Oracle Stock Analysis 2025: Is ORCL Stock a Buy After 87% YTD Surge?

Oracle Stock Analysis 2025: Is ORCL Stock a Buy After 87% YTD Surge?

Key Takeaways:

- Oracle stock (ORCL) surged 87% in 2025, marking its best performance since 1989

- The company secured $455 billion in performance obligations, driven by AI cloud demand

- Oracle Cloud Infrastructure revenue projected to grow from $18B to $144B by 2030

- Recent margin concerns raise questions about AI cloud profitability

Table of Contents

- Oracle Stock Performance in 2025

- The AI Cloud Transformation

- Financial Outlook and Growth Projections

- Key Investment Risks to Consider

- Analyst Recommendations and Price Targets

- Investment Conclusion

- Frequently Asked Questions

Oracle Stock Performance in 2025: A Historic Rally

Oracle Corporation (NYSE: ORCL) has delivered extraordinary returns to investors in 2025, with the stock soaring 87% year-to-date as of October 2025. This remarkable performance represents the company's best start to a year since 1989, when it rallied 108.91%. The stock has transformed from a traditional database company into one of Wall Street's most coveted artificial intelligence plays.

The catalyst for this meteoric rise has been Oracle's successful positioning in the rapidly expanding AI infrastructure market. Beginning at $166.64 per share in January 2025, Oracle stock reached a record high of $328.33 following its September earnings announcement before experiencing recent volatility due to margin concerns.

Oracle Corporation (NYSE: ORCL) has delivered extraordinary returns to investors in 2025, with the stock soaring 87% year-to-date as of October 2025. This remarkable performance represents the company's best start to a year since 1989, when it rallied 108.91%. The stock has transformed from a traditional database company into one of Wall Street's most coveted artificial intelligence plays.

The catalyst for this meteoric rise has been Oracle's successful positioning in the rapidly expanding AI infrastructure market. Beginning at $166.64 per share in January 2025, Oracle stock reached a record high of $328.33 following its September earnings announcement before experiencing recent volatility due to margin concerns.

The AI Cloud Transformation: Oracle's Strategic Pivot

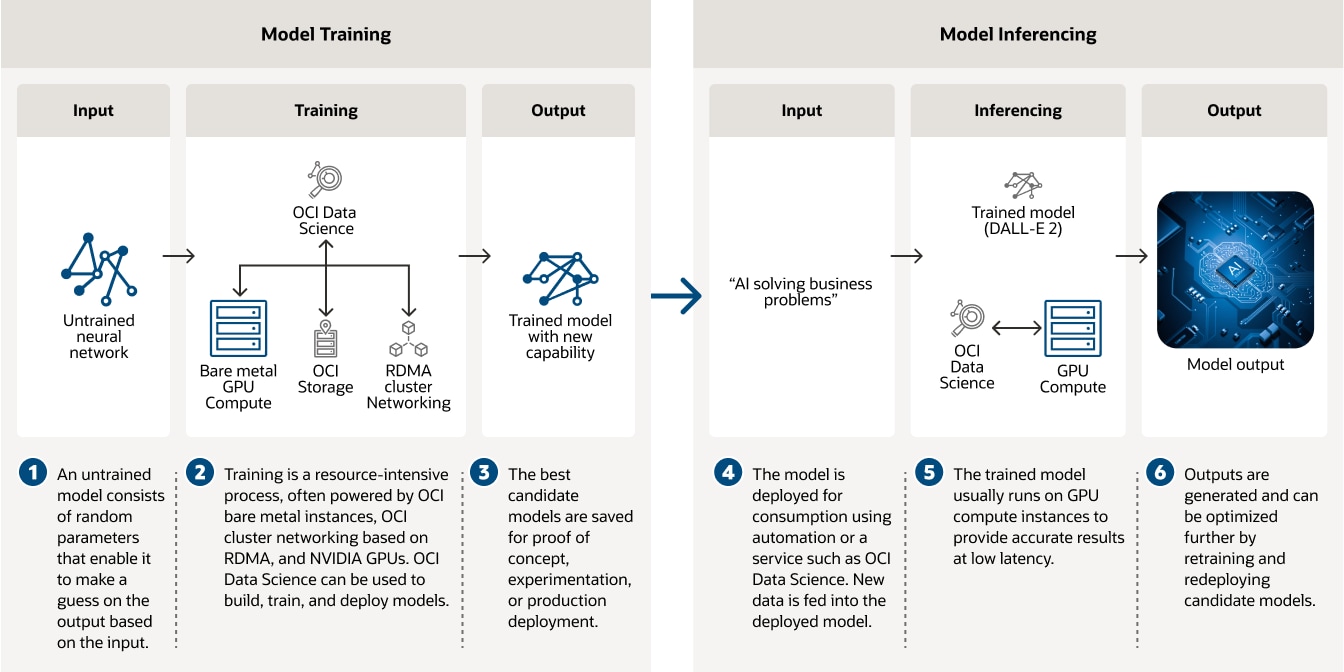

Oracle's transformation from a legacy enterprise software provider to an AI cloud infrastructure powerhouse represents one of the most significant strategic pivots in technology. The company's Oracle Cloud Infrastructure (OCI) has become the cornerstone of this evolution, attracting high-profile clients like OpenAI through the ambitious Stargate project.

The Stargate partnership alone represents a $30 billion annual commitment over five years, positioning Oracle as a critical infrastructure provider for the next generation of AI applications. This deal exemplifies how Oracle has leveraged its decades of enterprise experience to capture a significant share of the AI infrastructure boom.

