Will Health Insurance Go Up in 2026? What You Need to Know About Rising Premiums

Will Health Insurance Go Up in 2026? What You Need to Know About Rising Premiums

Yes, health insurance premiums will increase significantly in 2026—and the news is worse than many Americans expected. As open enrollment begins November 1, 2025, millions of consumers will face sticker shock when they see their 2026 health insurance options. This comprehensive guide explains exactly what's happening, why premiums are skyrocketing, and what you can do to manage these increased costs.

How Much Will Health Insurance Premiums Increase in 2026?

According to recent analyses from the Kaiser Family Foundation (KFF), health insurance premiums will increase by an average of 26% nationally in 2026. This represents one of the largest premium hikes since the Affordable Care Act (ACA) marketplaces launched over a decade ago.

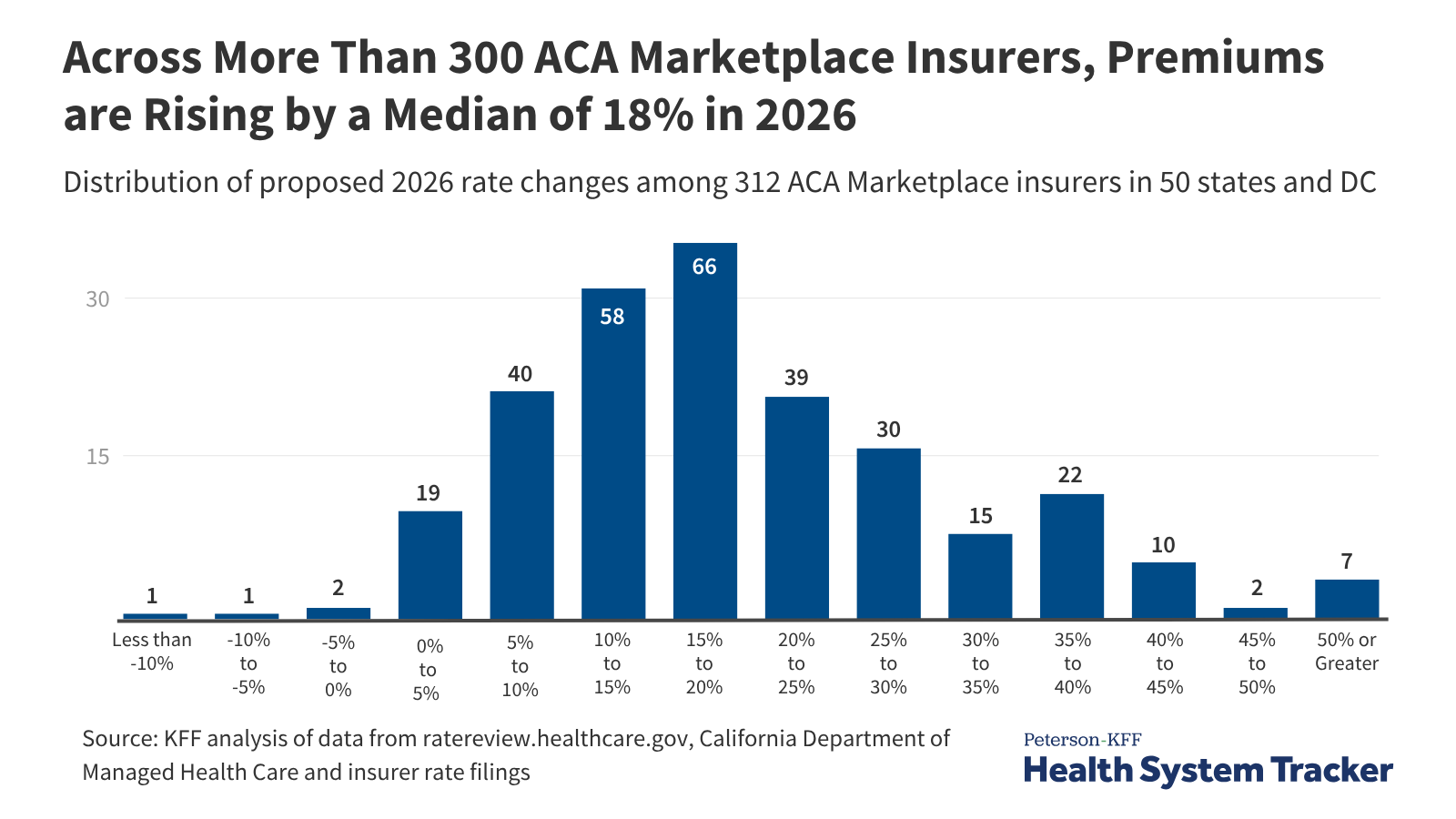

Breaking down the numbers further:

- Federal Healthcare.gov states: Benchmark plan premiums will rise 30% on average

- State-run exchanges: Benchmark plan premiums will increase 17% on average

- Median proposed increase: 18% across all marketplace insurers

- Some states facing extreme hikes: California premiums expected to increase up to 97%, effectively doubling for many residents

These increases don't even account for the full impact consumers will experience, which brings us to the bigger problem: the expiration of enhanced premium subsidies.

