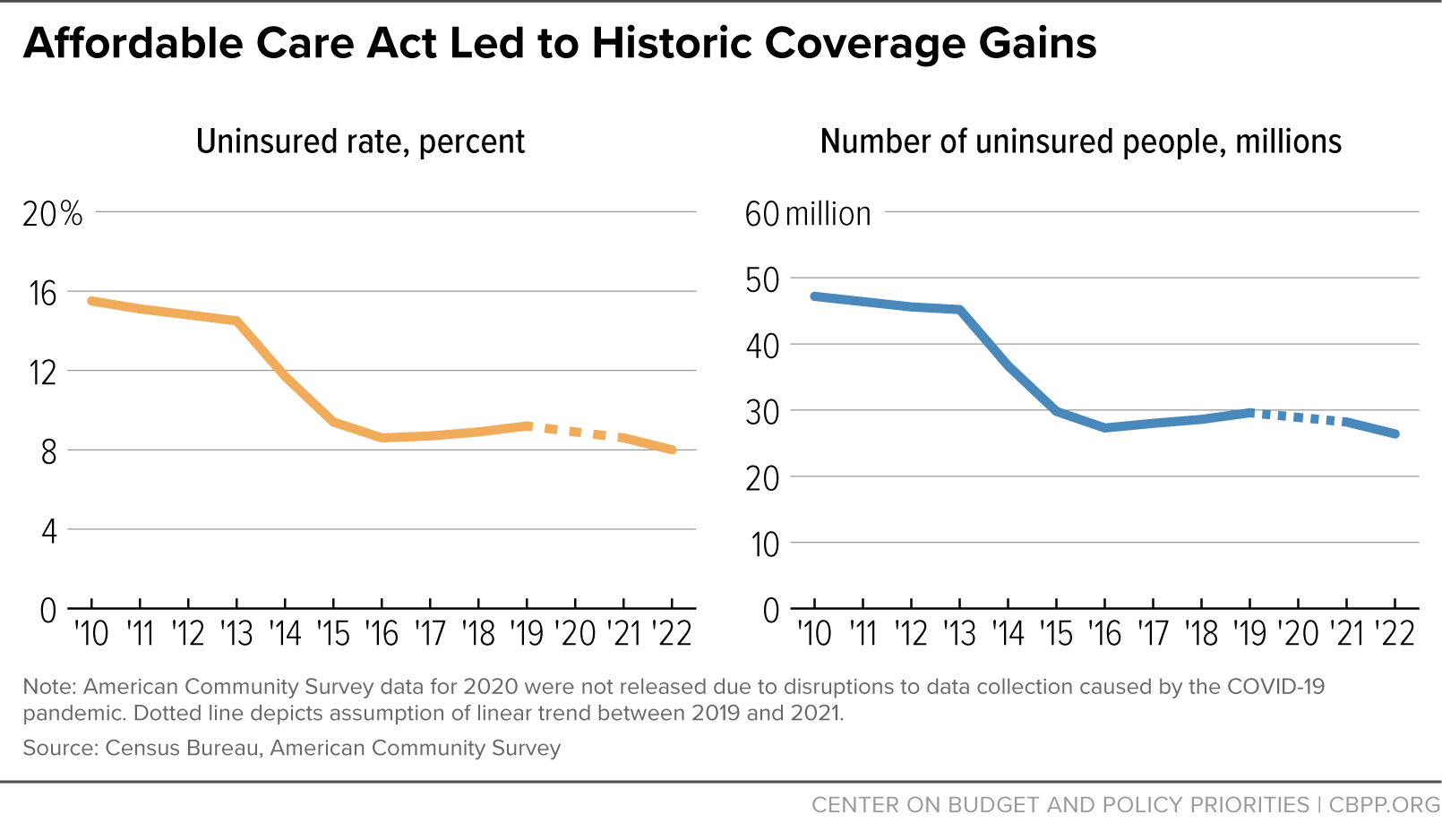

The Health Insurance Marketplace, operated through Healthcare.gov, offers comprehensive Affordable Care Act (ACA) plans. These plans cover essential health benefits including preventive care, prescription drugs, mental health services, and maternity care. Most importantly, you cannot be denied coverage based on pre-existing conditions.

To enroll in a Marketplace plan outside Open Enrollment, you'll need to qualify for a Special Enrollment Period. Qualifying life events include:

- Loss of health coverage from your employer or through divorce

- Changes in household size (marriage, birth, or adoption)

- Moving to a new coverage area

- Changes in income that affect your eligibility for financial assistance

- Gaining citizenship or lawful presence in the U.S.

State-Based Enrollment Options

Some states operate their own health insurance marketplaces. For example, Georgia Access provides residents with a state-specific portal to compare and enroll in quality coverage. Check if your state has its own marketplace, as enrollment periods and available plans may differ slightly from the federal Healthcare.gov platform.

Can You Get Health Insurance Immediately?