Oracle's transformation from a legacy enterprise software provider to an AI cloud infrastructure powerhouse represents one of the most significant strategic pivots in technology. The company's Oracle Cloud Infrastructure (OCI) has become the cornerstone of this evolution, attracting high-profile clients like OpenAI through the ambitious Stargate project.

The Stargate partnership alone represents a $30 billion annual commitment over five years, positioning Oracle as a critical infrastructure provider for the next generation of AI applications. This deal exemplifies how Oracle has leveraged its decades of enterprise experience to capture a significant share of the AI infrastructure boom.

Cloud Infrastructure Expansion

Oracle's aggressive data center expansion strategy sets it apart from competitors. The company plans to increase its multicloud data centers from 34 to 71 locations and double its dedicated Oracle data centers to nearly 60 facilities. Chairman Larry Ellison notably stated that Oracle will build more data centers than all competitors combined, demonstrating the company's commitment to AI infrastructure leadership.Financial Outlook and Growth Projections

Oracle's financial trajectory reflects its successful AI cloud transition. The company concluded fiscal 2025 with $57.4 billion in revenue, representing 8% year-over-year growth. However, analysts expect this growth rate to double in fiscal 2026, with projected revenues reaching $67 billion.

Oracle's financial trajectory reflects its successful AI cloud transition. The company concluded fiscal 2025 with $57.4 billion in revenue, representing 8% year-over-year growth. However, analysts expect this growth rate to double in fiscal 2026, with projected revenues reaching $67 billion.

Revolutionary Performance Obligations

The most striking metric in Oracle's recent earnings was its remaining performance obligations (RPO) of $455 billion, representing a staggering 359% increase from the previous year. This backlog is nearly three times the company's revenue over the past three fiscal years combined, providing unprecedented visibility into future growth. Oracle's long-term guidance projects OCI revenue will explode from $18 billion in fiscal 2026 to $144 billion by fiscal 2030. If achieved, this would represent one of the most dramatic revenue expansions in enterprise technology history.Revenue Growth Acceleration

By fiscal 2028, Oracle's total revenue is expected to approach $120 billion, driven primarily by cloud infrastructure demand. This projection assumes successful execution of the company's aggressive data center buildout and continued AI adoption across enterprise markets.Key Investment Risks to Consider

Despite Oracle's impressive growth trajectory, several significant risks warrant investor attention:

Despite Oracle's impressive growth trajectory, several significant risks warrant investor attention:

Margin Pressure Concerns

Recent reports indicate Oracle's AI cloud business operates with gross margins of approximately 14% on $900 million in quarterly sales, substantially below the company's overall gross margin of 70%. This margin compression raises questions about the long-term profitability of Oracle's AI infrastructure strategy.Execution Challenges

Oracle faces enormous execution risks in delivering on its ambitious growth projections. The company must rapidly secure land, electricity, and GPU resources while managing complex construction timelines. Morningstar analyst Luke Yang forecasts three years of negative free cash flow and nearly $200 billion in new debt requirements.Competitive Landscape

While Oracle has carved out a unique position in AI infrastructure, it competes with established hyperscale providers including Amazon Web Services, Microsoft Azure, and Google Cloud Platform. These competitors possess greater scale and resources, potentially limiting Oracle's long-term market share expansion.Analyst Recommendations and Price Targets

Wall Street analysts remain cautiously optimistic about Oracle's prospects, with consensus price targets reflecting continued upside potential. Based on 39 analyst twelve-month price targets, the average target stands at $304.71, with the highest reaching $410.00 and the lowest at $130.00. Morningstar's Luke Yang maintains a fair value estimate of $330 per share, suggesting modest upside from current levels. Yang emphasizes that Oracle's valuation depends heavily on successful execution of its OCI growth strategy and efficient conversion of performance obligations into actual revenue.Investment Conclusion: Balancing Growth and Risk

Oracle stock represents a compelling but complex investment opportunity in 2025. The company has successfully repositioned itself at the forefront of AI infrastructure demand, securing massive long-term contracts that provide unprecedented revenue visibility. However, margin pressures, execution risks, and balance sheet concerns create significant uncertainty around future returns. For investors considering Oracle stock, the key question centers on management's ability to efficiently convert its $455 billion performance obligation backlog into profitable revenue growth. Success could drive continued outperformance, while execution failures could result in significant volatility.

💡 Investment Takeaway: Oracle offers compelling long-term growth potential for investors comfortable with execution risk and margin uncertainty. The stock appears fairly valued at current levels, making it suitable for patient investors seeking AI infrastructure exposure.

Frequently Asked Questions

Will Oracle stock grow in 2025?

Oracle stock has already grown 87% in 2025, marking its best performance since 1989. Analysts expect continued growth driven by AI cloud infrastructure demand, though margin concerns may create volatility.

What is the price target for ORCL in 2026?

Analysts project average twelve-month price targets of $304.71, with ranges from $130.00 to $410.00. Morningstar estimates fair value at $330 per share based on cloud infrastructure growth projections.

Is ORCL buy, sell, or hold?

Most analysts rate Oracle as a hold or moderate buy, citing strong growth prospects balanced against execution risks and margin concerns. The stock appears fairly valued at current levels.

What drives Oracle's AI cloud growth?

Oracle's growth is driven by partnerships with AI companies like OpenAI, aggressive data center expansion, and the $455 billion performance obligations backlog representing future revenue commitments.

📈 Found This Oracle Stock Analysis Helpful?

Share this comprehensive ORCL investment guide with fellow investors!