Military Pay 2025: Complete Guide to Salaries, Benefits & Allowances

Military Pay 2025: Complete Guide to Salaries, Benefits & Allowances

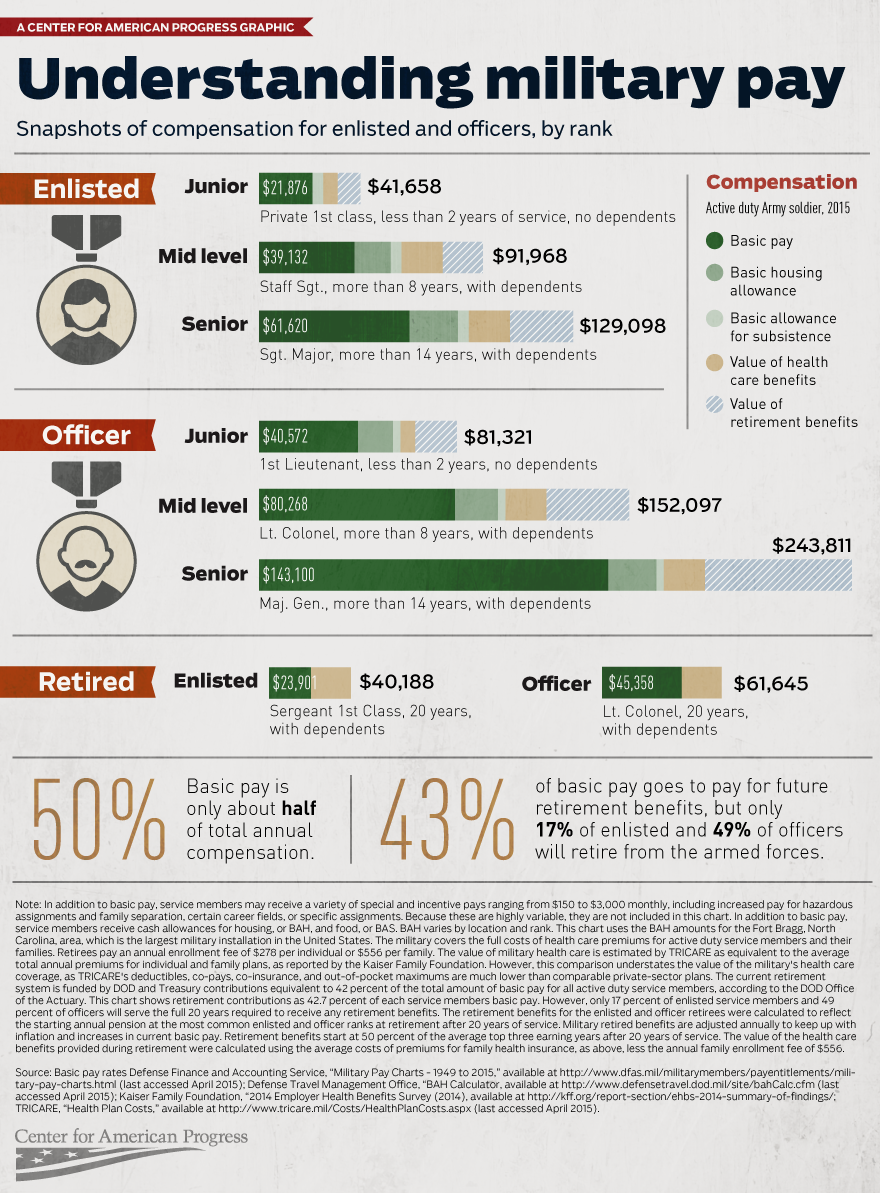

Military pay represents one of the most comprehensive compensation systems in the United States, providing service members with competitive salaries, tax-free allowances, and extensive benefits. Understanding military compensation is crucial for current service members, potential recruits, and military families planning their financial future.

Military Basic Pay Overview

Military basic pay serves as the foundation of all service member compensation, determined by two primary factors: paygrade (rank) and years of service. For 2025, most military personnel received a 4.5% pay increase, while junior enlisted members (E-1 through E-4 and some E-5s) received a substantial 14.5% raise to address retention challenges.

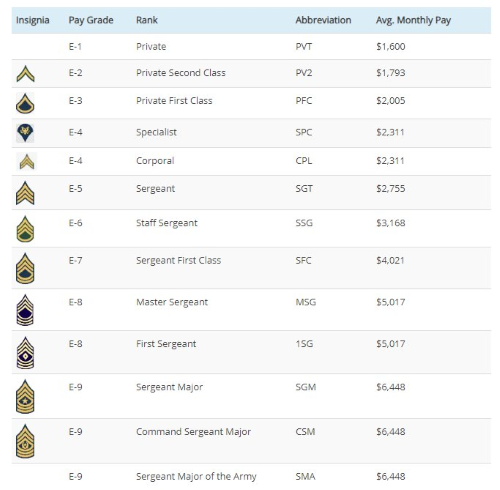

How Military Ranks Affect Pay

Military pay scales are structured across different ranks, from enlisted personnel (E-1 through E-9) to warrant officers (W-1 through W-5) and commissioned officers (O-1 through O-10). Each rank has corresponding pay grades that increase with years of service, creating a predictable career progression path.

