Trilogy Metals Stock (TMQ): U.S. Government Investment Sparks 170% Surge Analysis

Trilogy Metals Stock (TMQ): U.S. Government Investment Sparks 170% Surge Analysis

Trilogy Metals Inc. (NYSE: TMQ) has captured unprecedented investor attention following a historic U.S. government investment announcement that sent shares soaring over 170% in pre-market trading. This comprehensive analysis examines the catalysts behind TMQ's explosive growth and what it means for investors in 2025.

Breaking: U.S. Government Takes Strategic 10% Stake in Trilogy Metals

The White House announced a groundbreaking $35.6 million investment in Trilogy Metals, securing a 10% ownership stake along with warrants to acquire an additional 7.5% of the company. This unprecedented move signals the U.S. government's commitment to domestic critical mineral production and reducing dependence on foreign suppliers, particularly China.

The investment comes as part of President Trump's broader strategy to secure America's supply chain for essential materials used in defense, technology, and renewable energy sectors. Trilogy Metals, a Canadian company focused on exploring and developing base and precious metals in Alaska, suddenly finds itself at the center of U.S. strategic resource planning.

Trump Administration Approves Ambler Road Project: A Game Changer

President Trump's executive order authorizing the Ambler Road Project represents a complete reversal of the Biden administration's 2024 decision to block the initiative over environmental concerns. The approved 211-mile industrial road will connect Alaska's resource-rich Ambler Mining District to the Dalton Highway, providing crucial infrastructure access that was previously missing.

This infrastructure development is critical for Trilogy Metals' success, as the Ambler Mining District contains some of the richest deposits of copper, zinc, lead, gold, and silver in North America. Without road access, these valuable resources remained economically unviable to extract.

Understanding Trilogy Metals' Business Model and Arctic Project

Trilogy Metals operates through a strategic 50-50 joint venture called Ambler Metals LLC, partnering with Australia's South32 Limited. This partnership focuses on developing the Upper Kobuk Mineral Projects (UKMP) within the Ambler Mining District in northwestern Alaska.

The company's primary asset is its stake in the Arctic Project, which encompasses multiple high-grade deposits of critical minerals essential for modern technology and defense applications. These minerals include:

- Copper: Essential for electrical infrastructure and renewable energy systems

- Cobalt: Critical for battery technology and electric vehicles

- Nickel: Key component in stainless steel and battery production

- Zinc and Lead: Important for construction and industrial applications

Financial Performance and Market Valuation Analysis

TMQ's financial profile reflects the typical characteristics of an exploration-stage mining company. With an enterprise value of approximately $449 million, the company has demonstrated remarkable growth potential following recent developments. Key financial metrics include:

Current Financial Position: Trilogy maintains a relatively strong balance sheet with total assets of $129 million and minimal long-term debt, indicating prudent financial management during the exploration phase.

Cash Flow Considerations: Like most pre-production mining companies, TMQ reports negative operating cash flow of -$1.27 million, which is expected during the development phase. The recent government investment provides crucial capital for advancing the Arctic Project.

Stock Performance: Year-to-date, TMQ shares have gained over 80% even before this week's explosive rally. The stock reached highs of $7.98 during Tuesday's trading session, representing a market capitalization exceeding $1 billion.

Strategic Importance: Reducing Chinese Dependence on Critical Minerals

The U.S. government's investment in Trilogy Metals aligns with broader national security objectives to reduce reliance on Chinese-controlled mineral supplies. According to Interior Secretary Doug Burgum, this investment ensures that ownership of critical mineral resources benefits American strategic interests.

This move follows a similar government stake in Lithium Americas, demonstrating a coordinated approach to securing domestic access to materials essential for:

- Defense technology and weapons systems

- Renewable energy infrastructure

- Electric vehicle battery production

- Advanced electronics and telecommunications

Investment Risks and Considerations for TMQ Stock

While TMQ's recent surge presents compelling opportunities, investors should consider several risk factors:

Regulatory and Environmental Challenges: Despite current approval, the Ambler Road Project may face ongoing environmental opposition and regulatory hurdles that could impact timeline and costs.

