Stock Market Investing: Your Complete 2025 Beginner's Guide to Building Wealth

Stock Market Investing: Your Complete 2025 Beginner's Guide to Building Wealth

The stock market has created more millionaires than any other investment vehicle in history. Yet many Americans still avoid investing, missing out on the potential for long-term wealth building. If you're ready to start your investing journey, this comprehensive guide will walk you through everything you need to know about stock market investing in 2025.

Why Invest in the Stock Market?

Over the past 50 years, the S&P 500 has delivered an average annual return of approximately 10%. This means a $10,000 investment could potentially grow to over $100,000 in 25 years through compound growth. While past performance doesn't guarantee future results, stocks have historically outpaced inflation and other traditional investments like bonds and savings accounts.

Step 1: Set Clear Investment Goals and Timeline

Before buying your first stock, define what you're investing for. Are you saving for retirement in 30 years, a house down payment in 5 years, or building general wealth? Your timeline directly impacts your investment strategy:

- Long-term goals (10+ years): Can handle more aggressive growth stocks and market volatility

- Medium-term goals (3-10 years): Balance growth with some stability

- Short-term goals (less than 3 years): Focus on conservative investments or high-yield savings

Step 2: Choose the Right Investment Account

Your choice of account can significantly impact your returns through tax advantages:

Popular Account Types:

- Roth IRA: Tax-free growth and withdrawals in retirement (best for young investors)

- Traditional IRA/401(k): Tax-deductible contributions, pay taxes on withdrawals

- Taxable Brokerage Account: No contribution limits, but pay taxes on gains

Many brokers now offer $0 account minimums and commission-free stock trades, making it easier than ever to start investing with small amounts.

Step 3: Master the Fundamentals - Stocks vs. Funds

New investors face a crucial decision: individual stocks or diversified funds?

Index Funds and ETFs (Recommended for Beginners)

Index funds like the S&P 500 ETF give you instant diversification across hundreds of companies. The iShares Core S&P 500 ETF (IVV) tracks America's 500 largest companies with an ultra-low 0.03% expense ratio. This single investment includes Apple, Microsoft, Amazon, and other market leaders.

Individual Stocks

While picking individual stocks can be exciting and potentially more profitable, it requires significant research and carries higher risk. Warren Buffett famously recommends that most investors stick with low-cost S&P 500 index funds.

Step 4: Determine Your Risk Tolerance

Understanding your comfort level with market volatility is crucial for long-term success:

- Conservative: Focus on dividend-paying stocks and bond funds

- Moderate: Mix of large-cap stocks, index funds, and some bonds

- Aggressive: Growth stocks, small-cap companies, and emerging markets

Remember: higher potential returns typically come with higher risk and more volatility.

Step 5: Start Investing with the Right Strategy

Dollar-Cost Averaging

Instead of trying to time the market, invest a fixed amount regularly (monthly or bi-weekly). This strategy reduces the impact of market volatility and removes emotion from investing decisions.

Best Stocks for Beginners in 2025

- Blue-chip stocks: Apple (AAPL), Microsoft (MSFT), Johnson & Johnson (JNJ)

- Dividend aristocrats: Coca-Cola (KO), Procter & Gamble (PG)

- Index ETFs: Vanguard S&P 500 ETF (VOO), Total Stock Market ETF (VTI)

Common Beginner Mistakes to Avoid

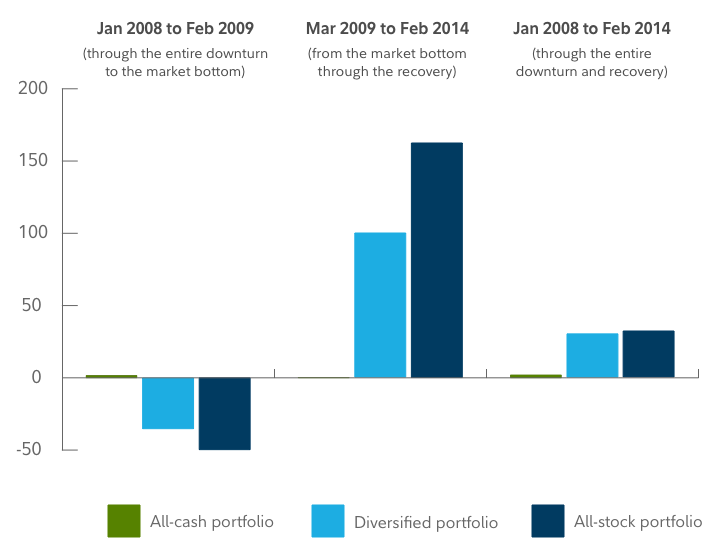

- Panic selling during market downturns: Stay focused on long-term goals

- Trying to time the market: Consistent investing beats market timing

- Putting all money in one stock: Diversification reduces risk

- Ignoring fees: High expense ratios can erode returns over time

How Much Money Do You Need to Start?

The barrier to entry has never been lower. Many brokers offer:

- $0 account minimums

- Fractional shares (buy portions of expensive stocks)

- Commission-free trading on stocks and ETFs

You can start investing with as little as $25-$50, though having $1,000 provides more flexibility and diversification options.

Building Your First Portfolio

A simple starter portfolio might include:

- 70% S&P 500 index fund

- 20% International stock fund

- 10% Bond fund

As you gain experience and knowledge, you can adjust allocations and add individual stocks.

Frequently Asked Questions

Is now a good time to start investing?

Time in the market beats timing the market. The best time to start investing is now, regardless of current market conditions. Long-term investors benefit from compound growth over decades.

How often should I check my investments?

Limit checking to once per month or quarterly. Daily monitoring can lead to emotional decisions and overtrading, which hurt long-term returns.

What if the market crashes after I invest?

Market corrections are normal and temporary. Since 1950, the S&P 500 has recovered from every crash and reached new highs. Stay invested and continue dollar-cost averaging.

Should I pay off debt before investing?

Pay off high-interest debt (credit cards) first. For low-interest debt like mortgages, you can invest simultaneously since stock market returns typically exceed low interest rates.

Take Action: Start Your Investment Journey Today

The stock market has created generational wealth for millions of Americans, and it can do the same for you. Start with these simple steps:

- Open a brokerage account with a reputable firm

- Fund your account with an amount you're comfortable investing

- Begin with a low-cost S&P 500 index fund

- Set up automatic monthly investments

- Stay committed to your long-term plan

Remember, successful investing is a marathon, not a sprint. Start today, stay consistent, and let compound growth work its magic over time.

💡 Share This Guide

Found this stock market guide helpful? Share it with friends and family who could benefit from learning about investing. Knowledge shared is wealth multiplied!

Share this article: Help others start their investment journey by sharing this comprehensive guide on social media or via email.