Why Are Health Insurance Premiums Skyrocketing in 2026?

Several factors are converging to create this perfect storm of premium increases:

Rising Healthcare Costs

Medical costs continue to escalate faster than general inflation. Insurers cite increasing expenses for hospital care, prescription drugs, and medical services as primary drivers behind rate increases. Healthcare utilization has also returned to pre-pandemic levels, putting additional pressure on insurance companies.

Policy Uncertainty and Regulatory Changes

The Trump administration implemented changes to how tax credits are calculated through the ACA Marketplace Integrity and Affordability rule. These modifications require enrollees to pay a higher share of their income toward benchmark premiums than under previous methodologies.

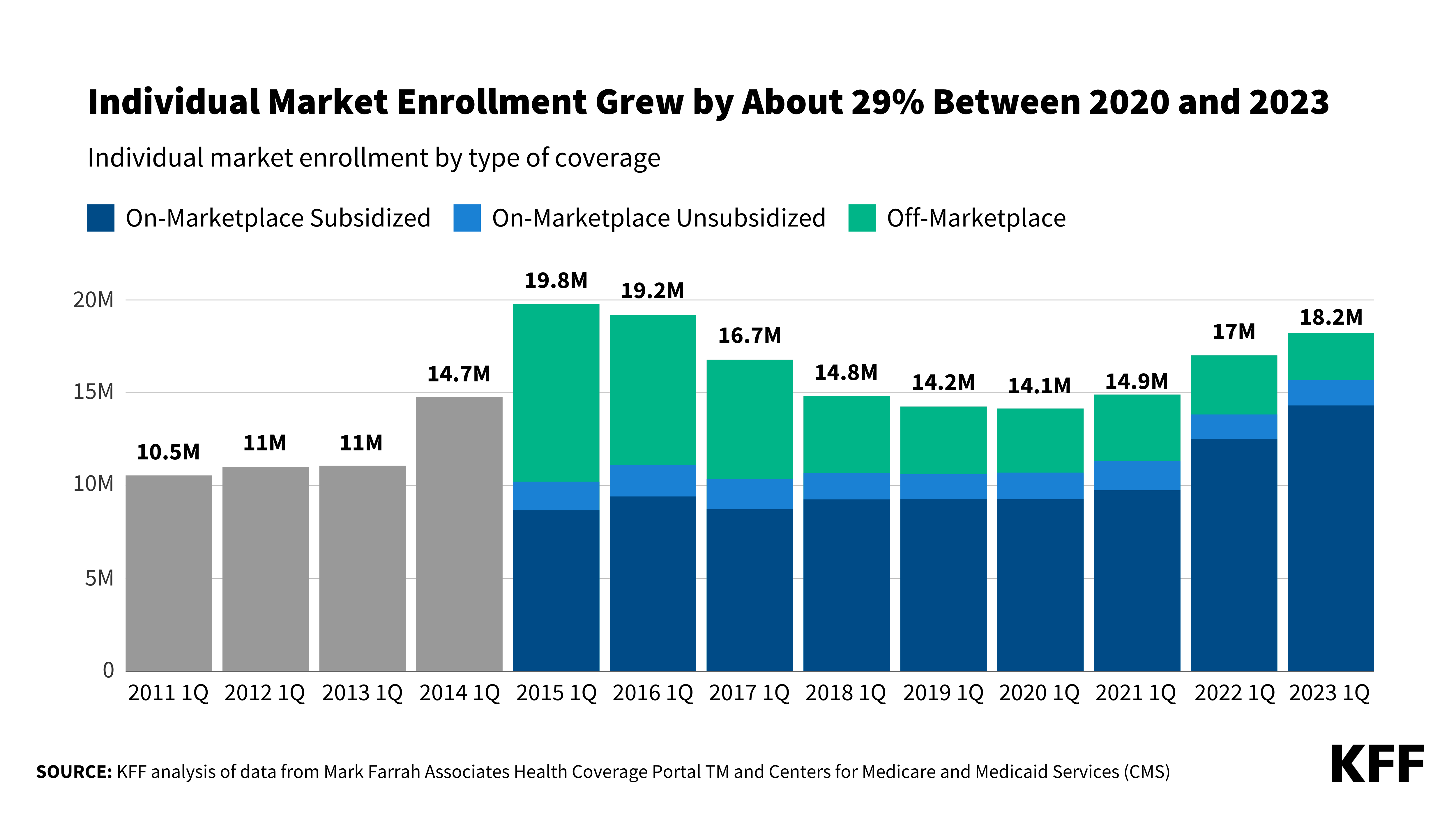

Expiration of Enhanced Premium Tax Credits

This is the single biggest factor. Enhanced premium tax credits introduced in 2021 and extended through 2025 are set to expire at the end of this year. Without Congressional action to renew them, Americans will lose access to the more generous financial assistance that has helped drive enrollment to record levels.

