Gold Price Today: Complete Guide to Gold Investment & Current Market Trends

Gold Price Today: Complete Guide to Gold Investment & Current Market Trends

:max_bytes(150000):strip_icc()/HowtoBuyGoldBarsGettyImages-1689908174-dd1c5db2500f4b62a6620a1749beee7d.jpg)

Current Gold Price & Live Market Data

Gold has reached historic heights in 2025, with spot prices surpassing $4,000 per troy ounce for the first time ever. Today's gold price reflects unprecedented demand driven by global economic uncertainty, geopolitical tensions, and central bank monetary policies. The precious metal continues trading at approximately $3,978-$3,980 per ounce, representing a significant milestone in gold's price history.

The current gold price represents more than just numbers on a screen—it reflects the collective sentiment of global markets, investor confidence, and economic stability worldwide. Gold prices update continuously during market hours, with major exchanges like COMEX in Chicago and the London Bullion Market Association (LBMA) determining benchmark pricing.

Key Factors Driving Gold Prices Higher

Economic Uncertainty and Safe-Haven Demand

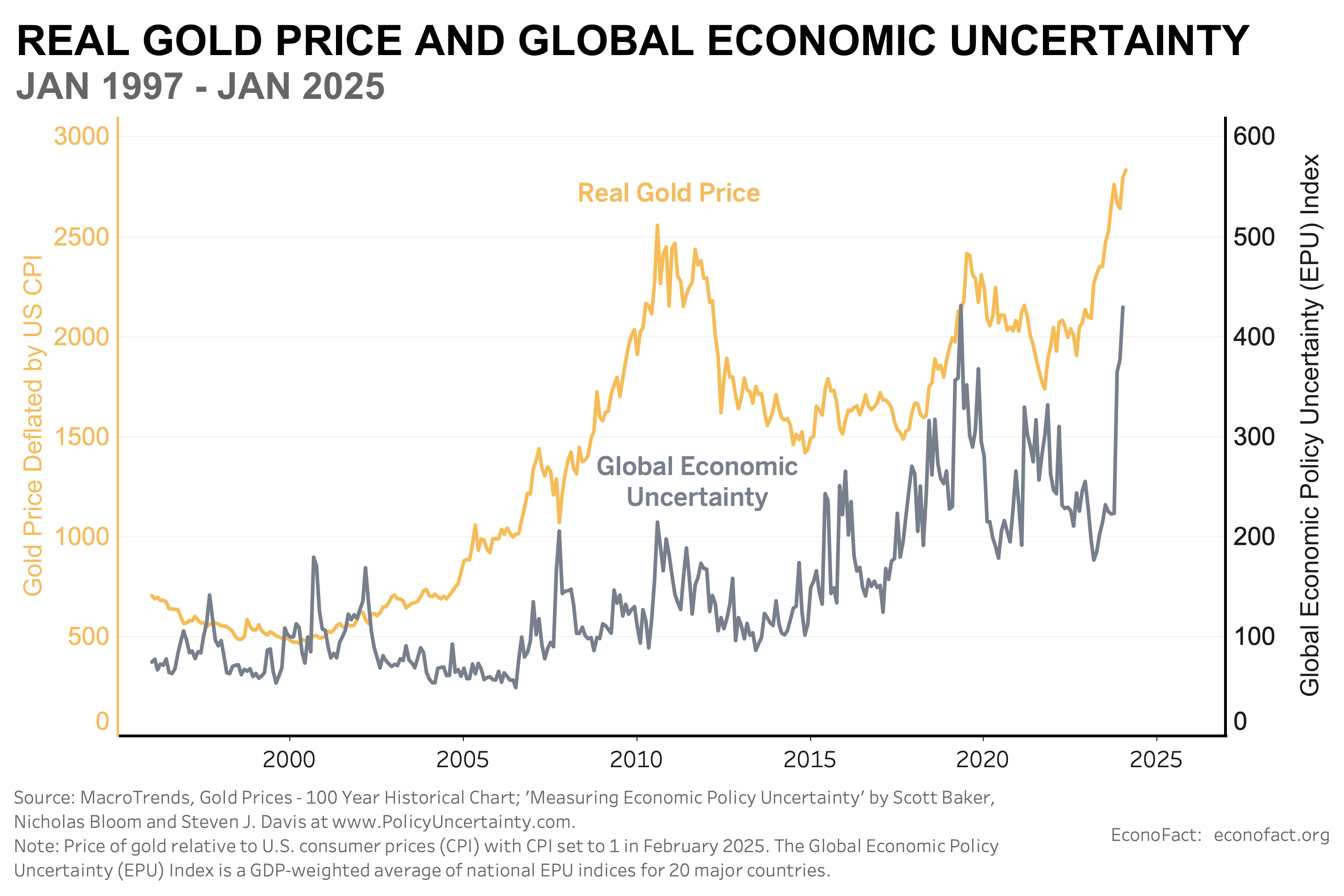

Gold's recent surge to record levels stems from multiple economic factors converging simultaneously. Inflation concerns, currency devaluation fears, and banking sector instability have pushed investors toward precious metals as a reliable store of value. The collapse of several major banks earlier this year demonstrated gold's protective role during financial crises.