The answer depends on which type of coverage you choose. Short-term health insurance plans can begin as soon as the next day after your application is approved. However, ACA Marketplace plans typically start on the first day of the following month after you enroll during Open Enrollment or a Special Enrollment Period.

Short-Term Health Insurance: Fast But Limited

Short-term health insurance plans offer quick coverage solutions for temporary gaps. Providers like UnitedHealthcare offer plans lasting from one month up to nearly 12 months, with some TriTerm plans extending up to three years in certain states.

Important considerations for short-term plans:

- Pre-existing conditions are NOT covered

- Essential health benefits like maternity care and mental health services may be excluded

- Limited or no preventive care coverage

- Medical underwriting is required (you must answer health questions)

- Lower monthly premiums but potentially high out-of-pocket costs

Short-term insurance works best if you're healthy, under 65, and need temporary coverage while waiting for employer benefits, Open Enrollment, or Medicare eligibility.

Financial Assistance: Making Health Insurance Affordable

Many Americans qualify for financial help that significantly reduces health insurance costs. Through the Marketplace, you may be eligible for:

- Premium Tax Credits - Lower your monthly insurance payment based on your income and family size

- Cost-Sharing Reductions - Decrease your out-of-pocket costs when you use healthcare services

- Medicaid/CHIP - Free or low-cost coverage if your income falls below certain thresholds

Most people earning between 100% and 400% of the federal poverty level qualify for some form of financial assistance. In 2025, that's approximately $15,060 to $60,240 for an individual, or $31,200 to $124,800 for a family of four.

How to Enroll in Health Insurance Today

Step 1: Check Your Eligibility

Start by visiting Healthcare.gov and entering your ZIP code to see what coverage options are available in your area. Answer questions about your household size, income, and any recent qualifying life events.

Step 2: Compare Plans

Marketplace plans come in four metal tiers - Bronze, Silver, Gold, and Platinum. Bronze plans have the lowest monthly premiums but highest out-of-pocket costs. Platinum plans are the opposite. Consider your expected healthcare needs when choosing.

Step 3: Complete Your Application

You can enroll online through Healthcare.gov, your state marketplace, by phone, or with help from a certified enrollment counselor. The application takes about 30-45 minutes and requires information about your income, household members, and current coverage status.

Step 4: Choose Your Start Date

If you qualify for a Special Enrollment Period, you typically have 60 days to enroll, and coverage usually begins the first day of the month following your enrollment.

Alternative Coverage Options

Medicaid Expansion

If you live in a state that expanded Medicaid, you may qualify for free or very low-cost comprehensive coverage. Eligibility extends to adults earning up to 138% of the federal poverty level in expansion states.

Employer-Sponsored Insurance

If you're starting a new job, don't wait - ask about when your benefits begin. Many employers offer coverage starting the first day of employment or within 30-90 days.

COBRA Coverage

Losing employer-sponsored insurance? COBRA allows you to continue your previous plan for up to 18 months. However, you'll pay the full premium plus a 2% administrative fee, making it expensive but comprehensive.

Frequently Asked Questions

Can I get health insurance if I have pre-existing conditions?

Yes! ACA Marketplace plans cannot deny you coverage or charge you more because of pre-existing conditions. However, short-term health insurance plans typically do not cover pre-existing conditions.

How much does health insurance cost per month?

On average, individual health insurance costs around $456 per month for a Marketplace plan before subsidies, but this varies significantly based on age, location, plan type, and whether you qualify for financial assistance. Many people pay much less after tax credits.

What if I miss Open Enrollment?

You can still enroll if you experience a qualifying life event that triggers a Special Enrollment Period. Alternatively, you can purchase short-term health insurance or check if you qualify for Medicaid, which has year-round enrollment.

Is short-term insurance worth it?

Short-term insurance can be valuable for healthy individuals needing temporary coverage between jobs or while waiting for other coverage to begin. However, it doesn't provide comprehensive protection and won't cover pre-existing conditions. Evaluate your health needs carefully.

Where can I get help enrolling?

Free help is available through certified enrollment counselors, navigators, and insurance agents. Call the Marketplace Call Center at 1-800-318-2596 (TTY: 1-855-889-4325) or visit Healthcare.gov to find local assistance.

Take Action: Get Covered Today

Don't wait to secure your health coverage. Medical emergencies and unexpected health issues can happen at any time, and having insurance protects both your health and your finances. Start by checking your eligibility at Healthcare.gov or your state's marketplace. Compare your options, understand your financial assistance eligibility, and enroll in a plan that meets your needs and budget.

💡 Pro Tip: If you need immediate coverage and don't qualify for a Special Enrollment Period, consider short-term insurance to bridge the gap until the next Open Enrollment. Just be aware of the coverage limitations.

Share This Essential Information

Found this guide helpful? Share it with friends and family who need health insurance!

Help others navigate their coverage options by sharing this article on social media or via email.

📱 Share on your favorite platform • 💙 Help someone get covered today