Polymarket Guide 2025: How the World's Largest Prediction Market Works

Polymarket Guide 2025: How the World's Largest Prediction Market Works

Key Takeaways:

- Polymarket is the world's largest decentralized prediction market platform

- Users buy and sell shares representing future event outcomes using cryptocurrency

- NYSE parent ICE invested $2 billion in October 2025, valuing Polymarket at $8 billion

- Platform blocked from US users since 2022 due to regulatory settlement

Table of Contents

- What is Polymarket?

- How Polymarket Works

- Getting Started with Polymarket

- Recent Developments and ICE Investment

- Regulatory Challenges and Restrictions

- Market Accuracy and Reliability

- Frequently Asked Questions

What is Polymarket?

Polymarket is a cryptocurrency-based prediction market platform that has revolutionized how people forecast and bet on future events. Founded in 2020 by Shayne Coplan, this New York-based company has become the world's largest prediction market, allowing users to buy and sell shares that represent the likelihood of specific outcomes occurring.

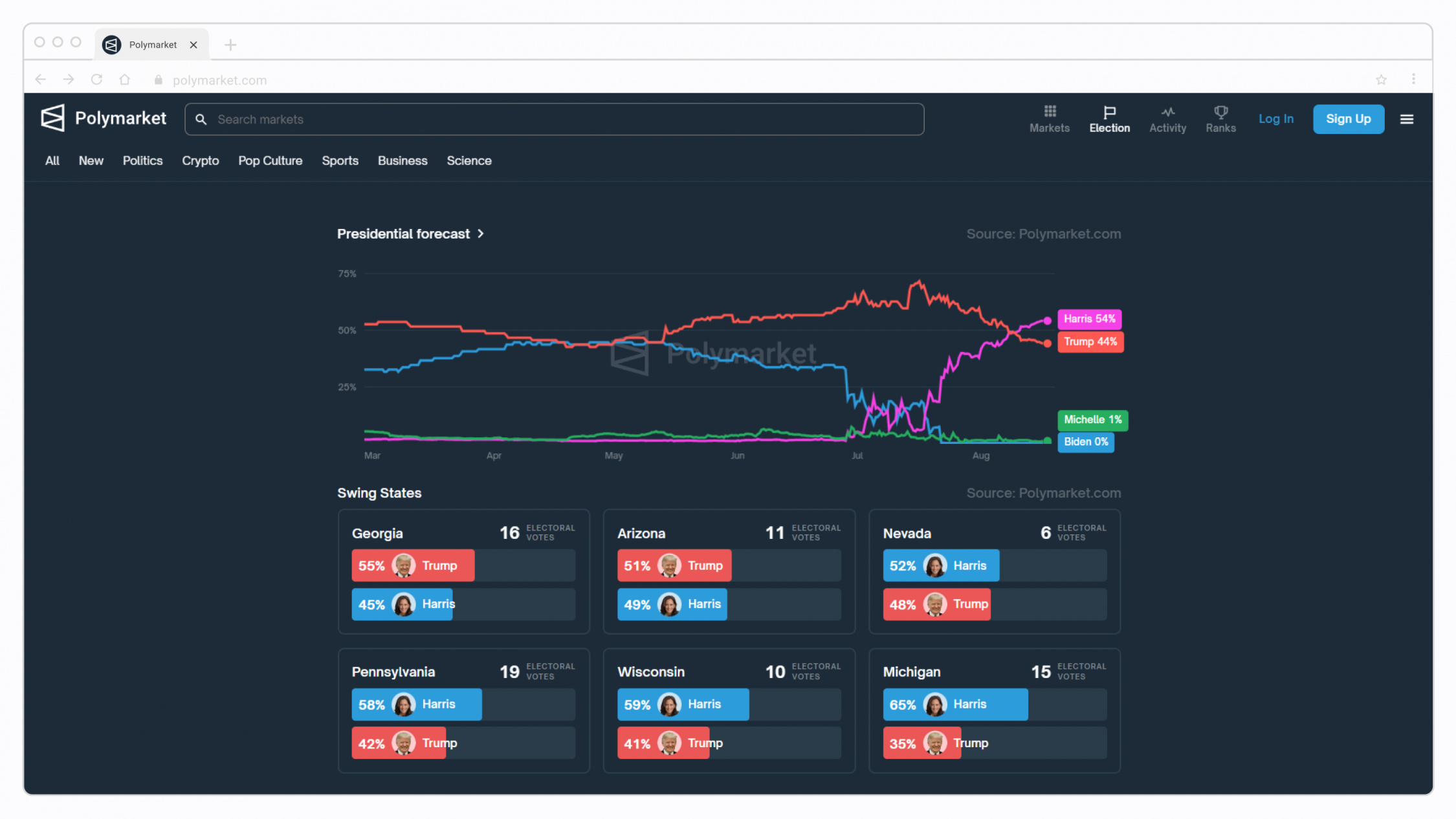

Unlike traditional betting platforms, Polymarket operates as a decentralized marketplace where market prices reflect the collective wisdom of participants. Users can predict outcomes across diverse categories including politics, economics, sports, entertainment, and current events. The platform gained significant attention during the 2024 US presidential election, where over $3.3 billion was wagered on the race between Donald Trump and Kamala Harris.

Polymarket is a cryptocurrency-based prediction market platform that has revolutionized how people forecast and bet on future events. Founded in 2020 by Shayne Coplan, this New York-based company has become the world's largest prediction market, allowing users to buy and sell shares that represent the likelihood of specific outcomes occurring.

Unlike traditional betting platforms, Polymarket operates as a decentralized marketplace where market prices reflect the collective wisdom of participants. Users can predict outcomes across diverse categories including politics, economics, sports, entertainment, and current events. The platform gained significant attention during the 2024 US presidential election, where over $3.3 billion was wagered on the race between Donald Trump and Kamala Harris.

How Polymarket Works: The Technology Behind Predictions

Polymarket operates on a simple yet sophisticated model that harnesses the power of crowd wisdom:

