Who Would You Choose: Your Wife or Money? The Ultimate Guide to Love vs. Wealth

Who Would You Choose: Your Wife or Money? The Ultimate Guide to Love vs. Wealth

The age-old question of choosing between love and money has puzzled Americans for generations. Would you really choose your spouse over a million dollars? Or does financial security matter more than romantic feelings? This comprehensive guide explores what Americans truly value when faced with this difficult decision, backed by research and real-world perspectives.

Table of Contents

- What Americans Really Think About Love vs. Money

- The Psychology Behind Choosing Love or Money

- When Financial Reality Meets Romance

- The Smart Approach: Balancing Both

- Frequently Asked Questions

What Americans Really Think About Love vs. Money

Recent surveys reveal surprising insights about American priorities when it comes to relationships and finances. According to a Merrill Edge survey, 56% of Americans prioritize a partner who provides financial security over "head over heels" love (44%).

However, the picture becomes more complex when you dig deeper. More than 60% of surveyed Americans stated they would marry for love, even if it meant a lifelong financial struggle. Yet when forced to decide between love and money, 46% chose money, and nearly 1 in 3 said they'd consider getting back with an ex if that person became wealthy.

Interestingly, younger generations show different values. Generation Z (born between 1996 and 2010) is the only cohort to choose love over money at 54%. This suggests that as people age and face financial realities, their priorities shift toward economic stability.

The Psychology Behind Choosing Love or Money

Why Money Matters in Relationships

Financial considerations aren't just about greed—they're about survival and quality of life. Research published in Psychology Today shows that 75% of women wouldn't marry an unemployed man. This isn't shallow; it reflects practical concerns about building a stable future together.