The Enhanced Subsidy Expiration: A Looming Crisis

The expiration of enhanced premium tax credits represents the most significant threat to health insurance affordability in 2026. Here's what the numbers show:

- Average increase in out-of-pocket costs: Subsidized enrollees will pay $1,016 more annually—a 114% increase

- Current average premium payment: $888 per year with enhanced subsidies in 2025

- Projected 2026 payment without enhanced subsidies: $1,904 per year

- Middle-income families hit hardest: Those earning above 400% of the federal poverty level will lose all subsidies

Real-World Impact Examples

Consider these scenarios that illustrate the dramatic cost increases:

- A 60-year-old couple earning $85,000 annually will see their yearly premium payments rise by over $22,600 in 2026

- A 45-year-old earning $20,000 in a non-Medicaid expansion state will see premiums jump from $0 to $420 annually

- An individual making $28,000 will pay nearly 6% of income ($1,562) instead of 1% ($325) toward a benchmark plan

- A family of four in Denver earning $128,000 will lose premium assistance entirely and see costs increase by $14,000 annually

Who Will Be Most Affected by 2026 Premium Increases?

Middle-Income Americans

Households earning between 400% and 600% of the federal poverty level will be devastated. Currently capped at paying 8.5% of income for benchmark coverage, many will lose all federal assistance starting January 1, 2026. For reference, 400% FPL equals approximately $60,240 for an individual or $124,800 for a family of four in 2025.

Older Adults Not Yet on Medicare

Americans aged 50-64 pay significantly higher premiums than younger enrollees due to age-based pricing. The combination of already-high base premiums, 26% rate increases, and subsidy expiration creates an affordability crisis for this demographic.

Self-Employed and Gig Workers

Without access to employer-sponsored insurance, self-employed individuals and gig economy workers rely heavily on Marketplace coverage. They'll bear the full brunt of premium increases and subsidy losses.

