Stock Market Volatility: Understanding Market Swings and Investment Opportunities

Stock Market Volatility: Understanding Market Swings and Investment Opportunities

Stock market volatility remains one of the most misunderstood aspects of investing, yet it presents both challenges and opportunities for savvy investors. Understanding market swings isn't just about protecting your portfolio—it's about recognizing when volatility can work in your favor.

What Is Stock Market Volatility?

Market volatility measures the degree of price fluctuations in stocks, bonds, or entire markets over a specific period. It's calculated as a statistical measure of an asset's deviations from its average performance, typically expressed as a percentage.

Think of volatility like riding a bicycle on different terrains. Smooth paths represent low volatility—predictable, steady progress. Rough, winding trails represent high volatility—more challenging to navigate, but potentially leading to exciting destinations if you stay the course.

Key Volatility Measurements Every Investor Should Know

The VIX: Wall Street's Fear Gauge

The CBOE Volatility Index (VIX) serves as the market's "fear gauge," measuring expected volatility over the next 30 days. Understanding VIX levels helps investors gauge market sentiment:

- Below 20: Generally indicates investor contentment and low volatility expectations

- 20-30: Moderate volatility and uncertainty

- Above 30: High anxiety and potential market turbulence

- Above 40: Extreme fear—historically rare but potentially profitable for patient investors

Beta and Standard Deviation

Beta measures how volatile an individual stock is compared to the broader market. A beta of 1.0 moves with the market, while higher betas indicate greater volatility. Standard deviation quantifies how much returns deviate from the average, helping investors understand consistency.

Types of Market Volatility

Historical vs. Implied Volatility

Historical volatility examines past price movements to understand how volatile an asset has been. Implied volatility uses option prices to predict future volatility, often serving as a forward-looking indicator of market expectations.

Why Volatility Creates Investment Opportunities

Market Overreactions Present Buying Opportunities

History demonstrates that investors often overreact to news and uncertainty. The March 2020 COVID-19 market crash saw three of the worst trading days since 1950—and five of the best—all within the same month. Investors who stayed invested or bought during the panic were rewarded with a 69% rebound within one year.