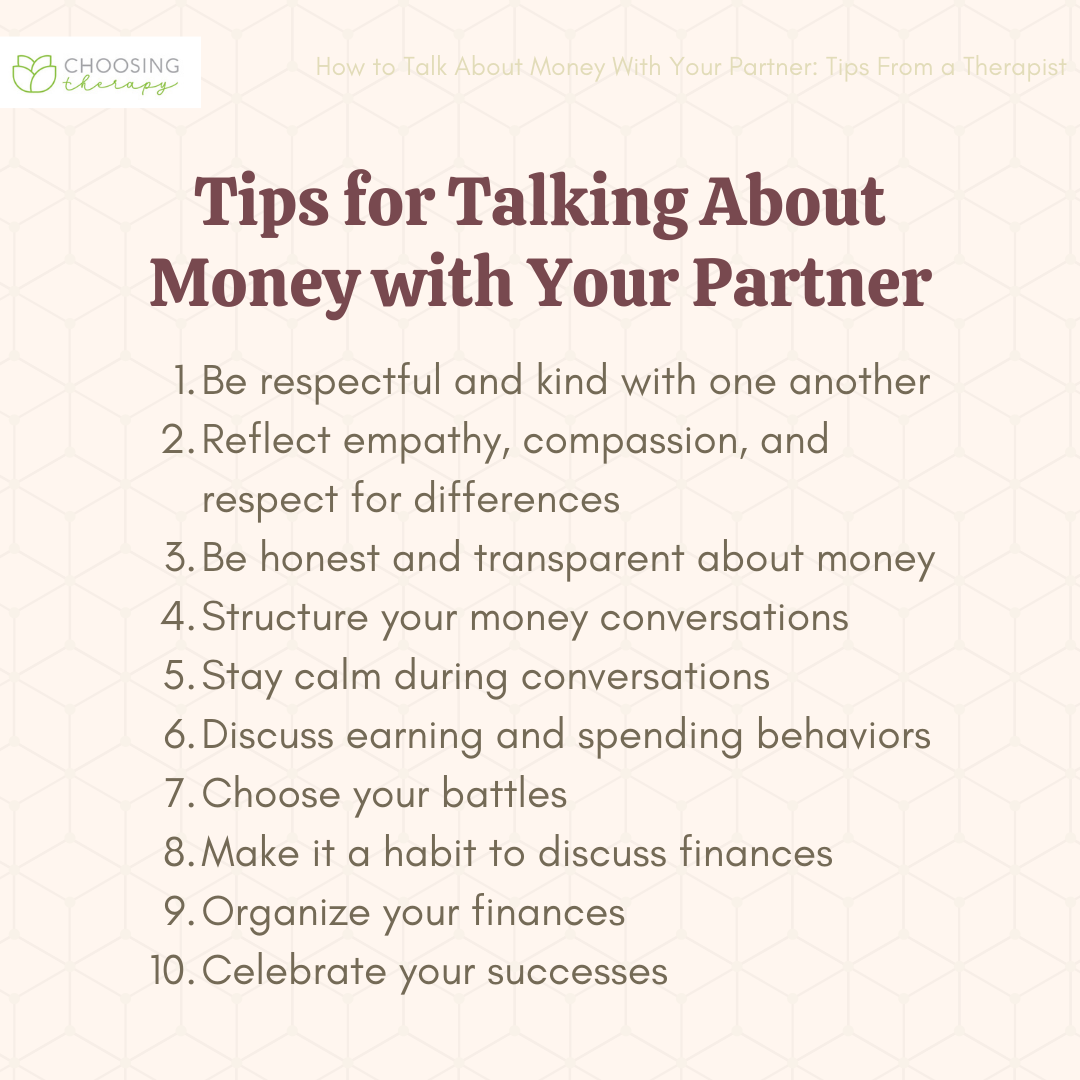

Arguments about money are actually the best predictor of divorce, according to relationship studies. Financial stress can erode even the strongest emotional bonds, which is why considering a partner's financial situation isn't mercenary—it's realistic.

The Love Threshold Theory

Most people don't choose money over love in absolute terms. Instead, they have a "financial threshold"—a minimum level of financial stability below which love alone isn't enough. Above this threshold, additional wealth matters less, and emotional connection becomes paramount.

When Financial Reality Meets Romance

Can You Really Separate Love and Money?

The truth is that love and money are deeply intertwined in modern relationships. A higher income is associated with less daily sadness, though not necessarily more daily happiness. Financial security provides the foundation for couples to focus on emotional intimacy without constant stress about bills, healthcare, or emergency expenses.

Consider these science-backed facts:

- People with higher incomes are more likely to find romantic partners

- Financial stability allows parents to spend quality time with children rather than working multiple jobs

- Couples who manage budgets effectively together report higher satisfaction

- Extravagant spenders are less attractive as long-term partners

The Marriage-Money Connection

Choosing a spouse is arguably the most important financial decision you'll ever make. Your partner will either help you build wealth or deplete it. This isn't just about their income—it's about shared financial values, spending habits, and long-term goals.

The Smart Approach: Balancing Love and Money

Three Science-Backed Strategies

1. Play the Long Game: Choose a partner who is willing to benefit you through generosity, cooperation, and trustworthiness rather than just someone with current wealth. Warmth and character have higher long-term value than a big paycheck alone.

2. Make Love the Real Investment: View your financial partnership as something you build together rather than a means to personal success. Joint flourishing creates stronger, more resilient relationships than one-sided financial arrangements.

3. Prioritize Happiness as Your Dividend: Be with someone who makes you genuinely happy and elicits positive emotions. Research shows that positive emotions are strongly correlated with wealth creation, meaning happy couples often build financial success together naturally.

Finding the Balance

The wisest approach isn't choosing between love and money—it's refusing to settle for a relationship that lacks either. Look for a partner who combines emotional compatibility with reasonable financial responsibility. This doesn't mean they need to be wealthy, but they should share your values about work ethic, saving, and spending.

Frequently Asked Questions

Would most people choose money over their spouse?

Survey data shows mixed results. While 56% prioritize financial security in a partner, only 46% would choose money over love when forced to decide. Most people want both and try to find a balance rather than choosing one extreme.

Is it wrong to consider money when choosing a spouse?

No, it's practical and wise. Considering a partner's financial stability isn't shallow—it's about ensuring you can build a secure life together. Financial problems are a leading cause of divorce, so factoring in financial compatibility is responsible.

Can money buy happiness in a relationship?

Money can't buy love, but it can reduce stress and create opportunities for happiness. Research shows that financial stability is associated with less daily sadness, though not necessarily more daily happiness. The sweet spot is having enough money to meet needs without letting wealth become the relationship's focus.

What matters more in marriage: love or financial compatibility?

Both are essential for long-term success. Love provides emotional fulfillment and connection, while financial compatibility reduces stress and conflict. The healthiest marriages combine genuine affection with aligned financial values and goals.

Do younger people prioritize love over money more than older generations?

Yes. Generation Z is the only age group to consistently choose love over money (54%). As people age and face real-world financial challenges, they tend to place greater emphasis on economic stability in relationships.

Final Thoughts: Making Your Choice

The question "Who would you choose: your wife or money?" presents a false dichotomy. The best relationships combine love with financial responsibility. While money alone can't create happiness, chronic financial stress can destroy even the most passionate romance.

The key is finding a partner who shares your values—both emotional and financial. Look for someone who makes you genuinely happy while also demonstrating responsibility, shared goals, and a willingness to build a future together. In the end, the wisest choice isn't between your spouse and money, but finding a spouse with whom you can create both love and financial stability together.

Found This Article Helpful?

Share this with someone who's navigating the complex intersection of love and money! Your friends and family might benefit from these insights too.