Gold Price Today: Complete Guide to Current Rates and Investment Trends

Gold Price Today: Complete Guide to Current Rates and Investment Trends

Understanding the current gold price is crucial for both seasoned investors and newcomers to precious metals trading. As one of the world's oldest and most trusted stores of value, gold continues to attract attention from investors seeking portfolio diversification and protection against economic uncertainty. This comprehensive guide covers everything you need to know about today's gold prices, market trends, and investment strategies.

Current Gold Price: Real-Time Market Updates

The live gold price fluctuates constantly throughout trading hours, responding to various economic factors and market conditions. As of today, gold is trading at approximately $4,035 per troy ounce, representing a significant increase from historical averages. This price reflects the ongoing demand for safe-haven assets amid global economic uncertainties.

Gold prices are quoted in multiple units to accommodate different investment preferences:

- Per Troy Ounce: The standard measurement for precious metals trading

- Per Gram: Popular for smaller investments and international markets

- Per Kilogram: Used for large-scale commercial transactions

Factors Influencing Gold Prices in 2025

Several key factors continue to drive gold price movements in the current market environment. Understanding these influences helps investors make informed decisions about timing their purchases or sales.

Economic Uncertainty and Inflation

Gold traditionally serves as a hedge against inflation and economic instability. With ongoing concerns about global monetary policy and potential economic downturns, investors increasingly turn to gold as a protective asset. The metal's value often rises when confidence in traditional currencies and financial markets declines.

Central Bank Policies

Federal Reserve decisions regarding interest rates significantly impact gold prices. Lower interest rates typically benefit gold, as the opportunity cost of holding non-yielding assets decreases. Recent monetary policy shifts have contributed to gold's strong performance throughout 2025.

Gold Investment Options for Modern Investors

Today's investors have numerous ways to gain exposure to gold, each with distinct advantages and considerations. The choice depends on investment goals, risk tolerance, and storage preferences.

Physical Gold Bullion

Physical gold remains the most direct way to own the precious metal. Popular options include gold coins, bars, and rounds from reputable mints. Physical ownership provides complete control but requires secure storage solutions.

Gold ETFs and Digital Platforms

Exchange-traded funds (ETFs) offer convenient exposure to gold prices without physical storage requirements. Modern digital platforms also provide fractional ownership opportunities, making gold investment accessible to smaller investors.

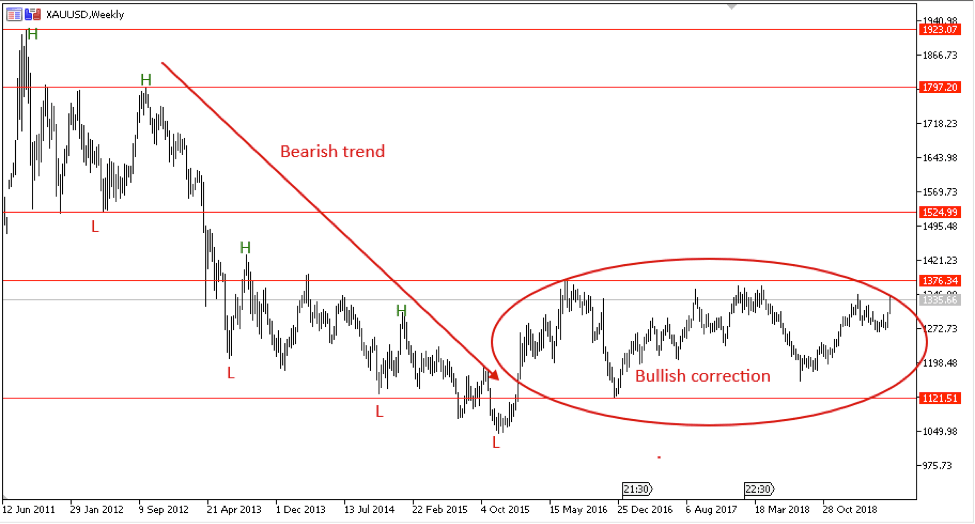

Technical Analysis and Price Predictions

Technical analysis plays a crucial role in understanding potential gold price movements. Chart patterns, support and resistance levels, and trading volumes provide insights into market sentiment and potential future directions.

Current technical indicators suggest continued strength in gold markets, with several factors supporting higher prices:

- Breaking through key resistance levels

- Sustained institutional buying pressure

- Positive momentum indicators

- Strong support at previous highs

Global Market Impact on Gold Pricing

Gold operates as a global commodity, with prices influenced by events worldwide. Major trading centers in London, New York, and Asia contribute to 24-hour price discovery, ensuring continuous market liquidity.

Currency Relationships

The relationship between gold and major currencies, particularly the US dollar, remains a key pricing factor. A weaker dollar typically supports higher gold prices, as the metal becomes more affordable for holders of other currencies.

Investment Strategies for Different Market Conditions

Successful gold investing requires understanding various market environments and adapting strategies accordingly. Whether markets are rising, falling, or moving sideways, gold can play different roles in investment portfolios.

Portfolio Diversification

Financial advisors commonly recommend allocating 5-10% of investment portfolios to precious metals. This allocation provides diversification benefits while limiting overexposure to any single asset class.

Dollar-Cost Averaging

Regular, consistent purchases help smooth out price volatility over time. This strategy works particularly well for long-term investors who want to build gold positions gradually.

Frequently Asked Questions About Gold Prices

What determines the daily gold price?

Daily gold prices are determined by supply and demand dynamics in global markets, influenced by economic data, geopolitical events, currency movements, and investor sentiment. Major markets in London, New York, and Asia contribute to continuous price discovery.

Is gold a good investment during economic uncertainty?

Historically, gold has served as a hedge during periods of economic uncertainty, inflation, and market volatility. While past performance doesn't guarantee future results, gold's track record as a store of value makes it attractive to many investors during turbulent times.

How often do gold prices change?

Gold prices change continuously during market hours, with updates occurring every few seconds. The market operates nearly 24 hours a day across different global trading centers, with brief closures over weekends.

What's the difference between spot gold and physical gold prices?

Spot gold represents the current market price for immediate delivery, while physical gold typically includes premiums for manufacturing, distribution, and dealer margins. Physical gold prices are usually higher than spot prices due to these additional costs.

Should I buy gold when prices are high?

Investment timing depends on individual circumstances and long-term goals. Many investors use dollar-cost averaging to reduce timing risk, making regular purchases regardless of short-term price movements. Consider consulting with financial advisors for personalized guidance.

Conclusion: Navigating Today's Gold Market

Understanding current gold prices and market dynamics is essential for making informed investment decisions. With gold continuing to play its traditional role as a store of value while adapting to modern investment platforms, opportunities exist for investors across different risk profiles and investment horizons.

Whether you're considering physical gold, ETFs, or digital platforms, staying informed about market trends, technical analysis, and global economic factors will help you navigate this dynamic market successfully. Remember that gold investment should align with your overall financial strategy and risk tolerance.

Ready to learn more about gold investing? Share this comprehensive guide with others who might benefit from understanding current gold market dynamics and investment opportunities.