Federal Reserve Policy Impact

Interest rate expectations significantly influence gold prices. When the Federal Reserve hints at potential rate cuts, gold becomes more attractive due to lower opportunity costs compared to yield-bearing assets. Recent FOMC meetings suggesting possible rate reductions have contributed substantially to gold's bull run.

Geopolitical Tensions and Global Events

International conflicts, trade disputes, and political instability consistently drive gold demand. Recent Middle Eastern tensions and ongoing global uncertainties have reinforced gold's status as the ultimate hedge against geopolitical risks, pushing prices to new heights.

Gold Investment Options for Every Investor

Physical Gold: Coins, Bars, and Bullion

Physical gold ownership remains the most direct investment method. Popular options include American Gold Eagles, Canadian Gold Maple Leafs, and various gold bars ranging from 1 gram to 1 kilogram. These tangible assets provide complete ownership without counterparty risk, though they require secure storage considerations.

Gold ETFs and Derivative Products

Exchange-traded funds offer gold exposure without physical storage requirements. Popular gold ETFs track spot prices closely, providing liquidity and convenience for investors. However, these products carry management fees and counterparty risks that physical gold avoids.

Gold Mining Stocks and Related Investments

Gold mining companies often amplify gold price movements, providing leveraged exposure to the precious metals sector. While potentially more volatile than physical gold, mining stocks can offer dividends and growth potential during bull markets.

Gold Market Analysis & Future Outlook

Historical Performance and Long-Term Trends

Gold has demonstrated remarkable long-term appreciation, averaging approximately 7.78% annual returns since 1971. This performance includes periods of significant volatility, but the overall trajectory shows gold's effectiveness as an inflation hedge and portfolio diversifier.

Goldman Sachs Price Projections

Major investment banks have revised their gold forecasts upward significantly. Goldman Sachs recently increased their December 2026 target to $4,900 per ounce, citing continued central bank demand and potential further monetary policy changes.

How to Buy Gold: A Complete Guide

Choosing Reputable Dealers

Successful gold investment begins with selecting trustworthy dealers. Look for established companies with transparent pricing, secure shipping options, and positive customer reviews. Authorized dealers often provide the best combination of competitive pricing and reliable service.

Understanding Premiums and Pricing

Gold products trade above spot price due to premiums covering manufacturing, distribution, and dealer margins. Smaller denominations typically carry higher premiums per ounce, while larger bars offer closer-to-spot pricing. Understanding these dynamics helps optimize investment decisions.

Storage and Security Considerations

Physical gold requires secure storage solutions. Options include home safes, bank safety deposit boxes, or third-party storage facilities. Each method involves different costs, accessibility, and security levels that investors must evaluate based on their specific needs.

Frequently Asked Questions About Gold Prices

What determines the daily gold price?

Gold prices are determined by global supply and demand dynamics, with major exchanges like COMEX and LBMA conducting electronic auctions. Economic conditions, currency movements, and geopolitical events all influence daily pricing fluctuations.

Is gold a good hedge against inflation?

Historically, gold has served as an effective inflation hedge over long periods. While short-term correlation may vary, gold's purchasing power has remained relatively stable across decades, making it valuable for wealth preservation during inflationary periods.

How much gold should be in an investment portfolio?

Financial advisors commonly recommend 5-10% gold allocation in diversified portfolios. This percentage provides meaningful diversification benefits without over-concentration in a single asset class. Individual circumstances may warrant different allocations.

What's the difference between gold ETFs and physical gold?

Physical gold provides direct ownership without counterparty risk but requires storage and insurance. Gold ETFs offer convenience and liquidity but involve management fees and potential tracking errors. Choice depends on investment goals and risk tolerance.

Will gold prices continue rising in 2025?

While no one can predict future prices with certainty, analysts cite several supportive factors including potential Federal Reserve rate cuts, ongoing geopolitical tensions, and continued central bank purchases. However, gold prices can be volatile and investment decisions should consider multiple scenarios.

Gold Investment Strategies for Different Market Conditions

Successful gold investing requires understanding how different market conditions affect precious metals performance. During economic expansion, gold may underperform growth assets but provides portfolio stability. In recessionary periods, gold often outperforms traditional investments as investors seek safe-haven assets.

Dollar-cost averaging into gold positions can help smooth out price volatility over time. This strategy involves making regular purchases regardless of current prices, potentially reducing the impact of timing decisions on overall returns.

Share This Gold Investment Guide

Found this gold price analysis helpful? Share it with fellow investors to help them stay informed about precious metals opportunities and market developments!

Stay Updated: Bookmark this page for the latest gold price insights and investment guidance in the evolving precious metals market.