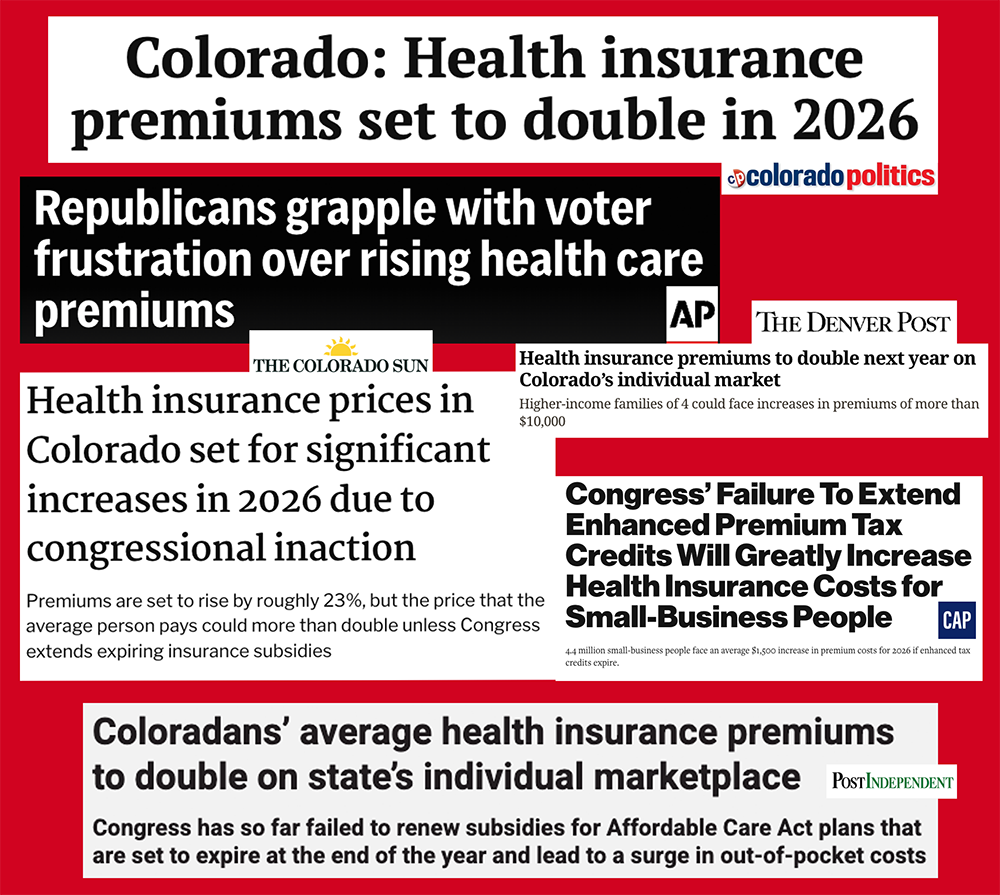

Residents of Certain States

Some states face particularly severe increases:

- California: Premiums expected to increase 97%, effectively doubling

- Colorado: Average increase of 101% projected

- New Jersey: Premiums jumping more than 174% on average, with 60,000 losing federal assistance entirely

What You Can Do to Manage Rising Health Insurance Costs

1. Shop and Compare During Open Enrollment

Open enrollment runs from November 1, 2025, through January 15, 2026. Don't automatically renew your current plan. "Window shopping" is now available on Healthcare.gov and state exchanges, allowing you to compare 2026 options before committing.

2. Consider Different Metal Tiers

If premiums are unaffordable at your current tier (Bronze, Silver, Gold, or Platinum), explore whether switching tiers makes sense. Bronze plans have lower premiums but higher deductibles, while higher tiers offer more comprehensive coverage at higher monthly costs.

3. Look for State-Based Assistance

Some states offer additional subsidies beyond federal assistance. Check if your state has programs that could help offset premium increases.

4. Evaluate Your Healthcare Needs

Honestly assess your expected healthcare utilization for 2026. If you're generally healthy, a lower-premium plan with higher out-of-pocket costs might save money. If you have ongoing medical needs, comprehensive coverage may be worth higher premiums.

5. Get Professional Help

Certified enrollment counselors, navigators, and insurance agents can provide free assistance in understanding your options. They can help you navigate the complexities of subsidy calculations and find the most affordable coverage for your situation.

⚠️ Important: Despite premium increases, most enrollees on Healthcare.gov will still have access to plans at or below $50 per month after applying the original (non-enhanced) tax credits. Nearly 60% of eligible re-enrollees can find coverage in this price range for 2026, compared to 83% in 2025.

The Bottom Line on 2026 Health Insurance Costs

Yes, health insurance is going up in 2026—significantly. Between insurer rate hikes averaging 26% and the expiration of enhanced subsidies, most Americans with Marketplace coverage will pay substantially more for health insurance next year. The political battle over extending enhanced subsidies continues on Capitol Hill, but consumers cannot wait for Congressional action.

The best strategy is to actively participate in open enrollment, carefully compare your options, and select coverage that balances affordability with your healthcare needs. Don't assume your current plan remains your best option—shop around, ask questions, and make an informed decision for 2026.

Frequently Asked Questions

When does open enrollment for 2026 health insurance start?

Open enrollment begins November 1, 2025, and runs through January 15, 2026. Coverage purchased during this period will start on January 1, 2026. It's crucial to enroll by December 15, 2025, if you want coverage starting January 1st.

Will enhanced premium subsidies be extended?

As of late October 2025, enhanced subsidies are set to expire December 31, 2025. Congressional Democrats are fighting to extend them, but the outcome remains uncertain. The window shopping tools on Healthcare.gov reflect the subsidy expiration, showing what you'll actually pay without the enhanced assistance.

How much will my specific premium increase?

Premium increases vary by state, age, income, and plan selection. Visit Healthcare.gov or your state exchange to get personalized quotes for 2026. Enter your information to see exactly what you'll pay with your current subsidy eligibility.

What happens if I can't afford the premium increases?

Explore all available options: switching to a lower-cost plan tier, checking Medicaid eligibility if your income qualifies, looking into employer coverage if available, or investigating state-specific assistance programs. Getting help from a certified enrollment counselor is free and highly recommended.

Are employer health insurance premiums also increasing in 2026?

Yes. Employer-sponsored health insurance premiums are also expected to increase 6% to 7% for 2026, though this is lower than the Marketplace increases. Employees may still experience sticker shock during their company's open enrollment period.

Take Action Now: Don't Miss Open Enrollment

Knowledge is power—share this critical information with family and friends!

Help others understand what's happening with 2026 health insurance costs so they can make informed decisions during open enrollment.

📱 Share on social media • 💙 Help someone prepare for 2026 costs • 🔔 Bookmark for reference