Polymarket operates on a simple yet sophisticated model that harnesses the power of crowd wisdom:

Binary Outcome Trading

Every market on Polymarket is structured as a yes/no question with binary outcomes. Users purchase shares priced between $0.01 and $0.99, with prices representing the market's assessment of probability. For example, if shares for "Will Bitcoin reach $150,000 by December 2025?" trade at $0.40, the market estimates a 40% probability of this occurring.Blockchain Infrastructure

The platform operates on the Polygon blockchain network, utilizing USDC cryptocurrency for all transactions. Smart contracts automatically execute trades and handle payouts when markets resolve. This decentralized approach ensures transparency and eliminates the need for traditional intermediaries.Market Resolution Process

When events conclude, markets undergo a resolution process where outcomes are proposed with bonds posted in USDC. If proposals are disputed, the UMA oracle system determines the final result. Winning shares pay out $1.00, while losing shares become worthless.Getting Started with Polymarket

Starting your prediction market journey on Polymarket involves several straightforward steps:

Starting your prediction market journey on Polymarket involves several straightforward steps:

Account Setup and Verification

New users must create an account and complete identity verification. Due to regulatory restrictions, US residents cannot access the platform directly. International users need to provide identification documents and proof of address.Funding Your Account

Users deposit USDC cryptocurrency through supported wallets like MetaMask, Coinbase Wallet, or WalletConnect. The platform requires users to maintain sufficient USDC balances for trading and potential bond requirements for market creation.Trading Strategies

Successful Polymarket traders employ various strategies including: - **Information arbitrage**: Acting quickly on breaking news before markets adjust - **Long-term positioning**: Taking positions based on fundamental analysis - **Diversification**: Spreading risk across multiple uncorrelated markets - **Limit orders**: Setting specific price targets for optimal entry and exit pointsRecent Developments and ICE Investment

October 2025 marked a pivotal moment for Polymarket when Intercontinental Exchange (ICE), owner of the New York Stock Exchange, announced a strategic $2 billion investment. This partnership values Polymarket at approximately $8 billion pre-investment and represents a major step toward bringing prediction markets into mainstream finance.