Dollar-Cost Averaging Benefits

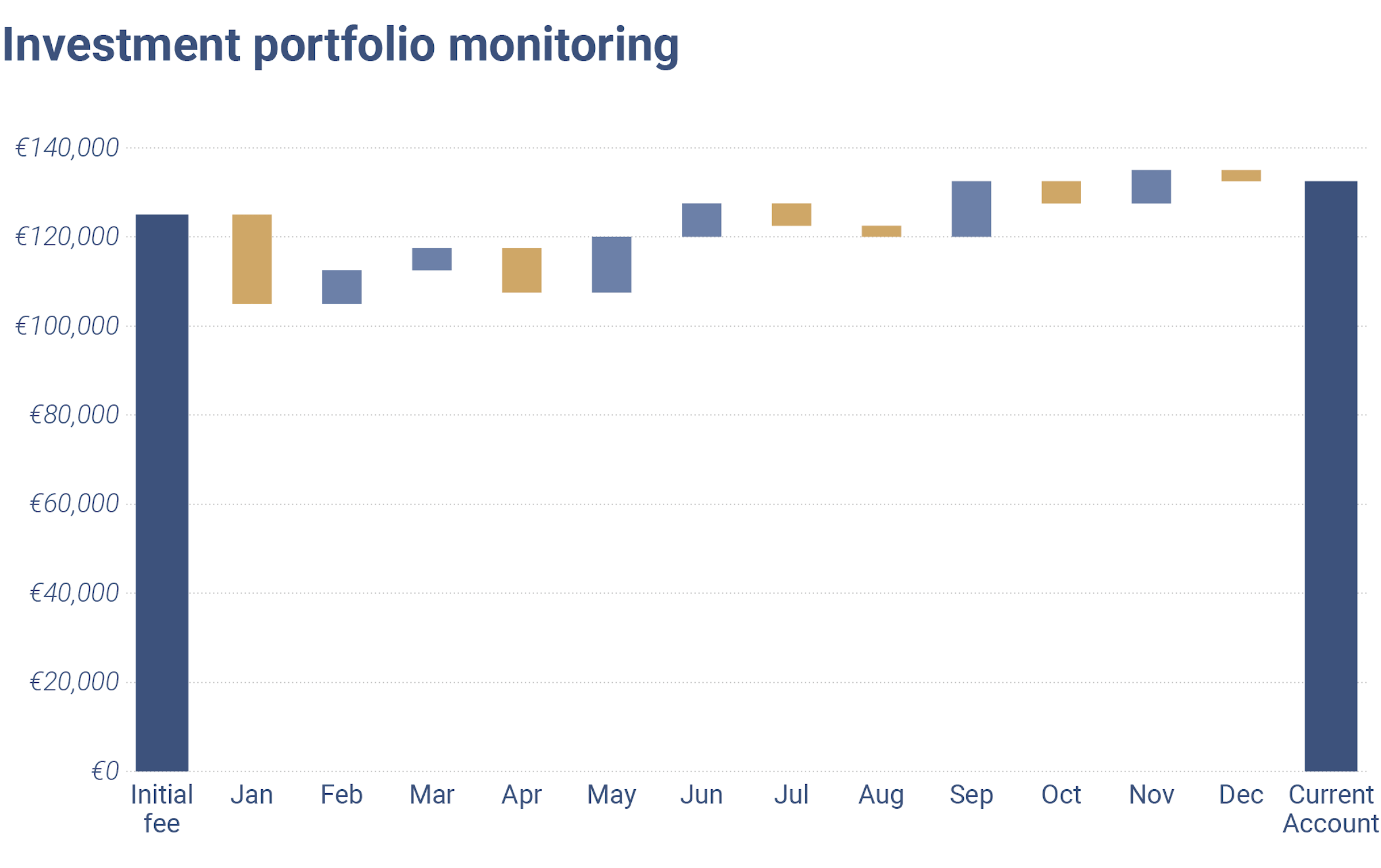

Volatile markets create ideal conditions for dollar-cost averaging strategies. When markets swing dramatically, regular investments automatically buy more shares when prices are low and fewer when prices are high, potentially improving long-term returns.