2025 Military Pay Charts and Salary Ranges

The 2025 military pay charts reflect significant improvements in compensation across all branches, including the Army, Navy, Air Force, Marines, Coast Guard, and Space Force. Here are key salary highlights:

Enlisted Pay Ranges (2025)

- E-1 (Private/Seaman Recruit): $2,319 monthly ($27,828 annually)

- E-4 (Corporal/Petty Officer 3rd Class): $2,851 - $3,468 monthly

- E-6 (Staff Sergeant/Petty Officer 1st Class): $3,398 - $4,585 monthly

- E-9 (Sergeant Major/Master Chief): $6,055 - $9,681 monthly

Officer Pay Ranges (2025)

- O-1 (Second Lieutenant/Ensign): $3,998 - $5,042 monthly

- O-4 (Major/Lieutenant Commander): $6,113 - $9,075 monthly

- O-6 (Colonel/Captain): $8,998 - $13,663 monthly

- O-10 (General/Admiral): Up to $20,302 monthly

Military Allowances and Tax-Free Benefits

Beyond basic pay, military compensation includes substantial allowances that significantly increase total compensation while providing tax advantages. These allowances address specific needs and living situations.

Basic Allowance for Housing (BAH)

BAH provides tax-free compensation for housing costs when government quarters aren't available. Rates vary by location, rank, and dependency status, with some high-cost areas providing over $3,000 monthly.

Basic Allowance for Subsistence (BAS)

BAS covers food costs for service members, providing $321.19 monthly for officers and $453.68 for enlisted personnel in 2025. This allowance is also tax-free, reducing overall tax burden.

Special and Incentive Pay Programs

Military services offer numerous special pay programs to attract and retain personnel in critical specialties and challenging assignments. These payments recognize additional skills, qualifications, or hardships.

Common Special Pay Types

- Flight Pay: For aviation personnel, ranging from $125-$1,000 monthly

- Hazardous Duty Pay: Additional compensation for dangerous assignments

- Combat Pay: Tax-free pay for service in combat zones

- Family Separation Allowance: Support during extended deployments

- Professional Pay: For medical, legal, and other specialized officers

Understanding Your Military Compensation Package

Total military compensation extends far beyond basic pay, including healthcare, retirement benefits, education assistance, and life insurance. Regular Military Compensation (RMC) combines basic pay, BAH, BAS, and tax savings to provide accurate compensation comparisons.

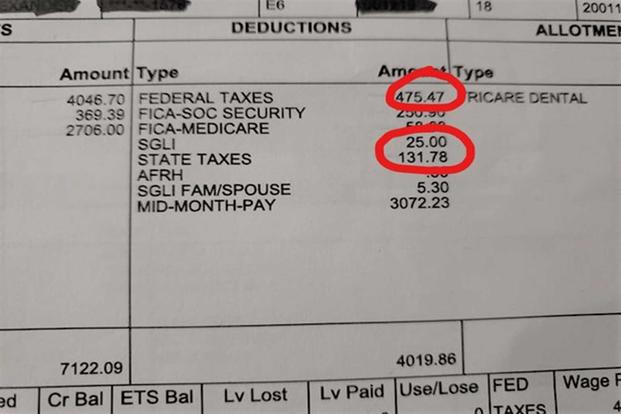

Reading Your Leave and Earnings Statement (LES)

Service members receive detailed monthly LES documents showing all pay components, deductions, and leave balances. Understanding your LES helps track compensation changes and identify any pay discrepancies requiring correction.

Military Pay vs. Civilian Compensation

Military compensation often exceeds equivalent civilian positions when considering total value, including healthcare, housing, food allowances, and retirement benefits. The tax-free nature of allowances further enhances the effective value of military pay packages.

Frequently Asked Questions About Military Pay

Q: How often does military pay increase?

A: Military pay typically increases annually, usually taking effect in January. The increase is based on the Employment Cost Index, though Congress may approve different amounts.

Q: Are military allowances taxable?

A: Most military allowances, including BAH and BAS, are not taxable, providing significant tax advantages over civilian compensation.

Q: What happens to military pay during government shutdowns?

A: During shutdowns, military pay may be delayed unless special funding measures are enacted. Recent shutdowns have seen efforts to ensure continued military compensation.

Q: Can military pay be garnished?

A: Military pay can be subject to court-ordered garnishments for child support, alimony, and certain debts, similar to civilian employment.

Q: How is deployment pay different?

A: Deployment pay often includes combat pay exclusions (tax-free income), family separation allowances, and hardship duty pay, significantly increasing total compensation.

Q: Do military reserves get the same pay?

A: Reserve and Guard members receive the same basic pay rates but only for days served, plus drill pay and annual training compensation.

Maximizing Your Military Pay Benefits

Service members can optimize their compensation through strategic financial planning, including maximizing Thrift Savings Plan contributions, utilizing tax-free combat pay, and taking advantage of education benefits. Understanding all available allowances and special pays ensures you receive full compensation entitlements.

Military pay continues evolving to maintain competitive compensation and support recruitment and retention goals. The 2025 increases, particularly for junior enlisted personnel, demonstrate ongoing commitment to fair compensation for military service. Service members should regularly review their LES, stay informed about pay changes, and consult with finance offices regarding any discrepancies or questions about their compensation.