October 2025 marked a pivotal moment for Polymarket when Intercontinental Exchange (ICE), owner of the New York Stock Exchange, announced a strategic $2 billion investment. This partnership values Polymarket at approximately $8 billion pre-investment and represents a major step toward bringing prediction markets into mainstream finance.

ICE Partnership Benefits

The collaboration with ICE provides several strategic advantages: - **Institutional data distribution**: ICE will distribute Polymarket's event-driven data to institutional investors globally - **Mainstream credibility**: Association with the NYSE enhances legitimacy and trust - **Tokenization initiatives**: Joint development of new tokenized financial products - **Regulatory pathway**: Potential route for compliant US market entryPlatform Growth Metrics

Polymarket's growth trajectory has been remarkable, with billions of dollars in predictions made throughout 2025. The platform has gained recognition as the Official Prediction Market Partner of X (formerly Twitter) and Stocktwits, cementing its position as a leading source for real-time probability assessments.Regulatory Challenges and Geographic Restrictions

Polymarket's journey has been shaped by significant regulatory challenges, particularly in the United States. In January 2022, the Commodity Futures Trading Commission (CFTC) fined the company $1.4 million for operating an unregistered derivatives-trading platform. Following this settlement, Polymarket blocked access to US customers.Global Regulatory Landscape

Multiple countries have imposed restrictions on Polymarket: - **Switzerland**: Blocked by Swiss Gambling Supervisory Authority in November 2024 - **France**: Geo-blocked following National Gaming Authority investigation - **Poland**: Ministry of Finance blocked access in January 2025 - **Singapore**: Gambling Regulatory Authority blocked the platform - **Belgium**: Banned by Commission des Jeux de Hasard in February 2025 Despite these challenges, Polymarket continues expanding globally while working toward regulatory compliance in restricted jurisdictions.Market Accuracy and Reliability

Polymarket has demonstrated remarkable accuracy in predicting major events, often outperforming traditional polling methods. The platform correctly anticipated Joe Biden's withdrawal from the 2024 presidential race weeks before his official announcement, showing 70% probability after the June debate compared to just 20% previously.

Polymarket has demonstrated remarkable accuracy in predicting major events, often outperforming traditional polling methods. The platform correctly anticipated Joe Biden's withdrawal from the 2024 presidential race weeks before his official announcement, showing 70% probability after the June debate compared to just 20% previously.

Advantages of Prediction Markets

Several factors contribute to Polymarket's predictive power: - **Financial incentives**: Real money creates stronger motivation for accurate predictions - **Rapid information processing**: Markets adjust instantly to breaking news - **Diverse participant base**: Global users bring varied perspectives and information - **Continuous pricing**: 24/7 trading provides real-time probability updatesLimitations and Considerations

While generally accurate, prediction markets face certain limitations including potential manipulation by large bettors, liquidity constraints in smaller markets, and the influence of participant bias. The platform implements various safeguards and monitoring systems to maintain market integrity.

💡 Pro Tip: Polymarket works best for events with clear, verifiable outcomes and significant public interest. Markets with higher volume typically provide more reliable price discovery and better trading opportunities.

Frequently Asked Questions

Is Polymarket legal and safe to use?

Polymarket operates legally in many jurisdictions but is blocked in the US and several other countries due to gambling regulations. The platform uses blockchain technology and smart contracts to ensure transparent, secure transactions.

How accurate are Polymarket predictions?

Polymarket has shown impressive accuracy, often outperforming traditional polls and forecasting methods. The platform correctly predicted major events like Biden's 2024 withdrawal and various election outcomes with remarkable precision.

What cryptocurrency does Polymarket use?

Polymarket operates exclusively with USDC (USD Coin) on the Polygon blockchain network. Users must deposit USDC to participate in prediction markets and receive payouts in the same cryptocurrency.

Can US residents use Polymarket?

No, Polymarket has blocked US users since 2022 following a CFTC settlement. However, the recent ICE partnership may pave the way for compliant US operations in the future.

How does Polymarket make money?

Polymarket generates revenue through trading fees, market creation fees, and data licensing. The platform also benefits from the ICE partnership, which provides institutional data distribution revenue streams.

📊 Found This Polymarket Guide Helpful?

Share this comprehensive guide to prediction markets with your network!