Proven Strategies for Navigating Market Volatility

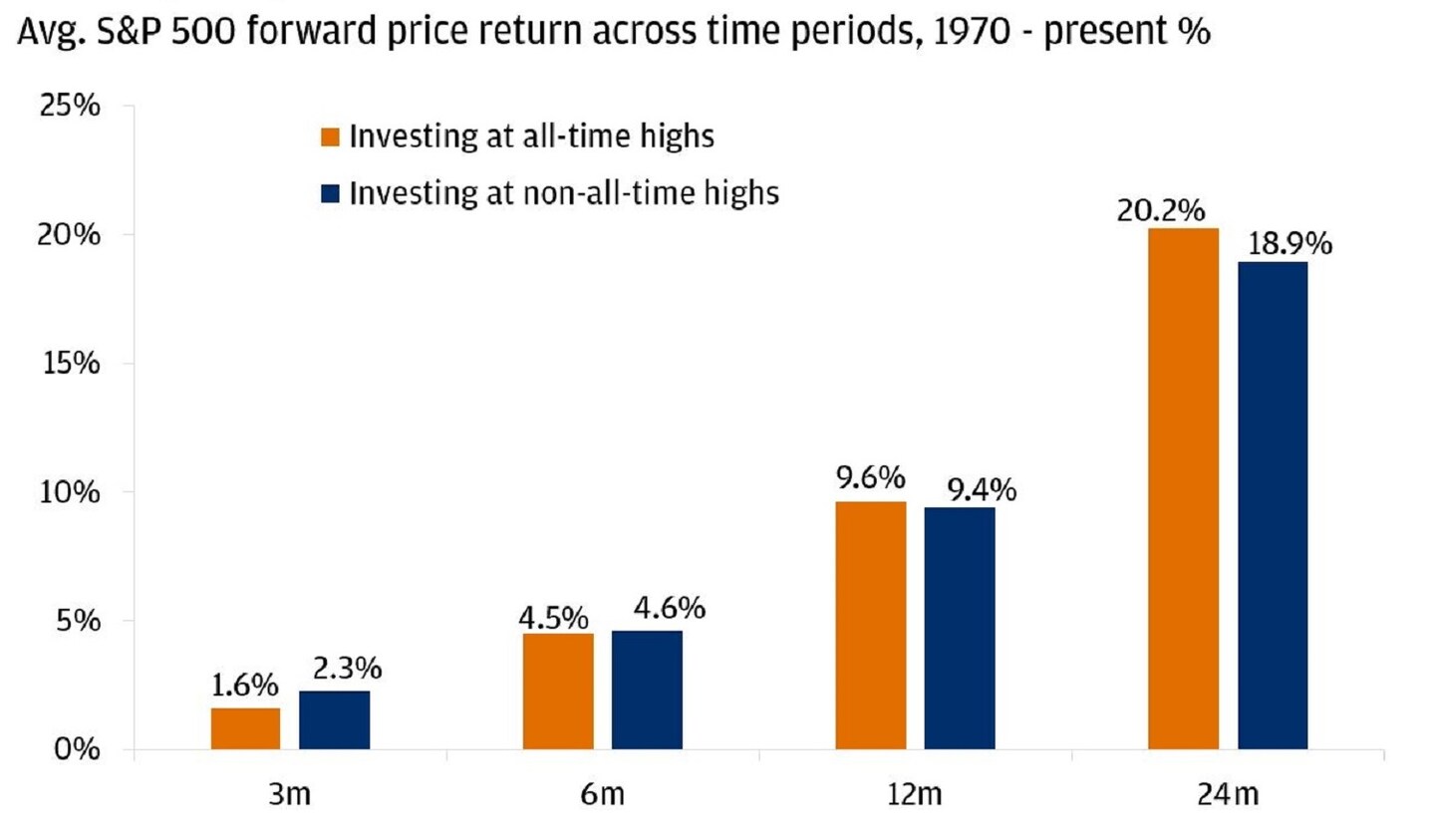

Stay Invested—Time in Market Beats Timing the Market

Missing just five of the market's best days over the past 20 years would have cut investor returns nearly in half. Since the best and worst days often cluster together, attempting to time the market frequently results in missing crucial recovery periods.

