Industry Ventures: Revolutionizing the Venture Capital Landscape in America

Industry Ventures: Revolutionizing the Venture Capital Landscape in America

In the dynamic world of venture capital, few firms have shaped the industry as significantly as Industry Ventures. Since its founding in 2000, this pioneering investment firm has transformed how venture capital operates in the United States, managing over $8 billion in assets and establishing itself as a leader in innovative funding solutions across the entire startup lifecycle.

:max_bytes(150000):strip_icc()/Venturecapital-2f7ba3a27d0545f682a6238ea6b16cb9.png)

The Evolution of Venture Capital Through Industry Ventures

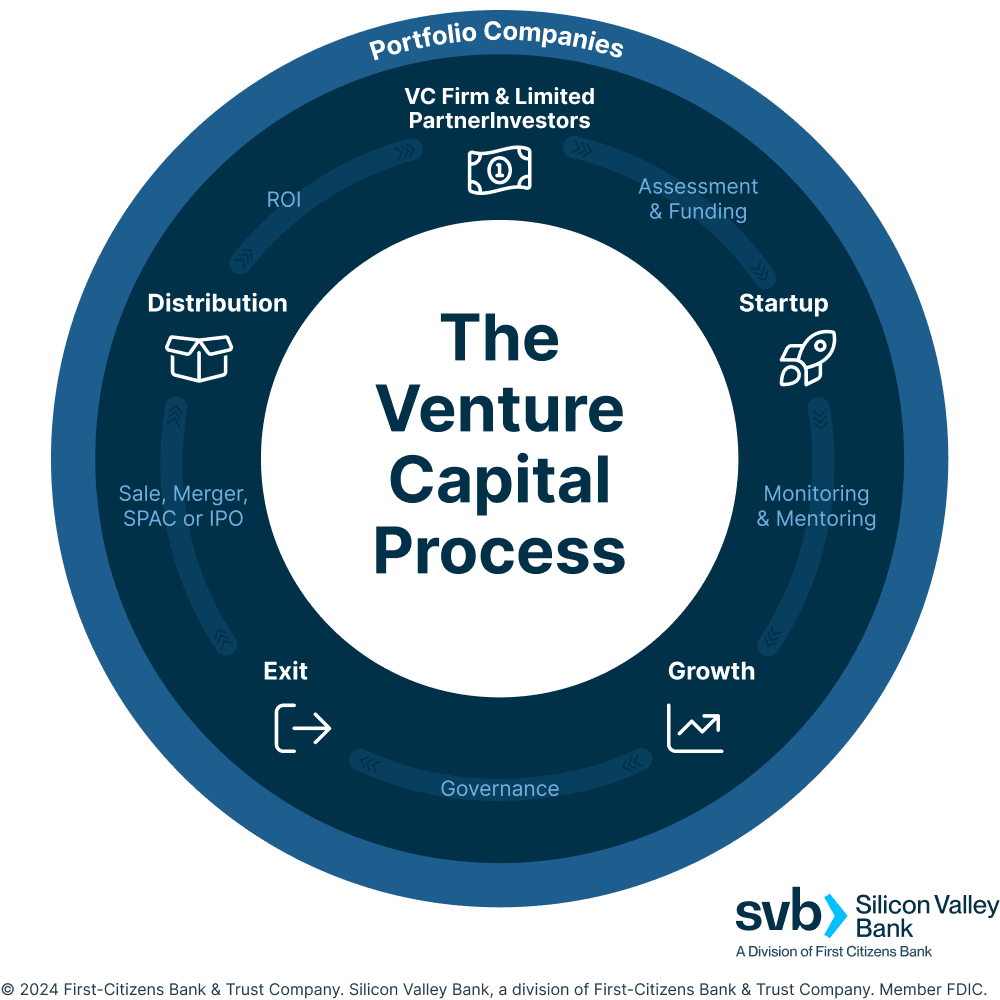

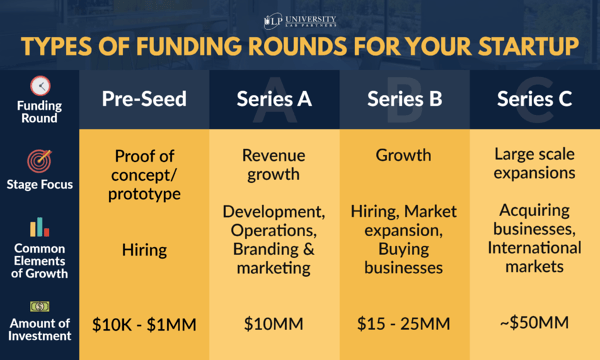

Industry Ventures has revolutionized the traditional venture capital model by introducing flexible capital solutions that address every stage of the startup journey. Unlike conventional VC firms that focus on single investment stages, Industry Ventures has created a comprehensive platform that supports companies from seed funding through late-stage growth and eventual exit strategies.