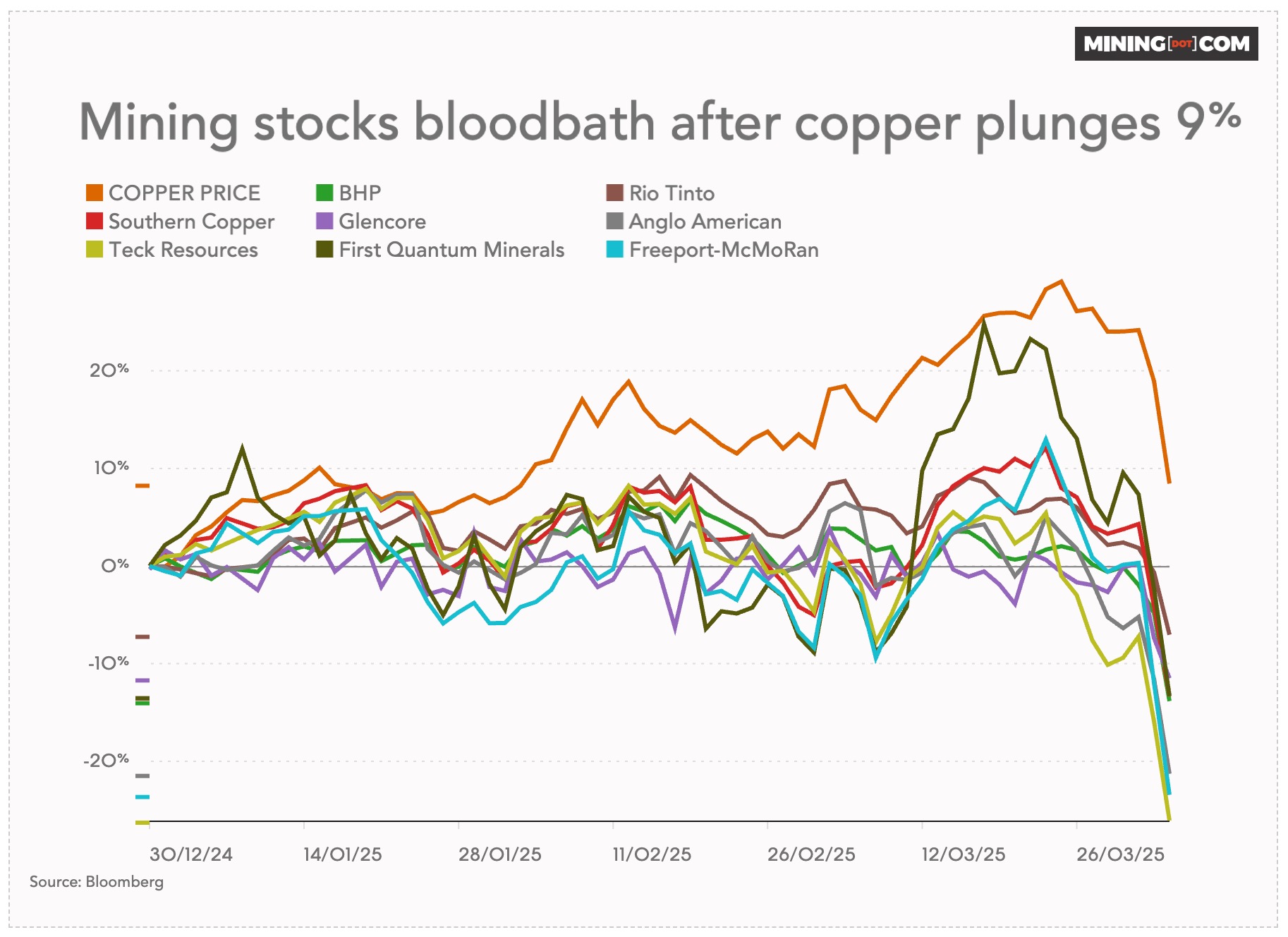

Commodity Price Volatility: TMQ's future profitability depends heavily on copper, cobalt, and nickel prices, which can be highly volatile based on global economic conditions.

Development Execution Risk: Successfully transitioning from exploration to production requires significant capital investment and operational expertise in challenging Arctic conditions.

Market Timing: With shares up over 170% in recent trading, new investors face the risk of buying at elevated valuations compared to the company's pre-announcement levels.

Analyst Outlook and Price Targets for Trilogy Metals

Financial analysts are rapidly reassessing TMQ's valuation following the government investment announcement. The combination of infrastructure approval, strategic government backing, and access to world-class mineral deposits has fundamentally altered the company's risk-reward profile.

Key factors supporting bullish analyst sentiment include:

- Government partnership reducing political and financing risks

- Infrastructure development removing major operational barriers

- Growing demand for critical minerals supporting long-term pricing

- Strategic location providing potential cost advantages

What This Means for Long-Term Investors

Trilogy Metals represents a unique opportunity for investors seeking exposure to the critical minerals sector with significant government backing. The company's transformation from a speculative exploration play to a strategic national asset creates a compelling investment thesis.

Long-term investors should consider TMQ's position in the broader context of America's energy transition and national security strategy. As the country moves toward greater electrification and renewable energy adoption, demand for copper, cobalt, and nickel is expected to grow substantially.

Frequently Asked Questions About TMQ Stock

What exactly did the U.S. government buy in Trilogy Metals?

The U.S. government invested $35.6 million for a 10% ownership stake in Trilogy Metals, plus warrants to potentially acquire an additional 7.5% of the company. This gives the government significant influence over the company's strategic direction.

Why is the Ambler Road Project so important?

The 211-mile road provides essential access to the Ambler Mining District, which contains world-class deposits of critical minerals. Without this infrastructure, these valuable resources would remain economically unviable to extract.

Is TMQ stock a good buy after the 170% surge?

While the fundamentals have improved dramatically, investors should carefully consider the elevated valuation following the recent surge. Long-term investors focused on critical minerals exposure may find value, but timing and position sizing are crucial.

Conclusion: TMQ's Transformation Into a Strategic Asset

Trilogy Metals has undergone a remarkable transformation from a speculative mining stock to a strategic national asset backed by the U.S. government. The combination of Trump administration support, infrastructure development, and access to critical mineral resources positions TMQ uniquely in the current market environment.

For investors, TMQ represents both significant opportunity and notable risks. The government partnership substantially reduces political and financing risks while providing access to world-class mineral deposits. However, the recent price surge means new investors must carefully consider entry points and position sizing.

As America continues prioritizing domestic critical mineral production, Trilogy Metals stands to benefit from this long-term strategic shift. The company's success will largely depend on successful project execution and maintaining government support through changing political environments.