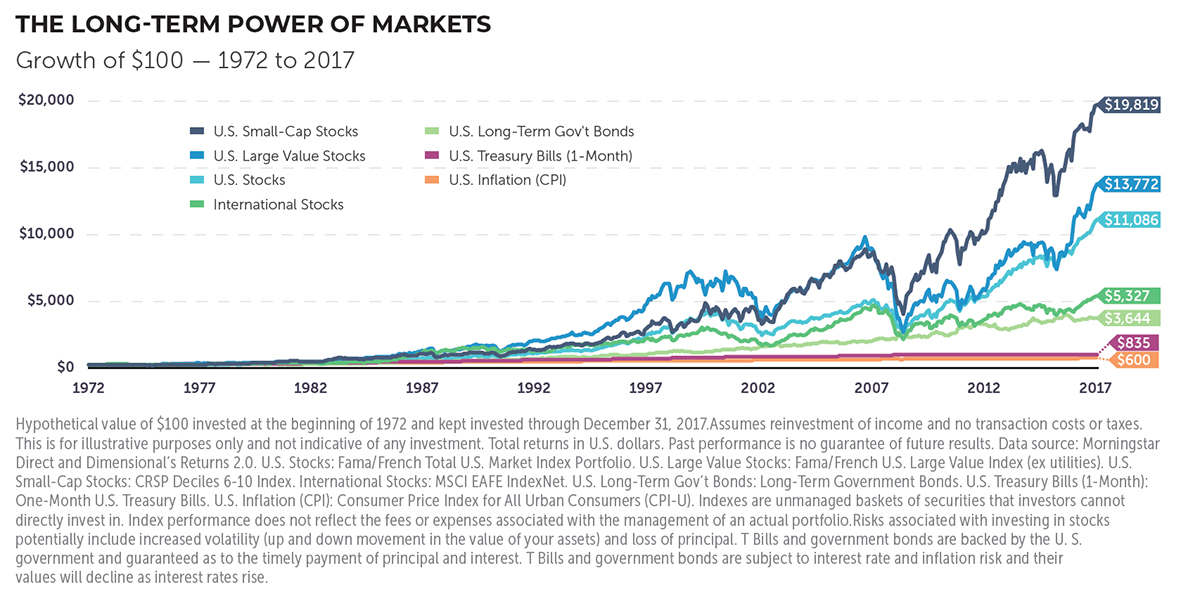

Diversification Reduces Portfolio Volatility

Spreading investments across different asset classes, sectors, and geographic regions helps smooth out volatility. Consider including:

- International stocks for geographic diversification

- Bonds to balance equity volatility

- Real estate investment trusts (REITs) for alternative exposure

- Low-volatility funds designed to minimize market swings

Rebalancing During Volatile Periods

Market volatility creates opportunities to rebalance portfolios at favorable prices. When stock prices fall significantly, consider rebalancing to maintain target asset allocations while potentially capturing discounted investments.

Historical Perspective: Volatility in Context

2024 Market Conditions

Despite global uncertainties, 2024 demonstrated relatively low volatility compared to historical averages. Only 19% of trading days experienced swings of +/-1%, well below typical market behavior during uncertain periods.

Long-Term Market Resilience

From 1985 to 2024, the S&P 500 averaged 11.78% annual returns despite experiencing significant volatility. Stocks delivered positive returns in 76% of calendar years, demonstrating the market's long-term upward bias despite short-term fluctuations.

Common Volatility Mistakes to Avoid

- Panic selling during market drops: Emotional decisions often lock in losses

- Trying to time market tops and bottoms: Even professionals struggle with market timing

- Confusing volatility with risk: Short-term volatility doesn't necessarily indicate long-term risk

- Ignoring volatility entirely: Understanding volatility helps set realistic expectations

Preparing Your Portfolio for Volatile Markets

Emergency Fund Importance

Maintaining adequate cash reserves prevents the need to sell investments during market downturns. Aim for 3-6 months of expenses in readily accessible accounts.

Investment Horizon Considerations

Younger investors with longer time horizons can typically tolerate higher volatility for potentially greater returns. Those nearing retirement may prefer lower-volatility investments to preserve capital.

Frequently Asked Questions About Market Volatility

Is volatility always bad for investors?

No, volatility creates opportunities for gains as well as losses. Patient investors can benefit from volatility through dollar-cost averaging and buying quality investments at discounted prices during market downturns.

How can I protect my portfolio during volatile periods?

Diversify across asset classes, maintain appropriate cash reserves, avoid emotional decision-making, and consider low-volatility investment options if market swings cause significant stress.

What causes stock market volatility?

Multiple factors contribute to volatility, including economic data releases, geopolitical events, interest rate changes, earnings reports, and shifts in investor sentiment or market psychology.

Should I invest more during volatile markets?

If you have adequate emergency funds and a long-term investment horizon, volatile markets can present attractive buying opportunities. However, only invest money you won't need for several years.

Conclusion: Embracing Volatility as an Investment Tool

Stock market volatility isn't something to fear—it's a natural characteristic of investing that, when properly understood, can enhance long-term returns. By maintaining a long-term perspective, staying diversified, and avoiding emotional decision-making, investors can transform market volatility from a source of anxiety into a tool for building wealth.

Remember, successful investing isn't about avoiding volatility entirely—it's about understanding it, preparing for it, and positioning your portfolio to benefit from the opportunities it creates.

💡 Share this valuable insight: Help others understand market volatility by sharing this comprehensive guide. Knowledge shared is knowledge multiplied—spread the word about smart investing strategies!