The firm's innovative approach includes four distinct investment strategies: seed and early-stage investments, mid-stage growth funding, late-stage secondary acquisitions, and tech buyout solutions. This full-spectrum approach has enabled Industry Ventures to maintain relationships with portfolio companies throughout their entire growth trajectory, providing unprecedented continuity in the venture capital space.

Pioneering Secondary Market Innovation

One of Industry Ventures' most significant contributions to the venture capital ecosystem has been its pioneering work in secondary market investments. The firm recognized early on that traditional VC funds and their investors needed liquidity solutions before companies went public or were acquired. By creating robust secondary markets, Industry Ventures has provided essential liquidity to fund managers, limited partners, and company shareholders.

Strategic Investment Focus and Portfolio Performance

Industry Ventures has built an impressive track record with over 1,000 investments and an internal rate of return of 18% annually. The firm's success stems from its unique positioning as both a primary investor and secondary market facilitator, allowing it to capture value across multiple phases of the venture capital cycle.

The company's investment philosophy centers on supporting both emerging and established venture capital managers while providing growth capital to high-potential technology companies. This dual approach has created a powerful network effect, where Industry Ventures serves as a crucial bridge between entrepreneurs seeking funding and institutional investors looking for venture capital exposure.

Technology Sector Dominance

While Industry Ventures maintains a diversified portfolio, the firm has shown particular strength in technology sector investments. From artificial intelligence and machine learning startups to fintech and enterprise software companies, Industry Ventures has consistently identified and supported tomorrow's technology leaders before they achieve mainstream recognition.

The Goldman Sachs Acquisition: A New Chapter

In October 2025, Goldman Sachs announced its acquisition of Industry Ventures for $665 million in cash and equity, with an additional $300 million performance-based payment through 2030. This landmark deal, expected to close in Q1 2026, represents Goldman Sachs' commitment to expanding its alternative investment platform and strengthening its position in the venture capital market.

The acquisition will integrate Industry Ventures' 45 employees into Goldman Sachs' External Investing Group, which manages over $450 billion in assets. This combination creates unprecedented opportunities for cross-platform synergies and expanded service offerings to both entrepreneurs and investors.

Strategic Implications for the VC Industry

The Goldman Sachs acquisition signals a broader trend of consolidation in the venture capital industry, where traditional investment banks are recognizing the strategic value of specialized VC expertise. For Industry Ventures' existing portfolio companies and fund partners, the acquisition provides access to Goldman Sachs' global resources, international networks, and institutional client base.

Future Outlook and Industry Impact

As Industry Ventures integrates with Goldman Sachs, the combined entity is positioned to address the evolving needs of the venture capital ecosystem. Key trends driving future growth include the increasing time companies spend in private markets, growing demand for secondary liquidity solutions, and the expansion of alternative investment access to a broader range of institutional and high-net-worth investors.

The firm's proven ability to adapt to market changes while maintaining strong performance metrics suggests continued success in the new organizational structure. Industry Ventures' established relationships with over 500 venture capital fund managers and thousands of portfolio companies provide a solid foundation for future growth and innovation.

Frequently Asked Questions

What makes Industry Ventures different from traditional VC firms?

Industry Ventures offers a complete lifecycle approach, providing funding and liquidity solutions at every stage from seed investment through company exit, rather than focusing on just one investment stage.

How does the Goldman Sachs acquisition affect existing investments?

The acquisition is expected to enhance Industry Ventures' capabilities by providing access to Goldman Sachs' global resources and client network while maintaining the firm's existing investment strategy and team.

What is secondary market investing in venture capital?

Secondary market investing involves purchasing existing stakes in venture capital funds or portfolio companies from current investors, providing liquidity before traditional exit events like IPOs or acquisitions.

Conclusion: Leading the Venture Capital Revolution

Industry Ventures has established itself as a transformative force in American venture capital through innovative investment strategies, comprehensive lifecycle support, and pioneering secondary market solutions. The Goldman Sachs acquisition marks a new chapter that promises to amplify the firm's impact while maintaining its commitment to supporting entrepreneurs and venture capital managers across the United States.

As the venture capital landscape continues to evolve, Industry Ventures' proven track record of adaptation and innovation positions it to remain at the forefront of industry development. For investors, entrepreneurs, and industry observers, Industry Ventures represents the future of venture capital – flexible, comprehensive, and continuously evolving to meet market needs.

💡 Found this article valuable? Share it with your network and help spread insights about the evolving venture capital landscape!